Nippon Steel’s $15 Billion U.S. Steel Takeover Bid Is in Peril

NYT M&A

AUGUST 25, 2024

The proposed merger of Japanese and American industrial giants, which proponents say would benefit both countries, is ensnared by political and labor opposition.

NYT M&A

AUGUST 25, 2024

The proposed merger of Japanese and American industrial giants, which proponents say would benefit both countries, is ensnared by political and labor opposition.

Financial Times M&A

AUGUST 25, 2024

Industry could step up share buybacks as large M&A opportunities are limited, analysts say

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

AUGUST 25, 2024

Posted by Mark Mushkin, Orrick, Herrington & Sutcliffe LLP, on Sunday, August 25, 2024 Editor's Note: Mark Mushkin is a Partner at Orrick, Herrington & Sutcliffe LLP. This post is based on his Orrick memorandum. With signs of a measured return of the IPO markets, companies and investors are revisiting the fundamental question, “What do I need to look like to go public?

Financial Times M&A

AUGUST 25, 2024

Companies want commodities critical for clean energy such as copper that could drive deals

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Reynolds Holding

AUGUST 25, 2024

The venture capital (VC) industry has undergone a profound transformation over the past two decades with the emergence of common VC investors — that is, VC firms that hold ownership stakes in multiple startups within the same industry or product markets. In a forthcoming article, we describe the origins and implications of common VC investment and highlight research questions about its benefits and costs.

Financial Times M&A

AUGUST 25, 2024

Slowdown in public listings and takeovers means staff and investors are selling shares for cheap on secondary market

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Exit Strategy

AUGUST 25, 2024

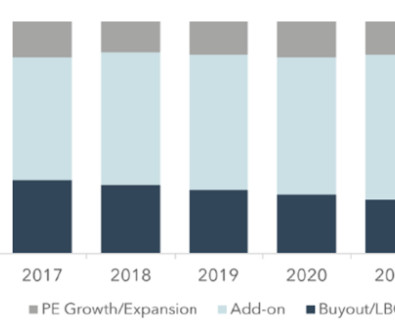

PE firms are increasingly using strategic “add-on” (aka bolt-on) acquisitions to consolidate fragmented industries, particularly in sectors like healthcare and business services, where operational efficiencies and market share gains are achievable. This approach to growth allows firms to create more valuable and competitive entities more quickly than organic growth, usually with lower business and financial […] The post Add-On Acquisitions Continue Popularity appeared first on

Appraisers Blog

AUGUST 25, 2024

Agencies should emulate the CAMA models employed by County Assessors, as AVMs are highly analogous to these mass appraisal techniques.

Benzinga

AUGUST 25, 2024

Delhi, Aug. 26, 2024 (GLOBE NEWSWIRE) -- Multispecific antibody therapeutics are rapidly emerging as a transformative approach in the treatment of various diseases, particularly cancer, autoimmune disorders, and infectious diseases. Unlike traditional monoclonal antibodies that target a single antigen, multispecific antibodies are designed to engage multiple targets simultaneously.

Appraisers Blog

AUGUST 25, 2024

Agencies should emulate the CAMA models employed by County Assessors, as AVMs are highly analogous to these mass appraisal techniques.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Reynolds Holding

AUGUST 25, 2024

On August 20, 2024, Judge Ada Brown of the U.S. District Court for the Northern District of Texas issued a permanent injunction setting aside the Federal Trade Commission’s final rule banning non-compete agreements in Ryan LLC v. FTC. Last month, the court afforded temporary relief as to the named plaintiffs only by issuing a preliminary injunction enjoining the rule’s application against them.

Peak Business Valuation

AUGUST 25, 2024

Are you looking to buy a business ? If so, the auto parts wholesale industry is a safe bet. As the average vehicle age increases, consumers will need replacement parts. This boosts the demand for auto parts wholesale businesses. As such, buying an auto parts wholesale business can be a profitable investment. But to ensure you are buying the right business, it is important to obtain an auto parts business valuation.

Let's personalize your content