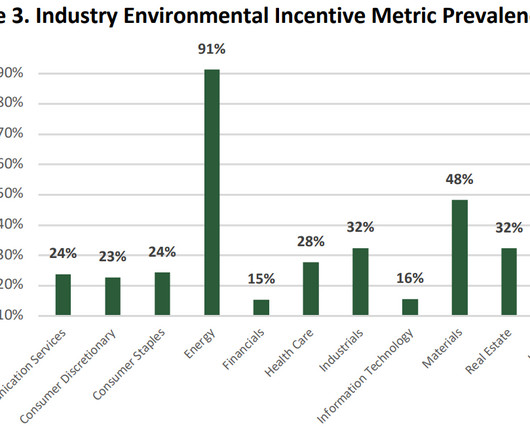

Environmental Performance Metrics in Incentive Plans: Incentive Trends and Key Design Considerations

Harvard Corporate Governance

JULY 23, 2024

Posted by Tara Tays, Phil Johnson (Pay Governance), and Ashley Gamarra (SustainaBase), on Tuesday, July 23, 2024 Editor's Note: Tara Tays is a Partner, Phil Johnson is a Senior Consultant at Pay Governance, and Ashley Gamarra is Head of Marketing at SustainaBase. This post is based on their Pay Governance memorandum. Introduction In recent years, global companies have grappled with defining a baseline for environmental metrics, establishing the processes and controls to measure and report progre

Let's personalize your content