Data Update 2 for 2024: A Stock Comeback - Winning the Expectations Game!

Musings on Markets

JANUARY 17, 2024

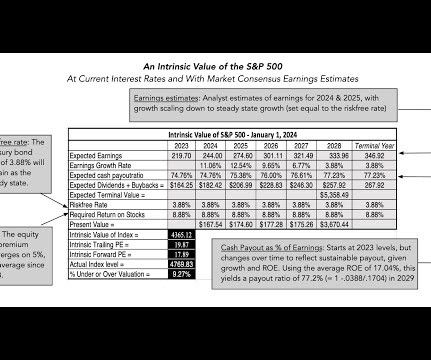

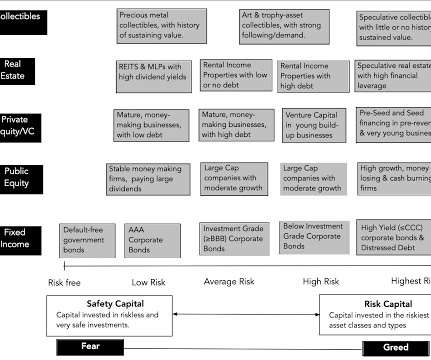

Going into 2024, investors are clearly in a better mood about what is to come this year, than they were a year ago, but they are pricing in that better mood. In contrast, at the start of 2024, the lifting of fear has led to higher prices, a more upbeat forecast of earnings and an expected return of 8.48% and an equity risk premium of 4.60%.

Let's personalize your content