Watch Your Derivatives: The Role 13Fs Play in Detecting Shareholder Activism

Harvard Corporate Governance

SEPTEMBER 5, 2024

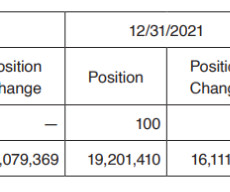

Posted by David Farkas, Georgeson LLC, on Thursday, September 5, 2024 Editor's Note: David Farkas is the Head of Shareholder Intelligence at Georgeson LLC. This post is based on an article that was featured in the July/August 2024 issue of The Deal Lawyers. SEC Form 13F public filings can help companies understand whether the threat of a proxy fight is imminent and, crucially, take steps to defend themselves. 13F filings, as they’re known, reveal the share position of institutional investors or

Let's personalize your content