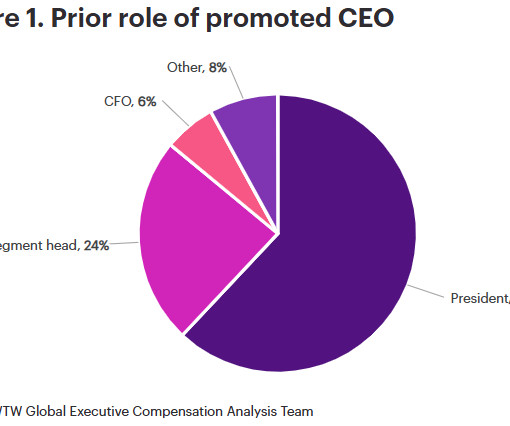

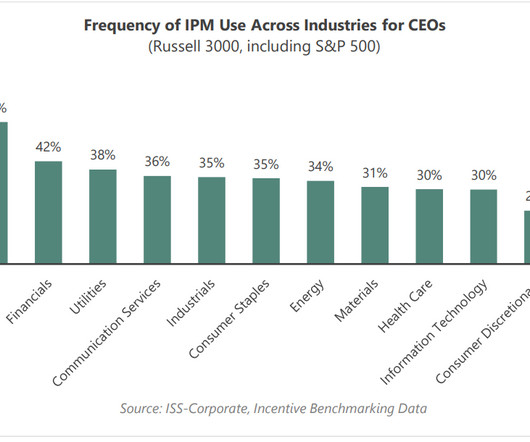

By the Numbers: How Companies Pay Execs They Promote to CEO

Harvard Corporate Governance

DECEMBER 2, 2024

Posted by Theresa Tovar and Robert Newbury, Willis Towers Watso, on Monday, December 2, 2024 Editor's Note: Theresa Tovar is a Director and Robert Newbury is a Senior Director at Willis Towers Watson. This post is based on their Willis Towers Watson memorandum. Choosing the right candidate to fill the corner office comes with a unique set of challenges.

Let's personalize your content