Dark Accounting Matter

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

IVSC

FEBRUARY 7, 2022

Searching for stocks with low price-to-book ratios was a good indication of a potential bargain. This makes the task of valuation much more difficult, but also a lot more interesting. In the past, market valuations often mirrored the reported balance sheet.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sun Acquisitions

OCTOBER 13, 2023

This approach relies on analyzing the market value of comparable publicly traded companies, known as guideline companies or multiples. By comparing key financial metrics such as price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price-to-book (P/B) ratios, analysts can estimate the target company’s value.

Musings on Markets

JULY 17, 2023

In 2022, old-time value investors felt vindicated, as the damage that year was inflicted on the highest growth companies, especially in technology.

RNC

OCTOBER 1, 2024

Different Methods of Benchmark Valuation There are several ways to conduct a benchmark valuation, each with its unique focus and methodology: Price-to-Earnings Ratio (P/E) The P/E ratio compares a company’s current share price to its earnings per share (EPS). It’s one of the most popular metrics for evaluating stock performance.

Valutico

MAY 6, 2024

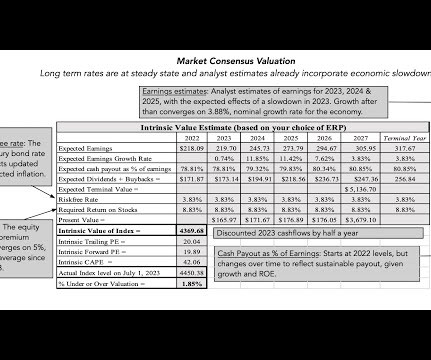

Market-based methods like Comparable Companies Analysis and Precedent Transactions Analysis offer relative measures of value based on market data. Income-based methods such as Discounted Cash Flow analysis focus on future cash flows to determine value.

Andrew Stolz

JANUARY 12, 2022

Book value is the value attributable to shareholders in case the company sells all its assets and repays its liabilities (also called liquidation value). A price-to-book ratio of less than 1x indicates that the market values the net assets less than the balance sheet suggests.

Let's personalize your content