Weighted Average Cost of Capital Explained – Formula and Meaning

Valutico

APRIL 17, 2023

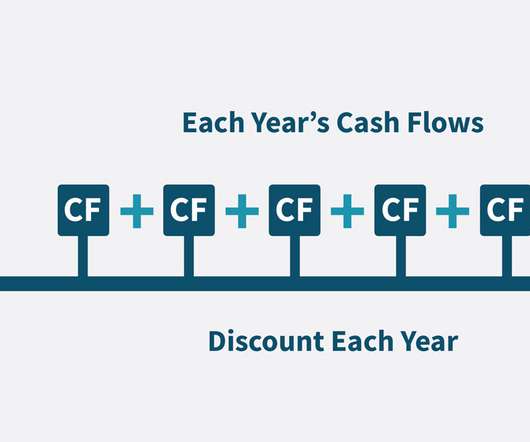

Weighted Average Cost of Capital Explained – Formula and Meaning In this article, we’ll explain what the Weighted Average Cost of Capital (WACC) is, by breaking it down into its components, and highlighting its role in valuing a company through the Discounted Cash Flow method (DCF).

Let's personalize your content