Disney Says It Will Take Full Control of Hulu

NYT M&A

NOVEMBER 1, 2023

The company will pay at least $8.61 billion to Comcast, which owned a 33 percent stake of the popular streaming service.

NYT M&A

NOVEMBER 1, 2023

The company will pay at least $8.61 billion to Comcast, which owned a 33 percent stake of the popular streaming service.

Harvard Corporate Governance

OCTOBER 31, 2023

Posted by Blair Jones, Rachel Ki, and Jennifer Teefey, Semler Brossy LLC, on Tuesday, October 31, 2023 Editor's Note: Blair Jones is a Managing Director, Rachel Ki is an Associate, and Jennifer Teefey is a Senior Associate Consultant at Semler Brossy LLC. This post is based on a NACD Directorship magazine publication. Many leaders delved into human capital management (HCM) when the economy was booming, just before the Great Resignation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Value Scope

NOVEMBER 3, 2023

The Value of X X, formerly Twitter, is now valued at $19 billion, according to the company’s employee equity compensation plan. This is a significant drop from the $44 billion that Elon Musk paid to acquire the company in October 2022. Several factors may have contributed to the valuation drop. The overall economic slowdown: The tech sector has been particularly hard hit by the recent economic downturn, and X is no exception.

IVSC

OCTOBER 31, 2023

The International Valuation Standards Council (IVSC) Annual General Meeting (AGM) took place this year at Maison de la Chimie in the heart of Paris, gathering over 150 valuation leaders and experts from around the globe. Hosted by Compagnie Nationale des Commissaires aux Comptes (CNCC) and Conseil Superieur de L’ordre des Experts-Comptables (CNOEC), and sponsored by HypZert and Taqeem, the AGM is a key fixture in the calendar of valuation leaders.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

NOVEMBER 3, 2023

A new McKinsey Health Institute survey across 30 countries offers insights into how organizations can help create a workplace that prioritizes physical, mental, social, and spiritual health.

Harvard Corporate Governance

OCTOBER 29, 2023

Posted by Lawrence A. Cunningham, Matthew Bisanz, and Jeffrey Taft, Mayer Brown LLP, on Sunday, October 29, 2023 Editor's Note: Lawrence A. Cunningham is Special Counsel, and Matthew Bisanz and Jeffrey Taft are Partners at Mayer Brown LLP. This post is based on a Mayer Brown memorandum by Mr. Cunningham, Mr. Bisanz, Mr. Taft, Anna Pinedo , Megan Webster , and Andrew Olmem.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

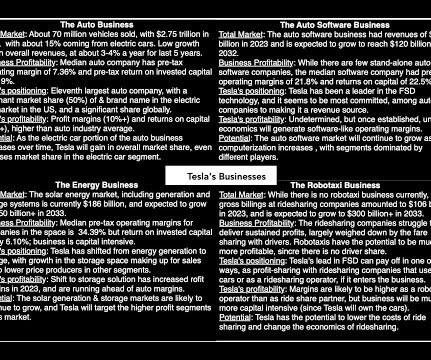

Musings on Markets

NOVEMBER 1, 2023

I was planning to start this post by telling you that Tesla was back in the news, but that would be misleading, since Tesla never leaves the news. Some of that attention comes from the company's products and innovations, but much of it comes from having Elon Musk as a CEO, a man who makes himself the center of every news cycle. That attention has worked in the company's favor over much of its lifetime, as it has gone from a start-up to one of the largest market cap companies in the world, disrup

Mckinsey and Company

NOVEMBER 3, 2023

A chief of staff can be instrumental to a CEO’s success while also advancing their own career. Here are eight pieces of advice from those who have mastered the role.

Harvard Corporate Governance

NOVEMBER 3, 2023

Posted by Nathan Barnett, Daniel Bell, and Sebastian Orozco Segrera, McDermott Will & Emery LLP, on Friday, November 3, 2023 Editor's Note: Nathan Barnett and Daniel J. Bell are Partners and Sebastian Orozco Segrera is an Associate at McDermott Will & Emery LLP. This post is based on their McDermott memorandum. Beginning January 1, 2024, the US Corporate Transparency Act (CTA) will require “reporting companies” to submit a report to the Financial Crimes Enforcement Network (FinCEN) conta

Benzinga

NOVEMBER 1, 2023

A battle between two media giants over the valuation of a leading streaming platform is almost at its end with a deal announced by Walt Disney Co. (NYSE: DIS ) to acquire the stake in Hulu it did not already own. Here are the details. What Happened: Disney shares struggled in 2023 , but the company may have a catalyst or an item that needed more clarity before finally putting it to rest.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Financial Times M&A

OCTOBER 28, 2023

Online education company was once India’s most valuable start-up but now plans asset sales to settle debts

Mckinsey and Company

NOVEMBER 3, 2023

McKinsey research shows that a focus on aspiration, activation, and execution can help companies out-innovate and outgrow peers.

Harvard Corporate Governance

NOVEMBER 2, 2023

Posted by Cydney S. Posner, Cooley LLP, on Thursday, November 2, 2023 Editor's Note: Cydney S. Posner is Special Counsel at Cooley LLP. This post is based on her Cooley memorandum. As part of its fiscal-year-end enforcement surge, the SEC filed charges against three former executives of Pareteum Corporation, a telecommunications and cloud software company, for fraudulent revenue recognition practices—a settled action against the former controller and a complaint against the former CFO and f

ThomsonReuters

NOVEMBER 2, 2023

Jump to: What does SAS 145 address? 9 steps to apply SAS 145 Managing SAS 145 compliance What does SAS 145 address? At a high level, SAS 145 addresses a company’s system of internal control and information technology. It also revises the definition of significant risk so that auditors will be focused on where the risks lie on a spectrum of inherent risk.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

N Contracts

OCTOBER 31, 2023

Unfairness might be discriminatory, but Congress needs to amend the language of Dodd-Frank's UDAAP provisions to clarify this point before the Consumer Financial Protection Bureau (CFPB) can label discrimination outside the realm of credit an unfair practice. That’s what the United States District Court of the Eastern District of Texas said on September 8 when it ruled that the CFPB’s decision to revise the language of UDAAP guidance to include discrimination exceeded its authority.

Mckinsey and Company

NOVEMBER 3, 2023

Africa’s fintech start-ups are leveraging mobile technology and innovative platforms to transform digital banking. We spoke with Ashraf Sabry, founder and CEO of Fawry, about the sector’s potential.

Harvard Corporate Governance

NOVEMBER 1, 2023

Posted by Mike Nordtvedt, Rezwan Pavri, and Austin March, Wilson Sonsini Goodrich & Rosati, on Wednesday, November 1, 2023 Editor's Note: Mike Nordtvedt and Rezwan Pavri are Partners and Austin March is an Associate at Wilson Sonsini Goodrich & Rosati. This post is based on a WSGR memorandum by Mr. Nordtvedt, Mr. Pavri, Mr. March, Bryan King , Heath DeJean, and Sally Yin.

A Neumann & Associates

NOVEMBER 2, 2023

When it comes time to selling your business, there will be tremendous emphasis on the financials. There is no doubt that the performance of the company leading up to and during the sale process is a prominent factor – both for proper valuation and structuring the ultimate transaction. However, strong financial performance alone does not guarantee a successful experience or even an executed deal.

N Contracts

NOVEMBER 2, 2023

A recap of enforcement actions in 2023 including deceptive banking practices, third-party oversight, redlining, BSA/AML, credit concerns and other issues

Mckinsey and Company

NOVEMBER 3, 2023

Reducing greenhouse gases is essential for chemical companies to remain competitive. Investing in feedstock sources and conversion technologies can help close the gap to net zero.

Harvard Corporate Governance

OCTOBER 31, 2023

Posted by Ron Kaniel (University of Rochester Simon Business School), on Tuesday, October 31, 2023 Editor's Note: Ron Kaniel is the Jay S. and Jeanne P. Benet Professor of Finance at the University of Rochester Simon Business School. This post is based on an article f orthcoming in Journal of Financial Economics by Professor Kaniel, Zihan Lin , Markus Pelger , and Stijn Van Nieuwerburgh.

Appraisers Blog

NOVEMBER 3, 2023

In reply to Dennis Mcmillen. Agree completely. Looking for a new vocation. A few years ago I had calculated I could retire at 65. Thanks to reduced fees and low volume of work I’ll retire 2 days after my funeral. But, it won’t be as an appraiser.

NYT M&A

OCTOBER 30, 2023

The process of selling Simon & Schuster has been long and tumultuous, and was waylaid by an earlier antitrust suit.

Mckinsey and Company

NOVEMBER 3, 2023

A mobility budget is an employee benefit that can help employers attract and retain talent. It’s also an emerging solution to increase sustainable transit use and reduce congestion in urban areas.

Harvard Corporate Governance

OCTOBER 30, 2023

Posted by Lisa Baudot (HEC Paris) and Dana Wallace (University of Central Florida), on Monday, October 30, 2023 Editor's Note: Lisa Baudot is an Associate Professor of Accounting and Management Control at HEC Paris, and Dana Wallace is an Associate Professor of Accounting at University of Central Florida Kenneth G. Dixon School of Accounting. This post is based on their article forthcoming in the Journal of Accounting and Public Policy.

Machen McChesney

NOVEMBER 3, 2023

In most cases, employees anticipate receiving a raise after working a certain amount of time at your firm — usually six months to a year. Top performers who consistently exceed expectations expect to be paid a salary that reflects their hard work and level of responsibility. You look to offer competitive compensation to retain your best workers.

Avanade

NOVEMBER 2, 2023

How can you lead the way in responsible AI adoption for a brighter future? Find out in this blog post by our European AI & IoT Lead, Yolanda Alonso Cid.

Mckinsey and Company

NOVEMBER 3, 2023

Amid a challenging macroeconomic environment and rapid change, CEOs are searching for the next engine for growth. The answer may be right in front of them: a redefined and reinvigorated relationship with their CMO.

Harvard Corporate Governance

NOVEMBER 2, 2023

Posted by Amanda Rose (Vanderbilt Law School), on Thursday, November 2, 2023 Editor's Note: Amanda M. Rose is Professor of Law at Vanderbilt University Law. This post is based on her article forthcoming in the Columbia Business Law Review. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) and Will Corporations Deliver Value to All Stakeholders?

Machen McChesney

NOVEMBER 2, 2023

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In Notice 2023-68, the IRS announced the fiscal 2024 special “per diem” rates that became effective October 1, 2023.

Financial Times M&A

OCTOBER 31, 2023

Although Microsoft extended its partnership with the chatbot creator, the two companies are also competitors

Mckinsey and Company

NOVEMBER 3, 2023

Counterparty-credit-risk management is becoming more challenging and complex, reflecting a disrupted global economic, political, and regulatory environment, together with historically high levels of volatility.

Harvard Corporate Governance

OCTOBER 30, 2023

Posted by Alyssa Stankiewicz and Lindsey Stewart, Morningstar, Inc, on Monday, October 30, 2023 Editor's Note: Alyssa Stankiewicz is an Associate Director of Sustainability Research and Lindsey Stewart is a Director of Investment Stewardship at Morningstar, Inc. This post is based on their Morningstar memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A.

Gross Mendelsohn

OCTOBER 30, 2023

Any government contractor that procures products from the Xinjiang Uyghur Autonomous Region of the People's Republic of China is affected by a new ruling by the Department of Defense (DoD). This ruling takes effect October 30, 2023.

Let's personalize your content