Meta had ‘monopoly power’ after buying rival apps, FTC says

Financial Times M&A

APRIL 14, 2025

Blockbuster antitrust trial that could force break-up of $1.

Financial Times M&A

APRIL 14, 2025

Blockbuster antitrust trial that could force break-up of $1.

Law 360 M&A

APRIL 14, 2025

Sidley Austin LLP announced on Monday it has hired a partner from Skadden Arps Slate Meagher & Flom LLP to strengthen its mergers and acquisitions and private equity practices.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

APRIL 14, 2025

Sale is part of plan by the company to divest non-core assets

Appraisers Blog

APRIL 14, 2025

All kidding aside, any licensed or certified appraiser knows this whole hybrid dynamic to be suspect. DO NOT DO THEM!! Call their bluff. Get loud! These are GSEs’ still under conservatorship trying to blackmail you into doing something that you know will result in a misleading appraisal.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Financial Times M&A

APRIL 14, 2025

Plus, private equity group CVC scouts out private credit group and Intel sells off a stake in its chips unit

Appraisers Blog

APRIL 14, 2025

In reply to Divedude. Unfortunately, it appears there are too many Skippys completing these. After all, look at the less than stellar companies pushing them.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Appraisers Blog

APRIL 14, 2025

Reggora's survey results on hybrid appraisals is a textbook example of twisting flawed data to fit a preconceived flawed narrative.

Law 360 M&A

APRIL 14, 2025

Lowe's, advised by Covington & Burling LLP, has entered a definitive agreement to buy Dallas-based interior finishing company Artisan Design Group for more than $1.3 billion, expanding the reach of the American home improvement retail giant's professional services, dubbed Lowe's Pro, Lowe's announced Monday.

Appraisers Blog

APRIL 14, 2025

Anyone performing hybrids is an order taker, not an appraiser. Don,’t do them. Don’t be a sap! Some stiff collecting data for my reports? Someone better duck! LOL!

Law 360 M&A

APRIL 14, 2025

Meta Platforms CEO Mark Zuckerberg testified Monday that the social media giant is no longer solely focused on connecting friends and family, arguing on the first day of the Federal Trade Commission's monopolization trial that the company has broader focus and faces more competition than the FTC claims.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Norman Marks

APRIL 14, 2025

I like to think I have common sense. If I read or am told something, I question it. Does it make sense?

Law 360 M&A

APRIL 14, 2025

Management-side firm Akerman LLP added a partner to its labor and employment practice group in Chicago who is returning to the firm after seven years and called going back "a homecoming.

John Jenkins

APRIL 14, 2025

I recently blogged about the interesting circumstances surrounding the buyer’s decision to try to get out of the deal at issue in the Delaware Chancery decision in Desktop Metal v. Nano Dimension (Del. Ch.; 3/25).

Law 360 M&A

APRIL 14, 2025

Special purpose acquisition company Timber Road Acquisition Corp. filed documents on Monday that outlined its plans for a $200 million initial public offering in search of merger targets in real estate and consumer industries, with Reed Smith LLP representing the company and Loeb & Loeb LLP as counsel for an underwriter.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Financial Times M&A

APRIL 14, 2025

Slowdown in high-yield bond market issuance threatens a tentative rebound in dealmaking

Law 360 M&A

APRIL 14, 2025

British women's healthtech company Chiaro Technology Ltd. has filed for Chapter 15 recognition in Delaware bankruptcy court, seeking acknowledgment of an insolvency proceeding in the United Kingdom through which it aims to manage its American assets while pursuing a sale to a competitor.

Harvard Corporate Governance

APRIL 14, 2025

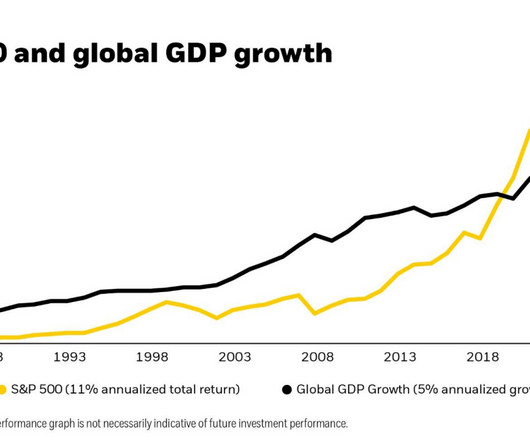

Posted by Larry Fink, BlackRock Inc., on Monday, April 14, 2025 Editor's Note: Larry Fink is Founder, Chairman and CEO of BlackRock Inc. This post is based on Mr. Finks annual letter to investors. I hear it from nearly every client, nearly every leadernearly every personI talk to: Theyre more anxious about the economy than any time in recent memory.

Law 360 M&A

APRIL 14, 2025

The Federal Trade Commission launched a public inquiry Monday to look into reducing regulations that are hindering competition, following a similar move by the U.S. Department of Justice last month.

NYT M&A

APRIL 14, 2025

Metas chief has grown accustomed to tough questioning in courts and hearings, but an antitrust trial that started Monday could be more grueling, experts said.

Law 360 M&A

APRIL 14, 2025

A private equity firm that bought the Joy dish soap brand has asked a Connecticut trial court judge to nix a manufacturer's claim that the firm should be held liable for a holding company's alleged failure to pay after asking the manufacturer to ramp up production.

NYT M&A

APRIL 14, 2025

Metas antitrust trial, in which the government contends the company killed competition by buying young rivals, hinges on unknowable alternate versions of Silicon Valley history.

Law 360 M&A

APRIL 14, 2025

Wilson Sonsini Goodrich & Rosati PC-steered Kodiak Robotics, a firm valued at $2.5 billion that specializes in driverless truck technology, said Monday it plans to go public later this year by merging with blank-check company Ares Acquisition Corp. II, which is being represented by Kirkland & Ellis LLP.

Harvard Corporate Governance

APRIL 14, 2025

Posted by Gladriel Shobe (BYU Law School), Jarrod Shobe (BYU Law School), and William W. Clayton (BYU Law School), on Monday, April 14, 2025 Editor's Note: Gladriel Shobe , Jarrod Shobe , and William W. Clayton are Professors of Law at Brigham Young University Law School. This post is based on their recent article forthcoming in the Yale Journal on Regulation, and is part of the Delaware law series ;links to other posts in the series are available here.

Law 360 M&A

APRIL 14, 2025

Clifford Chance LLP has grown its U.S. corporate mergers and acquisitions practice with the addition of a former White & Case LLP partner in New York, the firm said Monday.

Appraisers Blog

APRIL 14, 2025

In reply to K Schware. Might have been a non QM loan-not FRMC, non FNMA, etc. Anyway, something stinks worse than an abandoned fish market.

Law 360 M&A

APRIL 14, 2025

Dealmakers are adopting more cautious and deliberate merger and acquisition practices, such as earnout agreements, joint ventures and strategic partnerships that mitigate risk and bridge valuation gaps, amid the slower pace so far in 2025, says Louis Lehot at Foley & Lardner.

Appraisers Blog

APRIL 14, 2025

In reply to Baggins. “We have investigated ourselves, and determined we did nothing wrong. Great job boys, see you at the club.” I picture this in a movie clip in “Wolves of Wall Street” when he was first showing the “guys” how to use his script and well… I’m not going to use words here to describe it.

Law 360 M&A

APRIL 14, 2025

Morgan Stanley Investment Management said Monday it has closed its third dedicated private equity co-investment fund at its hard cap of about $2.3 billion, underscoring investor demand for direct exposure to deals alongside leading buyout firms.

Appraisers Blog

APRIL 14, 2025

In reply to Anna Richardson. In present restricted markets with limited sales, every deal counts. Every AMC is sensitive to ensuring the deal goes through, making the client happy in making more money. Less money is made when the deal falls apart (industry norm for same low appraisals, even through the concept is erroneous). A happy client stays on the hamster wheel.

Law 360 M&A

APRIL 14, 2025

A consortium of private equity firms, including TowerBrook Capital Partners LP, has completed its 283 million ($373 million) takeover of technology company Equals Group PLC, triggering the suspension of its shares from the London Stock Exchange, the British business said on Monday.

Appraisers Blog

APRIL 14, 2025

Appraisal Management Companies (AMCs) were originally created to provide a buffer between lenders and appraisers, especially after the 2008 financial crisis. The idea was to ensure that appraisers could operate independently, free from pressure to inflate property valuesa key issue leading to the housing crash. By acting as intermediaries, AMCs were meant to add a layer of fairness and objectivity.

Law 360 M&A

APRIL 14, 2025

Intel Corp. said Monday it has agreed to sell a 51% stake in its Altera business to Latham & Watkins LLP-advised Silver Lake, valuing the semiconductor solutions businessat $8.75 billion.

Appraisers Blog

APRIL 14, 2025

In reply to Anna Richardson. Anna. All but a minuscule portion of the amc industry is inexorably corrupt. Honest companies do not demand their vendors lie to customers and conceal their billing amounts, then base their volume of work order requests on the vendors open willingness to collude with defrauding customers. Grading, tiered placement, performance stars, all merely a flimsy cover to engage in preferential assignment, seeking the most biased, most compliant appraisers.

Law 360 M&A

APRIL 14, 2025

Law school often doesn't cover the business strategy, financial fluency and negotiation skills needed for a successful corporate or transactional law practice, but there are practical ways to gain relevant experience and achieve the mindset shifts critical to a thriving career in this space, says Dakota Forsyth at Olshan Frome.

Let's personalize your content