From start-up to centaur: Leadership lessons on scaling

Mckinsey and Company

MAY 3, 2024

This playbook for founder CEOs on scaling from start-up to standout and beyond borrows lessons from the global B2B software-as-a-service industry.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Start-ups Related Topics

Start-ups Related Topics

Mckinsey and Company

MAY 3, 2024

This playbook for founder CEOs on scaling from start-up to standout and beyond borrows lessons from the global B2B software-as-a-service industry.

NYT M&A

AUGUST 8, 2024

start-ups for their technology and top employees, but have shied from owning the firms. Google, Microsoft and Amazon have made deals with A.I. Here’s why.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

FEBRUARY 1, 2023

Posted by Bo Bian (University of British Columbia, Sauder School of Business), Yingxiang Li (University of British Columbia, Sauder School of Business), and Casimiro A.

Mckinsey and Company

NOVEMBER 10, 2022

A strategy to both increase the number of start-ups and facilitate their ability to scale can elevate the Netherlands to a global leader in the world of entrepreneurship ecosystems.

Mckinsey and Company

JUNE 23, 2023

More access to funding for underrepresented start-up founders can unlock massive investment and innovation opportunities. These founders are not just underrepresented—they are underestimated.

Mckinsey and Company

NOVEMBER 14, 2023

Henrik Henriksson, CEO of H2 Green Steel, talks about the challenges and successes in founding a green business start-up and out-executing peers in a competitive environment.

NYT M&A

DECEMBER 14, 2023

The congressional news start-up is doubling down on information for its audience of Capitol Hill obsessives.

Mckinsey and Company

DECEMBER 20, 2023

How do you find and keep the best salespeople at a start-up? Dominikus Kirchhoff, former managing director at Choco, discusses his recipe for doing just that.

NYT M&A

MARCH 18, 2025

The acquisition could make the Silicon Valley giant a bigger force in cybersecurity, and arrives months after an earlier round of talks collapsed.

Mckinsey and Company

JULY 24, 2024

In the post-COVID-19 era, investors pinch their pennies.

Mckinsey and Company

MARCH 10, 2025

Most promising mobility start-ups fizzle out before they can scale their operations. With billions of dollars in investment at stake, they need a better path to growth.

Mckinsey and Company

OCTOBER 11, 2024

How can a climate tech company get funding—and scale up—quickly? The Climate Brick, an open-source manual for entrepreneurs and investors, aims to provide some answers.

Financial Times M&A

JANUARY 16, 2024

Buyers return after secondary market for private shares was hit by higher interest rates

Harvard Corporate Governance

APRIL 4, 2022

While the period up to 2018 was marked by an absence of ESG and sustainability focused regulatory pressure, in the period since, there have been efforts across the globe to ensure investors, financiers and companies pursue more sustainable business practices. more…).

Financial Times M&A

AUGUST 5, 2024

Executives at Abu Dhabi’s $300bn fund lead restructurings and management changes as valuations sink

Financial Times M&A

AUGUST 1, 2024

Department of Justice has increased scrutiny of the chipmaker’s power in the emerging sector

Mckinsey and Company

DECEMBER 20, 2024

The CEO and co-founder of Arbol discusses how the insurtech fills gaps in insurance coverage with parametric solutions powered by AI while drawing from a diverse array of expertise.

NYT M&A

FEBRUARY 21, 2024

The digital-media company, which has plunged in value, is selling the unit to Ntwrk at a significant discount from its 2021 purchase price.

NYT M&A

MARCH 19, 2025

The move is a bet that Amperes chips can begin playing a significant role in data centers for creating artificial intelligence.

NYT M&A

FEBRUARY 10, 2025

The billionaire is leading a group of investors in the unsolicited offer, which complicates the start-ups plan to change its nonprofit status.

Harvard Corporate Governance

SEPTEMBER 26, 2022

And that means you need to start it early. In fact, the board should start planning for the next CEO from the first day a new one steps into the job. The question is, how do you start so early? And how do you nurture them to ensure they’re ready to step up when the time comes? How do you find high-potential candidates?

Viking Mergers

APRIL 10, 2023

Yet, despite these obstacles, new business owners are successfully paving their way to success by starting a new franchise, acquiring an existing business, or launching a venture from scratch. Investment It’s true that buying an existing business almost always requires more capital upfront than starting your own.

Financial Times M&A

AUGUST 25, 2024

Slowdown in public listings and takeovers means staff and investors are selling shares for cheap on secondary market

Harvard Corporate Governance

MAY 25, 2023

From the start, Uber racked up heavy losses. If its business model never added up, how did Uber come to dominate the market for urban transportation? But in hindsight it has become clear that Uber’s low fares and comparatively attractive driver pay were made possible only by massive venture capital subsidies.

Mckinsey and Company

JULY 24, 2024

Demystifying the narrative around five fundamental elements will help start-ups and scale-ups grow efficiently and continuously.

Viking Mergers

APRIL 3, 2023

Every year, millions of Americans give up their jobs in Corporate America to pursue the dream of owning a business. You can get started by reading this Viking blog post discussing current M&A trends and which business sectors have the best outlook.) Eventually, you will identify a prospective business and meet with the sellers.

Harvard Corporate Governance

FEBRUARY 22, 2023

Starting in January 2021, the U.S. Fueled by the rise of zero-commission trading (popularized by Robinhood) and online coordination through social media sites—such as Reddit—retail investors engaged in an active “buy” campaign to push up the stock prices of companies like GameStop and AMC to stratospheric levels.

Mckinsey and Company

NOVEMBER 3, 2023

Investing in start-ups can help you tap external innovation, as long as you avoid the pitfalls.

Mckinsey and Company

MAY 23, 2024

Leading a rapidly growing start-up presents distinct challenges. Developing the leaders to effectively lead hypergrowth organizations requires founders and senior executives to answer four key questions.

Financial Times M&A

OCTOBER 28, 2023

Online education company was once India’s most valuable start-up but now plans asset sales to settle debts

Mckinsey and Company

JANUARY 27, 2023

Digital-native start-ups and healthcare incumbents can both play important roles in building and scaling digital therapeutics to improve the management of chronic health conditions.

Brian DeChesare

OCTOBER 30, 2024

Corporate finance is fine if you’re in it to advance up the ladder over many years/decades while having a reasonable work/life balance. based roles will start in the $70 – $90K range and advance to the $200 – $250K range at the Director level. Can we speed up the data consolidation processes? Your total compensation in U.S.-based

Mckinsey and Company

NOVEMBER 3, 2023

Africa’s fintech start-ups are leveraging mobile technology and innovative platforms to transform digital banking. We spoke with Ashraf Sabry, founder and CEO of Fawry, about the sector’s potential.

Mckinsey and Company

MARCH 19, 2024

The managing partner and founder of Emerald Technology Ventures shares how the company works with start-ups and corporations in navigating the dynamic world of climate tech.

Harvard Corporate Governance

APRIL 19, 2022

Starting from the premise that the optimal number of regulations is not zero (and I recognize that there may be those who do not start from that premise), I want to enlist your help as we think through what is the right balance in regulating the private markets, and what those rules should look like. more…).

Mckinsey and Company

NOVEMBER 9, 2022

For many start-ups, the challenge is no longer about securing capital—it’s about learning how to restructure themselves as fast as their products or organizations can evolve.

Mckinsey and Company

SEPTEMBER 22, 2023

Matti Niebelschütz, cofounder and CEO of CoachHub, reflects on the company’s journey from scrappy start-up to global leader in digital coaching.

Mckinsey and Company

MARCH 19, 2024

Despite market slowdown and funding woes, some agriculture technology start-ups still retain high value. Here’s how investors can identify and pursue these opportunities in time.

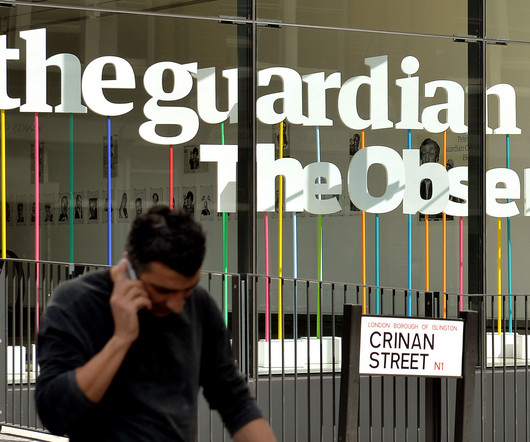

NYT M&A

DECEMBER 4, 2024

Workers have begun a 48-hour walkout, the first in 50 years for the outlet, over a proposal to sell The Observer to Tortoise Media, a digital media start-up.

Financial Times M&A

NOVEMBER 26, 2024

Investors hit by losses following billionaire’s takeover of social media platform reap rewards from shares in his AI start-up

Financial Times M&A

JANUARY 1, 2025

Group emerges as crucial backer of start-ups seeking to gain from the tech revolution its chips are powering

Appraisers Blog

FEBRUARY 17, 2025

Where do you come up with these wild ideas? When a father and sons moving truck drives by on the road do you spill your coffee and start cursing every time? Nepotism for independent 1099’s who earn less than fast food workers and are actively discriminated against by both private industry and government? Good ole boys?

Financial Times M&A

OCTOBER 14, 2024

South African businessman Gary Lubner in talks on taking minority stake in online start-up

Harvard Corporate Governance

APRIL 19, 2023

This proxy season is shaping up to be an uncommon tempest for companies and shareholders alike: macro-economic conditions are stressing corporate performance, trading multiples are depressed, and—last, but not least—the universal proxy card regime has finally come into effect.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content