When Private Equity Came for the Music Industry

NYT M&A

MARCH 18, 2024

Private equity is cannibalizing the music industry by buying up old hits and pushing them back into our cultural consciousness.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

NYT M&A

MARCH 18, 2024

Private equity is cannibalizing the music industry by buying up old hits and pushing them back into our cultural consciousness.

Value Scope

SEPTEMBER 4, 2020

Click to Download: Middle Market Private Equity M&A Activity – Q2 2020 Executive Summary Transaction Volume Shrinks Only 31 transactions were reported in Q2 2020, bringing the total reported transactions in 2020 to 113. If you liked this blog you may enjoy reading some of our other blogs here.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

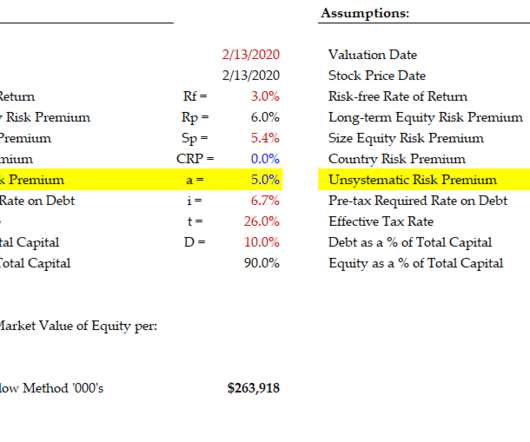

Value Scope

SEPTEMBER 4, 2020

Click to Download: Middle Market Private Equity M&A Activity – Q2 2020. The post Middle Market Private Equity M&A Activity – Q2 2020 appeared first on ValueScope. Executive Summary. Transaction Volume Shrinks. Size Premium. If you liked this blog you may enjoy reading some of our other blogs here.

Musings on Markets

JANUARY 21, 2023

In this post, I will begin by chronicling the damage done to equities during 2022, before putting the year in historical context, and then examine how developments during the year have affected expectations for the future. Actual Returns Your returns on equities come in one of two forms. Stocks: The What?

Musings on Markets

AUGUST 5, 2023

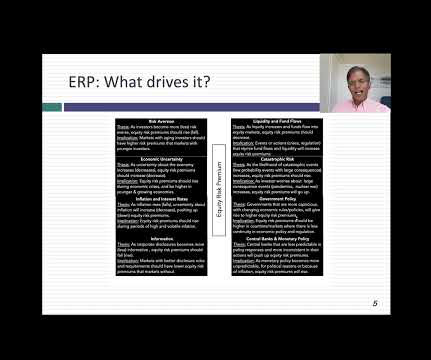

If you have been reading my posts, you know that I have an obsession with equity risk premiums, which I believe lie at the center of almost every substantive debate in markets and investing. How, you may ask, can equity risk premiums be that divergent, and does that imply that anything goes?

John Jenkins

APRIL 20, 2022

Our new Deal Lawyers Download podcast features my interview with Lippes Mathias’ John Koeppel about current trends in private equity deals. – How are private equity buyers approaching deal financing in the current market?

NYT M&A

APRIL 26, 2022

The deal with Abry Partners is the latest example of private equity’s pushing into Hollywood to cash in on the demand for streaming shows.

Private Funds CFO

JANUARY 28, 2022

In the magazine: CFOs offer their advice on what you need to look out for in the new era of inflation; Private equity compensation survey findings; The future of ESG-linked loans; What CFOs can learn from chipmakers; Plus much more….

IVSC

JUNE 6, 2023

Previously, Erica was Chief Financial Officer of Carlyle’s Global Credit segment and before that she was responsible for the Fund Management Operations of Carlyle’s Europe based private equity funds, based in Luxembourg and London. Prior to this role Erica led the Real Assets Partnership Accounting team in Washington D.C.

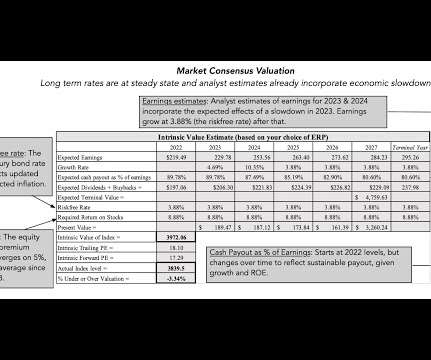

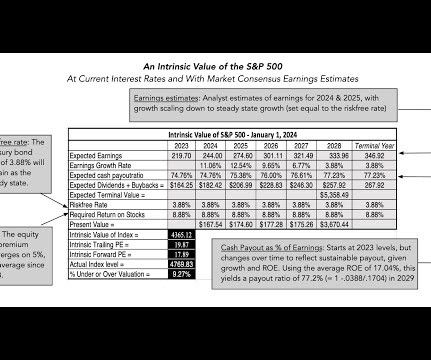

Musings on Markets

JANUARY 17, 2024

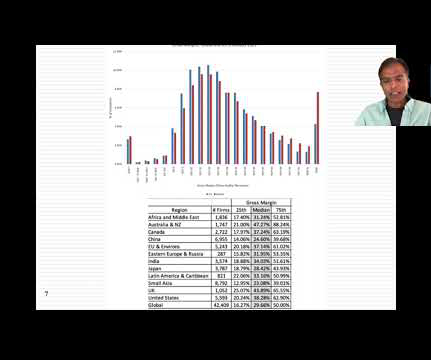

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. Breaking equities down by sub-region, and looking across the globe, I computed the change in aggregate market capitalization, by region: While US stocks accounted for about $9.5

Musings on Markets

JANUARY 30, 2023

If 2022 was an unsettling year for equities, as I noted in my second data post, it was an even more tumultuous year for the bond market. Download data US Treasury rates rose across all maturities, but more so at the short end of the term structure (3 months, 1 year and 2 year) than at the long end (10 year or 30 year).

Musings on Markets

SEPTEMBER 20, 2024

To gain perspective on how the Fed Funds rate has been changed over time, consider the following graph, where the effective fed funds rate is shown from 1954 to 2024: Download data In addition to revealing how much the Fed Funds rate has varied over time, there are two periods that stand out.

Lighter Capital

JULY 22, 2023

Equity funding has its downsides, too — for many founders, it’s , not worth diluting equity and ceding control of the business for a few million dollars of runway. Convertible debt is relatively low-interest and converts into equity at a specified date (generally after a round of equity financing). Download it here ➔

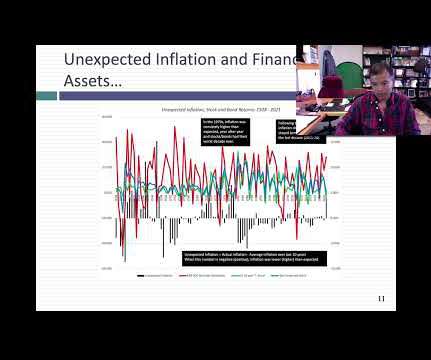

Musings on Markets

JANUARY 27, 2022

That said, the three primary inflation indices in the US, the CPI, the PPI and the GDP deflator all told the same story in 2021: Download historical inflation numbers The inflation rate during the course of the year reached levels not seen in close to 40 years, with every price index registering a surge.

Musings on Markets

OCTOBER 4, 2023

I looked at global equities, broken down by region of the world, and in US dollars, to allow for direct comparison: India is the only region of the world to post positive returns, in US dollar terms, in the third quarter, and is the best performing market of the year, running just ahead of the US; note again that of the $5.2

Musings on Markets

JULY 17, 2023

In my second data update post from the start of this year , I looked at US equities in 2022, with the S&P 500 down almost 20% during the year and the NASDAQ, overweighted in technology, feeling even more pain, down about a third, during the year. US Equities in 2023: Into the Weeds! that was lost last year.

Musings on Markets

JANUARY 5, 2024

Return on Equity 1. Equity Risk Premiums 2. Costs of equity & capital 4. Costs of equity & capital 1. Fundamental Growth in Equity Earnings 2. Return on Equity 2. Standard Deviation in Equity/Firm Value 2. Beta & Risk 1. Debt Ratios & Fundamentals 1. Debt Details 1. Buybacks 2.

Musings on Markets

FEBRUARY 8, 2022

Download sector average betas ( US , Global ) Note the preponderance of financial service firms on the lowest risk ranks, but note also that almost all of them are substantial borrowers, and end up with levered risk levels close to average (one) or above.

IVSC

JUNE 12, 2023

Download Carla's slides Srividya Gopal Managing Director and Southeast Asia Valuation Leader, Kroll Srividya is Managing Director & Southeast Asia Leader, Valuation Advisory Services at Kroll. She is also a frequent guest speaker in top business schools' MBA courses.

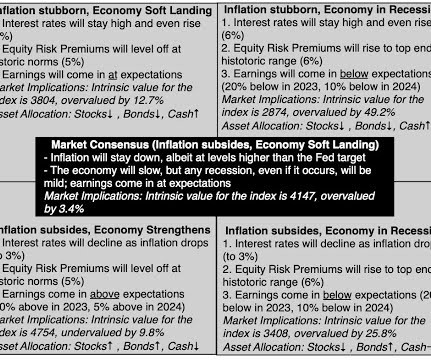

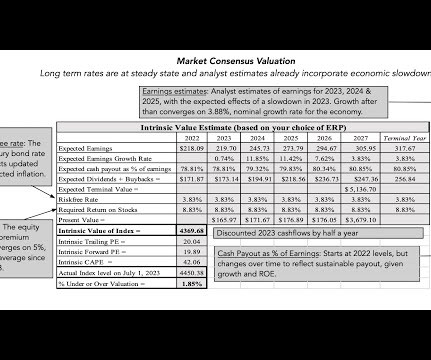

Musings on Markets

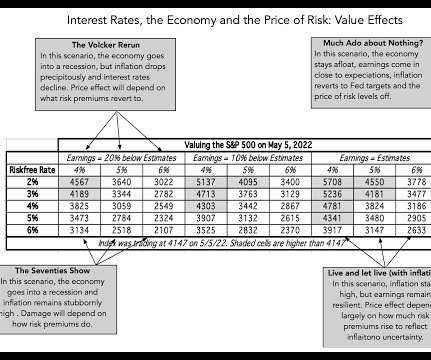

MAY 6, 2022

Investment Consequences As the storm clouds of higher inflation and interest rates, in conjunction with slower or even negative economic growth, gather, it should come as no surprise that equity markets are struggling to find their footing. At the close of trading on May 5, 2022, the S&P 500 stood at 4147, down 13.3%

Musings on Markets

FEBRUARY 12, 2022

In the midst of all the action, to no one's surprise, have been six stocks (Facebook, Amazon, Netflix, Google, Apple and Microsoft or FANGAM) that have largely driven US equities for the last decade, roiling the market with their most recent earnings reports.

IVSC

MARCH 28, 2024

With a strong focus on start-ups, technology, and private equity, Peter is a frequent presenter and writer on valuation and accounting topics. Download The post IVS Accepted by the Australian Taxation Office (ATO) appeared first on International Valuation Standards Council. The date the report is issued.

Musings on Markets

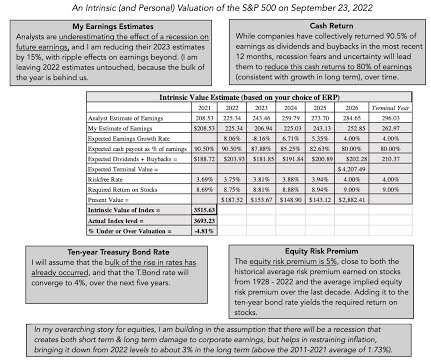

SEPTEMBER 27, 2022

In a third post on July 1, 2022 , I pointed to inflation as a key culprit in the retreat of risk capital, i.e., capital invested in the riskiest segments of every market, and presented evidence of the impact on risk premiums (bond default spreads and equity risk premiums) in markets.

Musings on Markets

FEBRUARY 11, 2023

In the month since, I have added two more data updates, one on US equities and one on interest rates , but my attention was drawn away by other interesting stories. In fact, there are about a dozen countries that are unrated, where I have used their PRS scores to make estimates of their equity risk premiums.

Musings on Markets

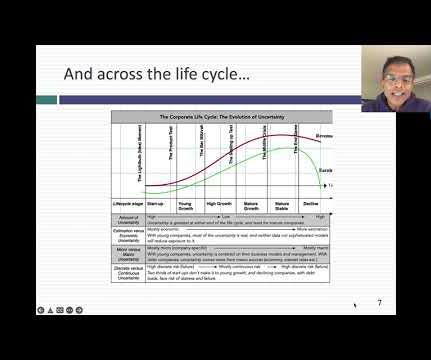

JANUARY 20, 2021

With equities, the metric that has been in use the longest is the PE ratio, modified in recent years to the CAPE, where earnings are normalized (by averaging over time) and sometimes adjusted for inflation. Estimation Approaches Why is it so difficult to estimate an equity risk premium?

Value Scope

JULY 21, 2020

Click to Download: ESG Valuation Considerations – Top Down or Bottom Up? ESG in Equity Analysis and Credit Analysis” was published in 2018 by the PRI, the Principles of Responsible Investment arm of the UN, and the CFA Institute. Executive Summary. More and more work is being done on the valuation aspect of ESG.

Biz Equity

FEBRUARY 9, 2023

You can download and adjust these templates to align with your message and your firm’s unique value proposition. To help you maximize the impact of the prospecting tool, we’ve created phone call and email templates to guide your outreach to each business owner.

ThomsonReuters

MARCH 15, 2023

This is especially true for firms eyeing a capital infusion from private equity investor s. Today, a growing number of private equity investors are entering the accounting market as they’ve discovered that investing in accounting firms can yield great returns. Why is an accounting firm’s tech stack important to private equity?

Benzinga

SEPTEMBER 3, 2024

(NASDAQ: DECA , the "SPAC")) announce the signing of an agreement and plan of merger for a proposed business combination (the "Business Combination Agreement"), which provides for a pre-transaction equity value of Semnur of $2.5 Download the presentation by clicking here. Download the publication by clicking here.

IVSC

AUGUST 28, 2024

This enables them to deliver insightful valuations aligned to the international standards.” This publication supports valuation professionals when they initiate conversations with their clients on ESG factors that might impact the valuation of a business.

Musings on Markets

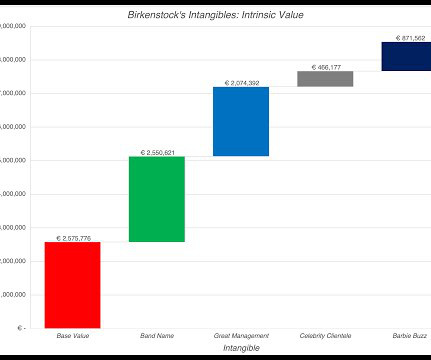

OCTOBER 6, 2023

In this post, I will look at another initial public offering, Birkenstock, that is likely to get more attention in the next few weeks, given that it is targeting to go public at a pricing of about €8 billion, for its equity, in a few weeks. So, how far has accounting come in bringing intangible assets on to balance sheets?

ThomsonReuters

FEBRUARY 24, 2023

This is due, in part, to a growing number of private equity firms entering the accounting market. As Allan D. Koltin, CEO of Koltin Consulting Group, explained, private equity firms perceive accounting firms as being low risk, high reward. M&A market heats up The M&A market is seeing an increase in activity.

Musings on Markets

JANUARY 24, 2024

In my last post, I looked at equities in 2023, and argued that while they did well during 2023, the bounce back were uneven, with a few big winning companies and sectors, and a significant number of companies not partaking in the recovery.

Lighter Capital

JANUARY 11, 2022

A debt warrant is an agreement in which a lender has a right to buy equity in the future at a price established when the warrant was issued or in the next round. The lender paid $9.17340 for each of the 400,000 Roku shares on which it wanted to exercise the equity warrant, paying a total of $3,669,360. Let's dive in.

Andrew Stolz

NOVEMBER 12, 2021

Download the full report as a PDF. What is an equity spinoff? In an equity spinoff, a company decides to create a new listed entity out of its existing operating business. The company is relatively highly levered with a debt-to-equity ratio of 78%. Download the full report as a PDF.

Value Scope

AUGUST 11, 2020

Click to Download: Oil and Natural Gas Prices-Are They Sustainable at These Levels? The valuation element was for equity compensation, for Accounting Standards Codification “ASC” 718 and Internal Revenue Code “IRC” 409(a) purposes. Executive Summary. Second, they are very volatile. I can remember it like it was just yesterday.

Andrew Stolz

FEBRUARY 4, 2022

Download the full report as a PDF. In 3Q21, its net debt-to-equity ratio stood at 0.3x, compared to 0.6x The company is characterized by a strong efficiency, which also boosts future return on equity. Download the full report as a PDF. Highlights: Heavy gov’t spending on infrastructure drives top-line growth.

IVSC

OCTOBER 31, 2023

The IVS drive transparency, quality, efficiency, consistency, and equity in markets, which makes them more attractive to investors and fosters a climate of confidence. The importance of the IVSC’s mission to promote the adoption of International Valuation Standards (IVS) cannot be understated in this economic environment.

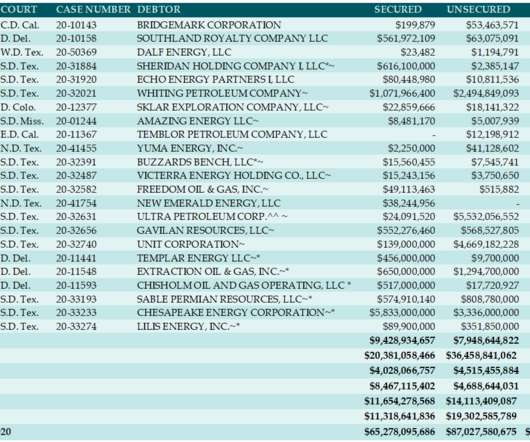

Value Scope

AUGUST 31, 2020

Click to Download: How to Avoid Chapter 22 in Restructuring Work for Energy Companies. Commodities, including oil and gas, are far more volatile than other asset classes like fixed-income and equities. Executive Summary. Recently, it has been an issue with companies operating in the energy complex. Why is Energy Different?

Musings on Markets

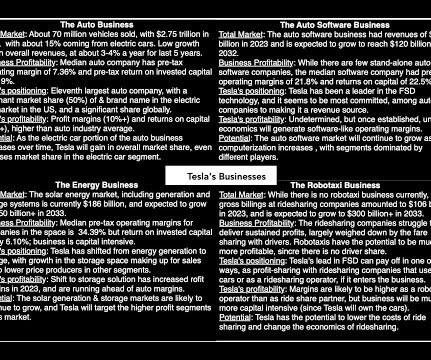

NOVEMBER 1, 2023

To deliver this growth, I did assume that Tesla would have to invest large amounts of capital in capacity, and that this would create a significant drag on value, resulting in a equity value of just under $10 billion. In subsequent valuations, I modified and adapted this story to reflect lessons that I learned about Tesla, along the way.

Musings on Markets

DECEMBER 11, 2024

These data tables should be accessible and downloadable (in excel), and if you find yourself stymied, when doing so, trying another browser often helps. The data is updated once a year, at the start of the year, and the 2025 data update will be available around January 10, 2025.

Musings on Markets

FEBRUARY 15, 2023

It is to remedy this defect that analysts scale profits to invested capital, with equity and capital variants: In the equity version, you divide net income by book equity to estimate a return on equity, a measure of what equity investors are generating on the capital they have invested in a company.

Andrew Stolz

NOVEMBER 21, 2021

Download the full report as a PDF. The repurchase has helped to keep return on equity above its target of 10%. It is deducted from equity when the company buys back its own shares. Download the full report as a PDF. Do you own Toyota? Highlights: EV skepticism could become costly in woke environment. Cash flow – Toyota.

Andrew Stolz

JANUARY 19, 2022

Download the full report as a PDF. Instead, EasyJet decided in Sep 21 to issue GBP1.2bn in equity through a rights offering. Leveraged increased significantly but was partly offset by the equity right offering. Download the full report as a PDF. Highlights: Cash injection to avert another takeover attempt.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content