Business Judgment and Valuing Impacts

Harvard Corporate Governance

JULY 30, 2024

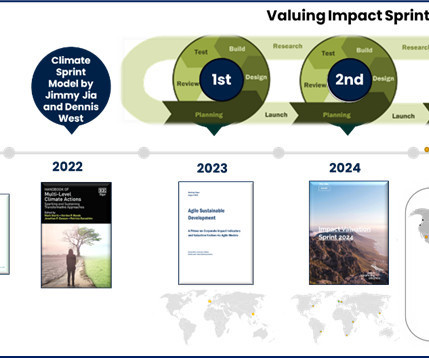

Posted by Dennis West (University of Oxford), and Dimitrij Euler (Value Balancing Alliance), on Tuesday, July 30, 2024 Editor's Note: Dennis West is a PhD Candidate at the University of Oxford and Dimitrij Euler is Director of Sustainable Finance at Value Balancing Alliance. This post is based on their recent report. Introduction About twelve years ago, when we first wrote about the relevance of social and environmental information to corporate governance [1] , scholars and practitioners alike r

Let's personalize your content