Economic empowerment made-to-measure: How companies can benefit more people

Mckinsey and Company

JANUARY 7, 2025

Connections, contexts, and capabilities can guide corporate efforts to create empowerment impact efficiently.

Mckinsey and Company

JANUARY 7, 2025

Connections, contexts, and capabilities can guide corporate efforts to create empowerment impact efficiently.

Peak Business Valuation

JANUARY 7, 2025

Are you interested in owning a business in the medical field? If so, buying a physical therapy practice could be right for you. A business valuation for buying a physical therapy practice can help you navigate the buying process. In an industry of high regulations and extensive training, owning a business in the medical field can be complicated. A physical therapy practice valuation is essential to the success of a practice.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Equilest

JANUARY 7, 2025

Dive into the financial forensics that could save your investments: Discover how the Beneish M-Score acts as a powerful lie detector for corporate financial statements, revealing hidden manipulation risks that could make or break your investment strategy. Introduction Traditional approaches frequently fail to identify hidden financial risks in the complicated art and science of business assessment.

Financial Times M&A

JANUARY 7, 2025

Acquisition of Citrin Cooperman from New Mountain Capital for $2bn marks a step up in valuations

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Law 360 M&A

JANUARY 7, 2025

GettyImages Holdings Inc. and Shutterstock said Tuesday they have agreed to merge into a visual content company that would have an enterprise value of approximately $3.7 billion, retaining the GettyImages name.

NYT M&A

JANUARY 7, 2025

The agreement ends litigation between the two companies over plans for a sports streaming service, but consumer advocates are pushing back.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Law 360 M&A

JANUARY 7, 2025

Investors suing the now-bankrupt oil and gas company Alta Mesa Resources Inc. have asked a Texas federal judge to preliminarily approve a $126.3 million deal to settle claims that the company and its executives misled investors about the value of a 2017 merger.

Vested

JANUARY 7, 2025

How Investors' Relief could reduce your Capital Gains Tax on investments in unlisted trading companies and the changes following the 2024 Autumn Budget.

Law 360 M&A

JANUARY 7, 2025

The Carlyle Group on Tuesday beat a more than four-year-old suit accusing the global investment giant and three directors of authentication provider Authentix Inc. of breaching their fiduciary duties in approving Authentix's $77.5 million sale to private equity firm Blue Water Energy LLP in 2017.

Financial Times M&A

JANUARY 7, 2025

Plus, one tech investor thinks Europe still has a shot at the AI race and Blackstone gets in on the accounting sector

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Law 360 M&A

JANUARY 7, 2025

The former parent company of a group of international automotive product suppliers has asked a Michigan federal judge not to force arbitration of its lawsuit accusing them of stiffing it out of more than $11 million in royalties, saying the suppliers waived their right to arbitration.

Reynolds Holding

JANUARY 7, 2025

One of the defining social issues of our time is the persistent earnings inequality in the U.S. between men and women and between white and minority workers. Many factors contribute to this inequality, but two stand out: (1) pay gaps, i.e., the difference in compensation between men and women or between white and non-white workers working in the same job category, and (2) job segregation, i.e., the overrepresentation or underrepresentation of women and certain minorities in particular occupation

Law 360 M&A

JANUARY 7, 2025

Oilfield equipment and services provider Flowco Holdings Inc. on Tuesday launched plans for an estimated $392 million initial public offering, represented by Sidley Austin LLP and underwriters' counsel Latham & Watkins LLP, marking the latest company to join the new year's IPO pipeline.

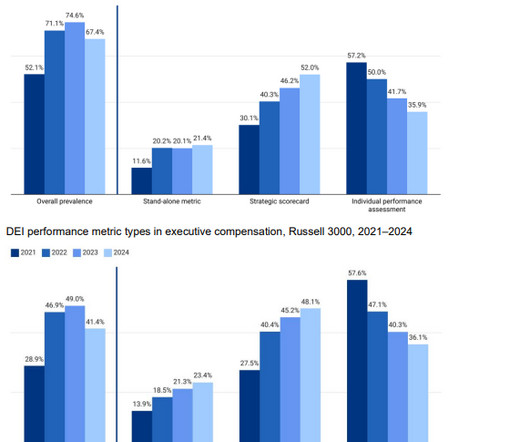

Harvard Corporate Governance

JANUARY 7, 2025

Posted by Matteo Tonello, The Conference Board, Inc., on Tuesday, January 7, 2025 Editor's Note: Matteo Tonello is Head of Benchmarking and Analytics at The Conference Board, Inc. This post is based on a Conference Board memorandum by Mr. Tonello, Paul Hodgson , and Andrew Jones. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here ) by Lucian A.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Law 360 M&A

JANUARY 7, 2025

Following another chilly year for initial public offerings in Canada, capital markets lawyers in the Great White North are approaching 2025 with caution, hoping that a few catalysts can break through and thaw an otherwise frozen market for public listings.

Harvard Corporate Governance

JANUARY 7, 2025

Posted by Brian V. Breheny,Raquel Fox, and Page Griffin, Skadden, Arps, Slate, Meagher & Flom LLP, on Tuesday, January 7, 2025 Editor's Note: Brian V. Breheny , Raquel Fox , and Page Griffin are Partners at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on a Skadden memorandum by Mr. Breheny, Ms. Fox, Mr. Griffin, Marc S. Gerber , Joseph M.

Law 360 M&A

JANUARY 7, 2025

Clark Hill PLC has hired a trio of former Taylor English Duma LLP partners in Atlanta to bolster its national franchise practice, the firm announced Tuesday, making them the latest attorneys to leave Taylor English to join Clark Hill since its Atlanta office opened last year.

Harvard Corporate Governance

JANUARY 7, 2025

Posted by Felix von Meyerinck (University of Zurich), Jonas Romer (University of St. Gallen), and Markus Schmid (University of St. Gallen), on Tuesday, January 7, 2025 Editor's Note: Felix von Meyerinck is a Senior Research Associate at the University of Zurich, Jonas Romer is a Research Assistant at the University of St. Gallen, and Markus Schmid is a Professor of Corporate Finance at the University of St.

Law 360 M&A

JANUARY 7, 2025

Davis Polk & Wardwell LLP-advised business services company Cintas on Tuesday publicly unveiled its proposal to acquire workwear company UniFirst Corp. for $5.3 billion, a move that comes as UniFirst refuses to engage on the matter, Cintas announced Tuesday.

Benzinga

JANUARY 7, 2025

Phillips 66 (NYSE: PSX ) shares are trading higher on Tuesday. On Monday, the company disclosed a definitive deal to acquire EPIC Y-Grade, LP’s natural gas liquids (NGL) business for $2.2 billion in cash. The EPIC NGL business includes two fractionators with a combined capacity of 170 MBD near Corpus Christi, Texas. The business also includes around 350 miles of purity distribution pipelines and an 885-mile NGL pipeline linking production from the Delaware, Midland, and Eagle.

Law 360 M&A

JANUARY 7, 2025

A former Sidley Austin LLP partner jumped to Winston & Strawn LLP's transactions department in Miami to continue his work advising multinational clients on cross-border transactions in the U.S. and Latin America, the firm announced Tuesday.

N Contracts

JANUARY 7, 2025

The Interagency Fair Lending webinar offered a wealth of insights and takeaways for financial institutions navigating an evolving regulatory landscape. The presentations from eight federal agencies covered several emerging topics, from the Combatting Redlining Initiative enforcements to the Equitable Housing Finance Plan Rule.

Law 360 M&A

JANUARY 7, 2025

Human capital management company Paychex Inc., advised by Davis Polk & Wardwell LLP, on Tuesday unveiled plans to buy fellow human capital management, payroll and talent acquisition software company Paycor, led by Kirkland & Ellis LLP, in a deal with an enterprise value of $4.1 billion.

Benzinga

JANUARY 7, 2025

Paychex, Inc. (NASDAQ: PAYX ) shares are trading higher on Tuesday after the company disclosed a deal to fully acquire Paycor HCM, Inc. (NASDAQ: PYCR ) in an all-cash transaction representing an enterprise value of around $4.1 billion. Paychex will acquire Paycor for $22.50 per share, which represents a 19% premium over Paycor’s 30-day volume-weighted average trading price as of January 3, 2025.

Law 360 M&A

JANUARY 7, 2025

The Federal Trade Commission brought a rare merger "gun jumping" action Tuesday under which Verdun Oil Co. will pay $5.6 million for exerting control over EP Energy LLC before the mandatory waiting period under U.S. antitrust law expired and its purchase of the company closed.

Benzinga

JANUARY 7, 2025

Unifirst Corporation (NYSE: UNF ) shares are trading higher on Tuesday. Cintas Corporation (NASDAQ: CTAS ) has made a solid move by submitting a proposal to acquire all outstanding shares of UniFirst for $275 per share in cash. This offer, which represents a 46% premium to UniFirst’s ninety-day average closing price as of January 6, 2025, values UniFirst at approximately $5.3 billion.

Law 360 M&A

JANUARY 7, 2025

Team Internet Group PLC said Tuesday that it has received two competing bids from investment managers TowerBrook and Verdane, which each value the internet services company at approximately 315 million ($394 million).

Meade & Moore

JANUARY 7, 2025

Employee benefit plans are a vital part of your organization's offerings, and ensuring they are fully compliant with regulatory requirements is a critical task for benefits administrators. Compliance testing isnt just a checkbox on your to-do listit's a key element in maintaining the integrity and success of your benefits program.

Law 360 M&A

JANUARY 7, 2025

Six law firms are guiding a deal disclosed Tuesday that will see funds managed by affiliates of Apollo and BC Partners purchase the environmental services business of GFL Environmental Inc. at an enterprise value of 8 billion Canadian dollars ($5.6 billion).

Benzinga

JANUARY 7, 2025

Getty Images Holdings, Inc. (NYSE: GETY ) and Shutterstock, Inc. (NYSE: SSTK ) shares are trading higher premarket on Tuesday after the companies entered a deal to create a visual content company in a merger of equals. The combined company will have an enterprise value of approximately $3.7 billion. The merger of Getty Images and Shutterstock will create a larger, more diverse content library, expand opportunities for contributors, and strengthen their commitment to inclusive content.

Law 360 M&A

JANUARY 7, 2025

Julius Baer said Tuesday that it has agreed to sell its domestic Brazilian wealth management business to Latin American investment bank BTG Pactual SA for 615 million Brazilian reais ($102 million).

Benzinga

JANUARY 7, 2025

On Monday, Stryker Corporation (NYSE: SYK ) agreed to acquire Inari Medical Inc. (NASDAQ: NARI ) for $80 per share in cash, representing a total fully diluted equity value of approximately $4.9 billion. Inari, founded in 2011, will help strengthen the peripheral vascular position in the growing segment of venous thromboembolism (VTE) to Stryker. VTE is a term for blood clots in the veins, which can lead to serious illness, disability, or death.

A Neumann & Associates

JANUARY 7, 2025

So, I hear youre selling your business. These are words you never want to hear when you are ACTUALLY selling your business. Why is that? Because if someone is telling you that, then chances are your employees know, your competitors know, your suppliers know, and your customers know. This means you have already lost leverage in any negotiation to market your business and may have negatively impacted your current sales and operations.

Benzinga

JANUARY 7, 2025

Dutch semiconductor manufacturing and design company NXP Semiconductors N.V. (NASDAQ: NXPI ) has agreed to acquire TTTech Auto , a software solutions provider specializing in safety-critical systems for software-defined vehicles (SDVs). The all-cash transaction, valued at $625 million, aims to strengthen NXP’s position in the automotive industry.

Let's personalize your content