Elon Musk’s artificial intelligence group buys X for $45bn

Financial Times M&A

MARCH 28, 2025

Billionaire entrepreneur says social media platform and AI group will share data and computational power

Financial Times M&A

MARCH 28, 2025

Billionaire entrepreneur says social media platform and AI group will share data and computational power

RNC

MARCH 30, 2025

Why Accurate Share Valuation Matters? Determining the true value of a company’s shares is crucial for investors, business owners, and stakeholders alike. Accurate share valuation methods empower informed decision-making, whether its for mergers, acquisitions, investments, or even strategic business planning. A miscalculated valuation can lead to financial loss and missed growth opportunities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

NYT M&A

MARCH 28, 2025

Mr. Musk said the deal valued xAI, his artificial intelligence start-up, at $80 billion, and X at $30 billion.

Class VI Partner

MARCH 24, 2025

Rollover equity is a powerful tool that can provide unique benefits to business owners who are selling their company in an M&A transaction. This practice ensures sellers maintain a stake in their business post-transaction and allows them to continue to see value from their company for years to come.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

IVSC

MARCH 31, 2025

Valuing Private Markets: Can We Get It Right? Private markets are expanding. As of 2024, private capital assets under management have surged to over $14 trillion globally, tripling over the past decade. Private credit alone now exceeds $2 trillion globally , according to the International Monetary Fund. But with growth comes scrutiny. Regulators, including the U.S.

Financial Times M&A

MARCH 26, 2025

Avian flu has driven prices for the versatile food to record highs in America

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

NYT M&A

MARCH 28, 2025

Federal prosecutors convinced a jury that Ms. Javice faked much of her customer list before selling her start-up, Frank, to the bank.

Mckinsey and Company

MARCH 27, 2025

Europe is a leader in social mobility, but progress has stalled. Businesses that act can gain significant performance benefits while helping close the skills gap and boost productivity.

LaPorte

MARCH 26, 2025

At LaPorte, our employees are more than just part of the teamtheyre the heart of everything we do. Each individual brings unique skills, experiences, and… The post Mo Al-kawafha first appeared on LaPorte.

Financial Times M&A

MARCH 27, 2025

President Aleksandar Vui says talks to prevent US restrictions on countrys only oil refinery failed to break deadlock

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Law 360 M&A

MARCH 27, 2025

Excelerate Energy has agreed to purchase New Fortress Energy's Jamaica business for $1.055 billion, with legal support from Gibson Dunn & Crutcher LLP and Vinson & Elkins LLP, the companies disclosed Thursday.

Redpath

MARCH 28, 2025

Find the right construction finance leader: 3 essential interview questions to identify candidates with industry expertise, breadth of experience, and technology fluency.

NYT M&A

MARCH 26, 2025

Nearly 10 years after buying Family Dollar for about $9 billion, Dollar Tree announced it would sell the retailer to two private equity firms.

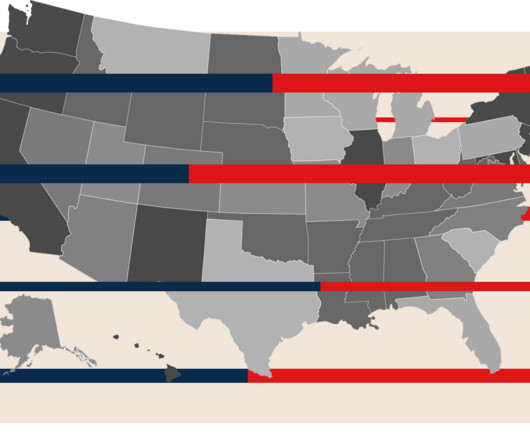

Mckinsey and Company

MARCH 26, 2025

Understanding micromarket trendsand utilizing AIin the US rack-to-retail fuel market could help retailers optimize their supply chains and improve margins.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Financial Times M&A

MARCH 28, 2025

First official response by Beijing adds to uncertainty over geopolitically sensitive transaction

Appraisers Blog

MARCH 27, 2025

Jail time was off the table, but the real estate agent still faced a hefty fine for impersonating an appraiser.

LaPorte

MARCH 27, 2025

(authored by RSM US LLP) Health care providers will likely face complex regulations, scrutiny on nonprofit status, private equity impact and more in the months to come. The post Health care faces ongoing regulatory scrutiny first appeared on LaPorte.

Machen McChesney

MARCH 25, 2025

Financial statements tell a powerful story about your business. However, they can seem like an overwhelming collection of figures without proper analysis. Financial benchmarking studies can help you identify historical trends, pinpoint areas for improvement, and forecast future performance with greater confidence.

Mckinsey and Company

MARCH 25, 2025

Sharpen your problem-solving skills the McKinsey way, with our weekly crossword. Each puzzle is created with the McKinsey audience in mind, and includes a subtle (and sometimes not-so-subtle) business theme for you to find. Answers that are directionally correct may not cut it if youre looking for a quick win.

Financial Times M&A

MARCH 28, 2025

Station and airport outlets will continue to trade under 233-year-old brand

Appraisers Blog

MARCH 27, 2025

This happens all the time. Its the in-house lending thats the worst at using BPOs by Realtors for loans. Appraisers are just seen as being in the way of loans closing and a problem for Realtors and loan officers- those that benefit from commission on the product and transaction. Nothing new herebut more fines and accountability is needed. Dodd Frank isnt and didnt work.

Trout CPA

MARCH 28, 2025

We are thrilled to celebrate an important milestone in Brendon Landiss career as he officially earns his Certified Public Accountant (CPA) designation!

Redpath

MARCH 26, 2025

Explore the three core business valuation approachesasset, income, and marketand how they've evolved to address modern business realities.

Mckinsey and Company

MARCH 24, 2025

In a challenging geopolitical and market environment, midsize industrial companies are under pressure to build resilience and scale. Seven transformation levers can help them reach their potential.

Financial Times M&A

MARCH 26, 2025

Italian media group could make bid as part of long-standing drive to build pan-European broadcaster

Appraisers Blog

MARCH 27, 2025

Jail time was off the table, but the real estate agent still faced a hefty fine for impersonating an appraiser.

Peak Business Valuation

MARCH 31, 2025

Gathering valuation multiples is a fundamental step in calculating a plumbing businesss value. While it is easy to find rough averages online, determining accurate and reliable multiples is complicated. As such, it is ideal to obtain a professional business valuation to determine plumbing business valuation multiples. The valuation process also provides business owners with a thorough understanding of their plumbing businesss strengths and weaknesses.

Scott Mashuda

MARCH 31, 2025

How Do I Sell My Business? For business owners in the lower middle market, mergers and acquisitions (M&A) activity represents a convergence of business readiness, personal timing and market conditions. Maximizing value in M&A requires sophisticated expertise beyond operational knowledge. And more often, it demands strategic enhancement of systems and processes while creating competitive tension among qualified buyers.

Mckinsey and Company

MARCH 26, 2025

The healthcare sector has been integrating generative AI to enhance operations and engage stakeholders, with many advancing to full-scale implementation.

Financial Times M&A

MARCH 27, 2025

EQT Ventures and Siemens Energy among new backers in Munich-based start-ups latest funding round

Appraisers Blog

MARCH 27, 2025

Imagine that. A Realtor disguised as an appraiser is fined $10,000 for fraud but an appraiser, cleared by VA, is spending tens of thousands of dollars in legal fees for a witch hunt. Makes little sense. That’s how screwed up the system has become.

Fox Corporate Finance

MARCH 30, 2025

FCF Fox Corporate Finance GmbH is delighted to publish the new FCF Healthcare & Life Sciences Venture Capital Monitor USA 02/2025. The Monitor is a monthly published overview of venture capital trends in. Read more The post FCF Healthcare & Life Sciences Venture Capital Monitor USA 02/2025 published appeared first on FCF Fox Corporate Finance GmbH.

Law 360 M&A

MARCH 28, 2025

Elon Musk said Friday that his artificial intelligence company xAI acquired his social media platform X in an all-stock deal for $45 billion, saying that the futures of the high-profile companies are now "intertwined.

Mckinsey and Company

MARCH 26, 2025

After the educational adventure of a lifetime, one familys experiences illustrate the transformative power of traveland how everyone can make the world their classroom.

Let's personalize your content