How Did the Pandemic Impact EBITDA Multiples in 2020? Explore a 12-Month Snapshot in the DealStats Value Index

BVR

MARCH 28, 2022

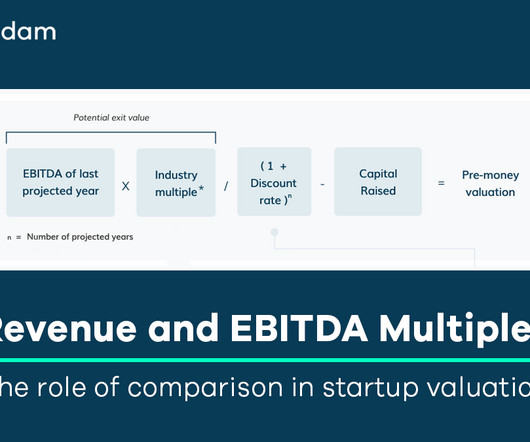

economy for most of 2020 and causing an unprecedented economic impact on small businesses, DealStats Value Index (DVI) captured the 12-month snapshot on how earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples have trended. With the COVID-19 pandemic putting a stranglehold on the U.S.

Let's personalize your content