Consumers Are Spending Again (Outside of China)

Mckinsey and Company

APRIL 7, 2024

Despite economic headwinds, Chinese consumption is exhibiting encouraging signs.

Mckinsey and Company

APRIL 7, 2024

Despite economic headwinds, Chinese consumption is exhibiting encouraging signs.

Harvard Corporate Governance

APRIL 7, 2024

Posted by Brian V. Breheny, Raquel Fox, and Ryan J. Adams, Skadden, Arps, Slate, Meagher & Flom LLP, on Sunday, April 7, 2024 Editor's Note: Brian V. Breheny and Raquel Fox are Partners, and Ryan J. Adams is Counsel at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on their Skadden memorandum. When finalizing proxy materials for annual shareholder meetings, companies should consider the following areas, which are described in more detail below: SEC Proxy Filing Requirements

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Appraisers Blog

APRIL 7, 2024

In reply to Baggins. Wow, interesting, If my memory serves me, when you review an appraisal you must review it based upon the USPAP that was in force in the year of the appraisal report. 2018 to present is 6 years, we are supposed to keep them for 5 year unless it went to court, and then more years after the conclusion of the court. The IRS believes that in the case of fraud, there is no deadline on how far back they may go.

Fox Corporate Finance

APRIL 7, 2024

FCF Fox Corporate Finance GmbH is pleased to publish the “CleanTech Venture Capital Report – 2024”. This edition of the “FCF DeepTech Series” focuses on VC funding developments within the European Cleantech vertical. This vertical. Read more The post FCF CleanTech Venture Capital Report – 2024 published appeared first on FCF Fox Corporate Finance GmbH.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Reynolds Holding

APRIL 7, 2024

Regulators globally are requiring companies to disclose their greenhouse gas (GHG) emissions. For companies in some industries, Scope 1 and 2 emissions – covering, respectively, emissions from direct fuel use and from acquired energy – will cover most relevant emissions caused by their activities, and these are relatively simple to calculate and disclose.

Reynolds Holding

APRIL 7, 2024

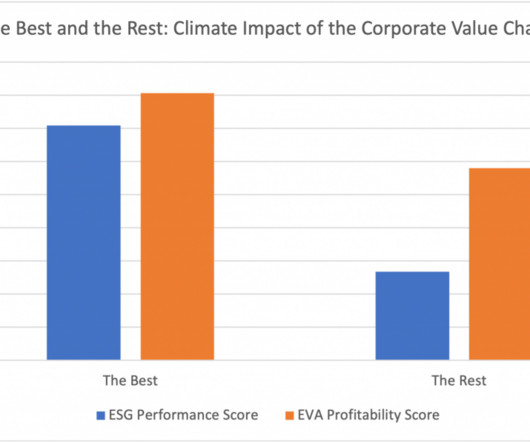

For many business economists and legal academics, the purpose of any business organization is simply stated: to maximize profits. And it is true that many practical advantages may follow from this statement of purpose. Focusing only on profit-making allows leaders of firms to discount all other moral, social, or environmental claims on a business as irrelevant.

Let's personalize your content