Is the world facing a state of permacrisis?

Mckinsey and Company

SEPTEMBER 25, 2024

Leading economists Mike Spence and Mohamed El-Erian talk about the “pretty complicated and disorienting environment” we face.

Mckinsey and Company

SEPTEMBER 25, 2024

Leading economists Mike Spence and Mohamed El-Erian talk about the “pretty complicated and disorienting environment” we face.

Harvard Corporate Governance

SEPTEMBER 25, 2024

Posted by Gabriel Rauterberg (Michigan Law School) and Jeffery Y. Zhang (Michigan Law School), on Wednesday, September 25, 2024 Editor's Note: Gabriel Rauterberg is a Professor of Law and Jeffery Y. Zhang is an Assistant Professor of Law at the University of Michigan Law School. This post is based on their article forthcoming in the Journal of Stanford Law Review.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

SEPTEMBER 25, 2024

Autonomous trucks offer compelling use cases and benefits to total cost of operation that could translate to an approximately $600 billion market in 2035.

Harvard Corporate Governance

SEPTEMBER 25, 2024

Posted by Kurt Moeller, FTI Consulting, on Wednesday, September 25, 2024 Editor's Note: Kurt Moeller is a Managing Director at FTI Consulting. This post is based on his FTI Consulting memorandum. Epic battles are the stock in trade for The Walt Disney Company (“Disney”), and not just on the big screen. Over the past 40 years, Disney has faced three waves of shareholder activism, with the first two resulting in its CEO being replaced.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Machen McChesney

SEPTEMBER 25, 2024

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Harvard Corporate Governance

SEPTEMBER 25, 2024

Posted by Kyoko Takahashi Lin, Robert Cohen, and Sidney Bashago, Davis Polk & Wardwell LLP, on Wednesday, September 25, 2024 Editor's Note: Kyoko Takahashi Lin , Robert A. Cohen , and Sidney Bashago are Partners at Davis Polk & Wardwell LLP. This post is based on a Davis Polk memorandum by Ms. Lin, Mr. Cohen, Ms. Bashago, Fuad Rana , and Veronica Wissel.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Financial Times M&A

SEPTEMBER 25, 2024

String of recent megadeals includes $36bn acquisition by Mars and $20bn takeover by Verizon

Mckinsey and Company

SEPTEMBER 25, 2024

As head of R&D at Novo Nordisk, Marcus Schindler is leading the company’s efforts to embrace external innovation and expand into new therapeutic areas with AI as a powerful catalyst for progress.

Financial Times M&A

SEPTEMBER 25, 2024

Australian property listings group chief says offer for UK rival is a ‘compelling proposition’

Mckinsey and Company

SEPTEMBER 25, 2024

McKinsey partner Brodie Boland explains how decarbonizing building operations is more crucial—but also more doable—than ever.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Financial Times M&A

SEPTEMBER 25, 2024

Chief executive Andrea Orcel tells conference ‘all scenarios are open’ after Italian bank built large stake in German rival

Mckinsey and Company

SEPTEMBER 25, 2024

With the markets for sustainable materials subject to recent headwinds, what will be the impact on green premia? A new survey paints a cautiously optimistic picture.

Appraisers Blog

SEPTEMBER 25, 2024

The appraiser must be able to anticipate what data gathering is necessary. That is why there are different forms for different housing types, creating a pre established framework. Such a concept was based on intelligent design. There must be zero confusion about what data the appraiser will need to gather ahead of time. If we can’t print out the form on paper ahead of the inspection the concept will not work properly in the real world.

Mckinsey and Company

SEPTEMBER 25, 2024

Spend digital twins could revolutionize procurement by handing negotiation power back to buyers—providing a clear and real-time view of fair market price.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Appraisers Blog

SEPTEMBER 25, 2024

In reply to Koma. Like that comment Koma. Some people are naturals with a camera. Other people simply never took the time to acquire those skills. The days of simply copying photos for this type of work are now more complicated. MLS’s nationwide have updated their rules. [link] [link] Pg 25-32, ownership of mls compilations and copyrights. What is contained in appraisal reports is not the GSE’s privately owned data they can do whatever they want without restriction.

Mckinsey and Company

SEPTEMBER 25, 2024

Bosch worked with McKinsey to develop and launch CyberCompare—a cybersecurity purchasing platform to help businesses and public sector entities compare quotations and match with cybersecurity vendors and service providers.

The Guardian M&A

SEPTEMBER 25, 2024

Australian company says it is frustrated that UK property website has refused to engage over £6.1bn offer Rightmove has rejected a third bid from Rupert Murdoch’s REA Group and said the offer was “unattractive” and undervalues the UK’s largest online property portal. On Wednesday Rightmove confirmed that its board had “unanimously rejected” the non-binding cash-and-shares offer put forward on Monday, which valued the company at £6.1bn.

Appraisers Blog

SEPTEMBER 25, 2024

In reply to Pray Hard. [link] That is a doc linked from your article. #450, specifically notes real estate appraisers. The issue is complicated because even under previous rules, many lenders and amc’s were already exceeding their authority and were in violation of previous IRS rules on classification of independent contractors. They have been using appraisers and forcing us into certain working conditions which should have classified us as employees, resulting in entitled benefits.

Financial Times M&A

SEPTEMBER 25, 2024

Fourteen major banks and financial institutions back COP28 goal of tripling nuclear capacity by 2050

Appraisers Blog

SEPTEMBER 25, 2024

The harassment campaign aims to accelerate loan approvals, circumventing the appraisal process, which they view as an unnecessary obstacle.

Machen McChesney

SEPTEMBER 25, 2024

Timing is critical in financial reporting. Under accrual-basis accounting, the end of the accounting period serves as a “cutoff” for when companies recognize revenue and expenses. However, some companies may be tempted to play timing games, especially at year-end, to boost financial results or lower taxes.

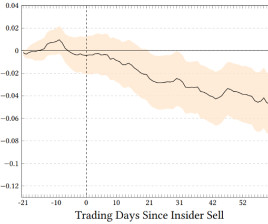

Reynolds Holding

SEPTEMBER 25, 2024

The Securities and Exchange Commission plays a crucial role as the watchdog of Wall Street by detecting financial misconduct and enforcing securities laws, but much of its investigative process has remained opaque to researchers and the public. In a new paper, we “watch the watchdogs” by building a geospatial database that allows us to uncover unprecedented insights into the SEC’s monitoring of public firms.

Benzinga

SEPTEMBER 25, 2024

Shares of Kimco Realty (NYSE: KIM ) have soared 25.9% in the past three months compared with its industry's rally of 17.2%. This Jericho, NY-based retail real estate investment trust (REIT) is well-poised to benefit from its portfolio of premium shopping centers, which are predominantly grocery-anchored, in the drivable first-ring suburbs within key major metropolitan Sunbelt and coastal markets.

Brian DeChesare

SEPTEMBER 25, 2024

If you ever want to trigger an entire community, go to an MBA-related subreddit and ask whether “an MBA is worth it.” You’ll get a wide range of responses, but most will be some variation of: “Yes, of course it’s worth it because I did it / I am doing it currently.” I wrote this article because I’m more of a neutral, 3 rd party observer. I never did an MBA, but plenty of friends and acquaintances have, and so have many students and coaching clients.

Benzinga

SEPTEMBER 25, 2024

In October 2023, Sanofi SA (NASDAQ: SNY ) announced its plans to spin off its consumer healthcare business as the French pharmaceutical company outlined its strategic update to increase investment in its drug-development pipeline and cut costs. Sanofi said the spinoff would allow it to increase its focus on innovative medicines and vaccines. Sanofi’s consumer health unit boasts a portfolio that includes popular over-the-counter products like Phytoxil cough syrups, Icy Hot pain relief gels,

LaPorte

SEPTEMBER 25, 2024

(authored by RSM US LLP) Nonprofits need to cultivate a new type of workforce by adopting a more operational mindset and investing in technology, which will attract top talent The post Nonprofits need to cultivate a new type of workforce first appeared on LaPorte.

Auto Dealer Valuation Insights

SEPTEMBER 25, 2024

We are excited to share the release of our latest book Buy-Sell Agreements: Valuation Handbook for Attorneys authored by Z. Christopher Mercer, FASA, CFA, ASA and published by the American Bar Association. This week, we share an excerpt from the book that discusses what you can expect to find in the full copy.

Law 360 M&A

SEPTEMBER 25, 2024

Special purpose acquisition company Breeze Holdings Acquisition Corp. on Wednesday announced that it has agreed to merge with and take public clinical-stage biopharmaceutical company YD Biopharma Ltd. in a deal that gives the combined company an estimated enterprise value of $694 million and was built by three firms.

Auto Dealer Valuation Insights

SEPTEMBER 25, 2024

An RIA’s margin is a simple, easily observable figure that condenses a range of underlying considerations about a firm that are more difficult to measure. As much as a single metric can, margins reflect the health of a firm—indicating whether a firm has the right people in the right roles, whether it’s charging enough for services, whether it has enough (but not too much) overhead, and much more.

Law 360 M&A

SEPTEMBER 25, 2024

An attorney for a private equity affiliate that beat a Barcelona-based electric scooter rental chain's attempt to force a closing on the scooter company's $100 million sale in Chancery Court told Delaware's Supreme Court Wednesday that the seller's current appeal ignores its own fatal contract breaches.

Benzinga

SEPTEMBER 25, 2024

Markforged Holding Corporation (NYSE: MKFG ) and Nano Dimension Ltd. (NASDAQ: NNDM ) shares jumped on Wednesday after the companies disclosed an acquisition deal. As per the deal, Nano Dimension will acquire all outstanding shares of Markforged in an all-cash deal at $5.00 per share. The aggregate total consideration payable to Markforged’s shareholders is $115 million.

Law 360 M&A

SEPTEMBER 25, 2024

Intellectual property management firm Zacco Holdings, formerly known as OpSec Group, and blank check company Investcorp Europe Acquisition Corp. I on Wednesday announced that they will be terminating their merger plans.

Benzinga

SEPTEMBER 25, 2024

HP Inc (NYSE: HPQ ) announced Wednesday the acquisition of Vyopta for an undisclosed price. Vyopta is an Austin, Texas-based provider of collaboration management solutions. It offers analytics and monitoring for extensive, unified communications and collaboration (UC) networks. Also Read: Broadcom Chipset Fuels FS’s High-Performance AI Networking Solutions Vyopta brings vast expertise and infrastructure to turbocharge the development of HP’s Workforce Experience Platform.

Law 360 M&A

SEPTEMBER 25, 2024

An arbitration board has sided with U.S. Steel amid its union's challenge to a planned $14.9 billion acquisition by Nippon Steel, clearing one hurdle while Nippon continues fighting on another front for approval from the Committee on Foreign Investment in the U.S.

Let's personalize your content