What Is Risk-Free Rate?

Andrew Stolz

AUGUST 4, 2020

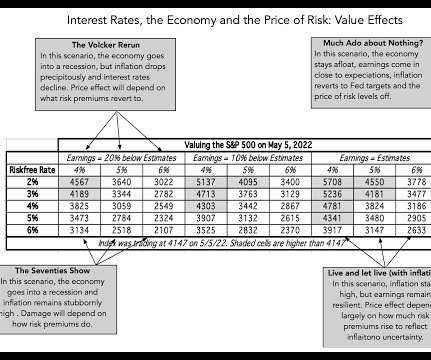

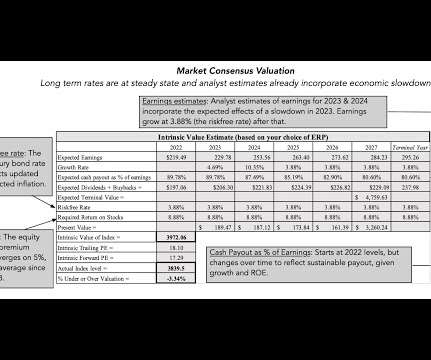

Definition of Risk-Free Rate. The risk-free rate is the minimum rate of return on an investment with theoretically no risk. Government bonds are considered risk-free because technically, a government can always print money to pay its bondholders. Treasury Bill. 10-Year U.S.

Let's personalize your content