Largest Companies View AI as a Risk Multiplier

Harvard Corporate Governance

NOVEMBER 20, 2024

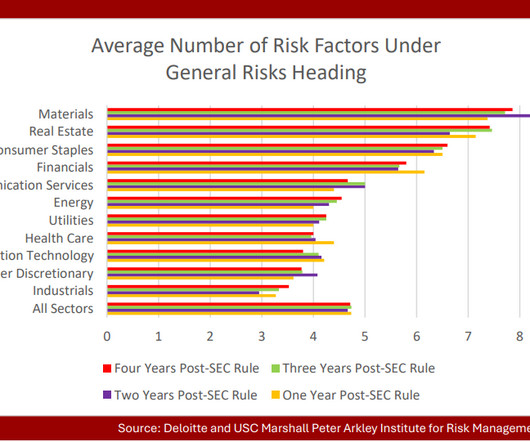

Posted by Dean Kingsley, Matt Solomon, Deloitte & Touche LLP, and Kristen Jaconi (USC Marshall), on Wednesday, November 20, 2024 Editor's Note: Dean Kingsley is a Principal and Matt Solomon is a Senior Manager at Deloitte & Touche LLP. Kristen Jaconi is an Associate Professor of the Practice in Accounting and Executive Director at Peter Arkley Institute for Risk Management at the USC Marshall School of Business.

Let's personalize your content