Elon Musk’s X is a lesson in ebitda and ebit-don’ts

Financial Times M&A

MARCH 19, 2025

The number can be tailored to suit the occasion

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Times M&A

MARCH 19, 2025

The number can be tailored to suit the occasion

Midstreet Blog

DECEMBER 2, 2022

If you’re interested in selling your business, you may be doing some research on how businesses are valued. There are lots of misleading theories out there about how to best value a business, including using a multiple of revenue (not good) or a multiple of net profit (even worse).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Equilest

DECEMBER 3, 2022

EBIT and EBITDA are two measurements of business profitability. This article will discuss two accounting terms used to build the FCFF - EBIT and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Both EBIT and EBITDA are indicators of the firm's profitability. . What is EBIT?

Quantive

JUNE 17, 2023

EBIT and EBITDA are two of the many metrics used to help […]

IBG Business

NOVEMBER 30, 2022

EBITDA: What’s It Worth? Frequently, the answer is tied to a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization), leaving the further question, “What is EBITDA worth as a key factor in value metrics?”. EBITDA is probably the most common approach today. Johnson , M&AMI.

Benzinga

FEBRUARY 14, 2024

Adjusted EBIT increased 18% Y/Y to $392 million, with margin expanding to 17% from 15% prior year quarter. Adjusted EBITDA rose by. Sales by segments : Composites $514 million (-13% Y/Y), Insulation $931 million (-3% Y/Y), and Roofing $928 million (+16% Y/Y). Adjusted EPS was $3.21, up from $2.49 Full story available on Benzinga.com

Valutico

SEPTEMBER 19, 2022

A useful tip is to check for consistency between the forecast margins and historical margins—EBITDA margin, EBIT margin, and Net Income margin. Hockey stick-like growth in your DCF projections may indicate these projections are not realistic.

Valutico

DECEMBER 15, 2022

The ratio used might be EV/EBITDA, EV/Sales, P/E or another, depending on the valuation performed and the type of business being valued. So another major assumption when adopting this method, is that the type of ratio chosen as the comparison point, such as P/E or EV/EBITDA should be similar across similar firms. .

Valutico

DECEMBER 15, 2022

The ratio used might be EV/EBITDA, EV/Sales, P/E or another, depending on the valuation performed and the type of business being valued. So another major assumption when adopting this method, is that the type of ratio chosen as the comparison point, such as P/E or EV/EBITDA should be similar across similar firms. .

Valutico

DECEMBER 6, 2022

At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. Salesforce experienced a terrible year financially in 2022, which explains these very high multiples.

Valutico

DECEMBER 6, 2022

At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. Salesforce experienced a terrible year financially in 2022, which explains these very high multiples.

Valutico

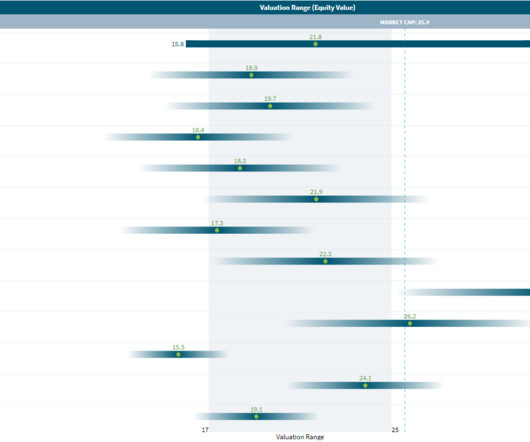

AUGUST 16, 2022

The trading comparables approach confirms this view with the median EV/EBITDA, EV/EBIT and P/E multiples applied to the 2023 forecasts producing a valuation range of USD 600 million to USD 1.1 While the current market capitalisation was USD 1.42 billion.

Valutico

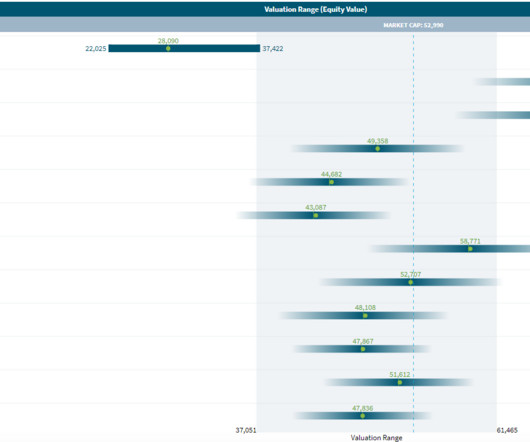

APRIL 24, 2023

billion, driven by lower interest expense and lower non-cash impairment losses, offset by lower Adjusted EBITDA, an accrual related to the securities class action lawsuit, and higher supply chain and commodity costs. Adjusted EBITDA decreased 5.8% billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E.

Valutico

APRIL 24, 2023

billion, driven by lower interest expense and lower non-cash impairment losses, offset by lower Adjusted EBITDA, an accrual related to the securities class action lawsuit, and higher supply chain and commodity costs. Adjusted EBITDA decreased 5.8% billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E.

Valutico

DECEMBER 19, 2022

The company also was able to increase its EBITDA by 6.5% with an overall EBITDA margin of 35.2%. The Trading Comparables analysis resulted in a valuation range of €98 to €222 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. billion which is an increase of 5.7% compared to last year’s Q3.

Valutico

DECEMBER 19, 2022

The company also was able to increase its EBITDA by 6.5% with an overall EBITDA margin of 35.2%. The Trading Comparables analysis resulted in a valuation range of €98 to €222 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. billion which is an increase of 5.7% compared to last year’s Q3.

Valutico

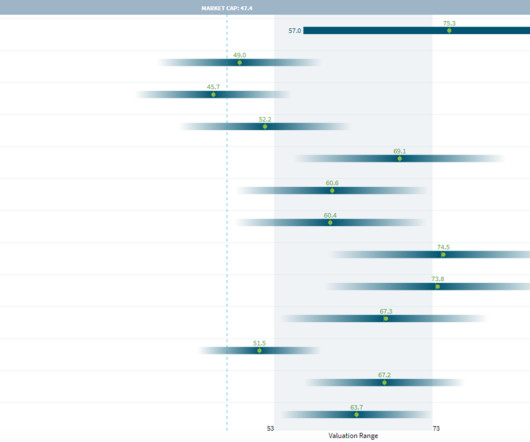

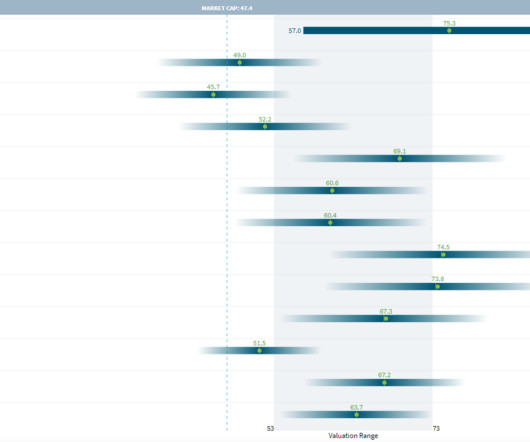

NOVEMBER 28, 2022

billion with EBIT margin increasing to 16.6% The Trading Comparables analysis resulted in a valuation range of CHF 47 to 83 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. ABB’s order intake rose 4% to CHF 7.9 billion, the company said in its third-quarter press release. from 15.1%

Valutico

NOVEMBER 28, 2022

billion with EBIT margin increasing to 16.6% The Trading Comparables analysis resulted in a valuation range of CHF 47 to 83 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. ABB’s order intake rose 4% to CHF 7.9 billion, the company said in its third-quarter press release. from 15.1%

Valutico

OCTOBER 17, 2022

In the fo rmer, we compared Porsche with peers such as BMW, Mercedes-Benz, Ferrari and Ford using thethe EV/EBITDA and the EV/EBIT multiples. We have performed a Trading Comparables analysis and a discounted cash flow using the Flow to Equity Approach. Our result suggests a valuation range of €74 billion to € 96 billion.

Valutico

JUNE 1, 2023

billion and an EBITDA of USD 1.09 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. Recent Financial Performance In Q1 2023, Marriott exceeded market expectations with gross lodging fees reaching USD 1.13 billion, up from last year’s USD 759 million. Marriott’s pipeline grew 2.6%

Valutico

MAY 24, 2023

2022 saw a robust cash and capital structure with a staggering USD 967 million adjusted EBITDA in Q4, up by 14% from the previous year. billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of USD 21.8 billion using a WACC of 10%.

Equilest

MARCH 17, 2022

In practice, professionals rely on several results, assessed at different levels of the income statement: - the gross operating surplus (EBIT or EBITDA) - net operating surplus (ENE or EBIT) - the Current Result Before Tax (RCAI) - Net Income (NR) - Self-Financing Capacity (CAF) or operating cash flow. EBITDA and EBIT).

Valutico

SEPTEMBER 22, 2023

This method is common in industries where valuations are commonly expressed as a multiple of Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) or Earnings Before Interest and Taxes (EBIT). It indicates how much an investor is willing to pay for a company’s operating earnings (EBITDA).

Valutico

JULY 7, 2023

billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT, P/E and P/B. The Discounted Cash Flow analysis produced a value of CAD 14.7 billion using a WACC of 8.8%. The Trading Comparables analysis resulted in a valuation range of CAD 6.4 billion to CAD 28.1 and Peninsula Energy Limited.

Valutico

JUNE 26, 2023

billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of USD 27.1 billion using a WACC of 11.7%. The Trading Comparables analysis resulted in a valuation range of USD 27.1 billion to USD 35.4 Earthstone Energy, Inc. and Northern Oil and Gas, Inc.

Valutico

FEBRUARY 8, 2023

The Trading Comparables analysis resulted in a valuation range of $257 billion to $296 billion by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Flow-to-Equity analysis produced a value of $308 billion using a Cost of Equity of 9.2%.

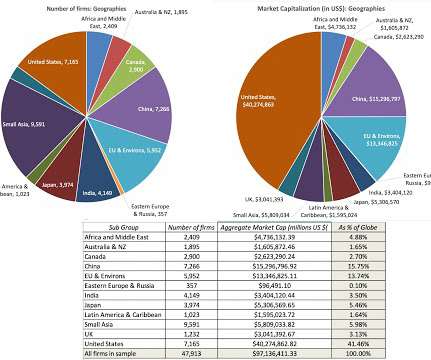

Musings on Markets

JANUARY 6, 2023

By the same token, it is impossible to use a pricing metric (PE or EV to EBITDA), without a sense of the cross sectional distribution of that metric at the time. For example, I have seen it asserted that a stock that trades at less than book value is cheap or that a stock that trades at more than twenty times EBITDA is expensive.

Valutico

JUNE 9, 2023

billion to USD 108 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of USD 212 billion using a WACC of 6.8%. The Trading Comparables analysis resulted in a valuation range of USD 57.2 Scandinavian Tobacco Group A/S and Vector Group Ltd.

Valutico

MARCH 9, 2023

The Trading Comparables analysis resulted in a valuation range of €305 billion to €492 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of €330 billion using a WACC of 9.3%.

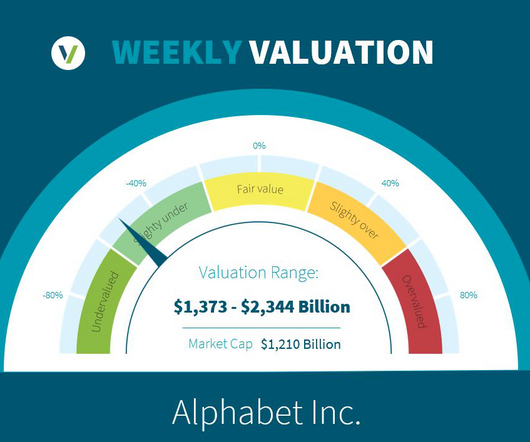

Valutico

FEBRUARY 21, 2023

The Trading Comparables analysis resulted in a valuation range of $1,517 billion to $2,344 billion by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of $1,373 billion using a WACC of 9.9%.

Valutico

FEBRUARY 1, 2023

The Trading Comparables analysis resulted in a valuation range of $121 billion to $150 billion by applying the observed trading multiples EV/EBITDA and EV/EBIT. The DCF analysis produced a value of $93.5 billion using a WACC of 8.8%. Combining our DCF and Trading Comparables analysis results in a value range of $93.5

Valutico

JANUARY 9, 2023

The Trading Comparables analysis resulted in a valuation range of $83 billion to $118 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of $68.6 billion using a WACC of 8%. . For our Trading Comparables we selected similar peers such as McDonald’s, Yum!

Valutico

NOVEMBER 21, 2022

The Trading Comparables analysis resulted in a valuation range of $202 billion to $231 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of $230 billion, with a WACC of 8.8%. .

Valutico

JANUARY 9, 2023

The Trading Comparables analysis resulted in a valuation range of $83 billion to $118 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of $68.6 billion using a WACC of 8%. . For our Trading Comparables we selected similar peers such as McDonald’s, Yum!

Valutico

NOVEMBER 21, 2022

The Trading Comparables analysis resulted in a valuation range of $202 billion to $231 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of $230 billion, with a WACC of 8.8%. .

Valutico

JULY 25, 2023

The Trading Comparables analysis resulted in a valuation range of USD 503 billion to USD 812 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a valuation range of USD 370 billion to USD 493 billion using a WACC of 12.9%. Microsoft Corporation.

Valutico

JUNE 15, 2023

The Trading Comparables analysis resulted in a valuation range of USD 60 billion to USD 277 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of USD 267 billion using a WACC of 13.6%. and Cisco Systems, Inc.

Valutico

MAY 18, 2023

The Trading Comparables analysis resulted in a valuation range of USD 106 billion to USD 235 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. The Discounted Cash Flow analysis produced a value of USD 222 billion using a WACC of 6.4%. and Alphabet Inc.

Valutico

MARCH 1, 2023

The Trading Comparables analysis resulted in a valuation range of GBP 98 (USD 199) billion to GBP 137 (USD 166) billion by applying the observed trading multiples EV/EBITDA, EV/EBIT, P/E and P/B. For our Trading Comparables we selected similar peers such as Total Energies, Shell, Chevron and Saudi Arabien Oil Company.

Valutico

JANUARY 5, 2023

billion to HKD 3,905 (USD 501) billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Trading Comparables analysis resulted in a valuation range of HKD 1,752 (USD 221.5) For our Trading Comparables we selected similar peers such as Alibaba, NetEase and Meta Platforms.

Valutico

NOVEMBER 7, 2022

We came up with this valuation range by using the observed trading multiples EV/EBITDA, EV/EBIT and P/E of peers such as Nike and Puma. . The Trading Comparable analysis shows a completely different picture for the valuation of Adidas, as it suggests a value between €15.6 billion and €26.2 billion to €44.9

Valutico

NOVEMBER 14, 2022

Our Trading Comparables analysis produced a valuation range of €178 billion to €222 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT, P/E and P/B. The Flow to Equity analysis produced a value of €272 billion, with a Cost of Equity of 8.9%.

Valutico

JANUARY 5, 2023

billion to HKD 3,905 (USD 501) billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Trading Comparables analysis resulted in a valuation range of HKD 1,752 (USD 221.5) For our Trading Comparables we selected similar peers such as Alibaba, NetEase and Meta Platforms.

Valutico

JANUARY 5, 2023

billion to HKD 3,905 (USD 501) billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. The Trading Comparables analysis resulted in a valuation range of HKD 1,752 (USD 221.5) For our Trading Comparables we selected similar peers such as Alibaba, NetEase and Meta Platforms.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content