Dark Accounting Matter

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Musings on Markets

MAY 7, 2023

While differentiating between good and bad banks can be straightforward, it does not follow that buying good banks and selling bad banks is a good investment strategy, since its success depends entirely on what the market is incorporating into stock prices.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

IVSC

FEBRUARY 7, 2022

Jeremy chairs the Corporate Reporting Users’ Forum (CRUF) UK and co-chairs the Capital Markets Advisory Committee (CMAC), which is one of the advisory groups of the International Financial Report Standards (IFRS) Foundation. ” The value of a smile. In the past, market valuations often mirrored the reported balance sheet.

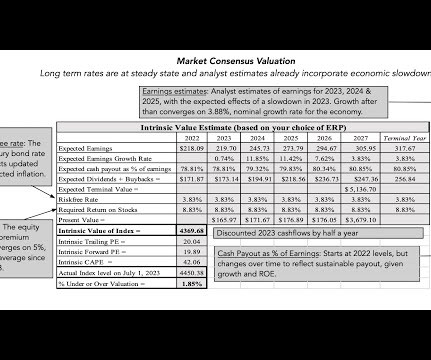

Musings on Markets

JULY 17, 2023

I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis.

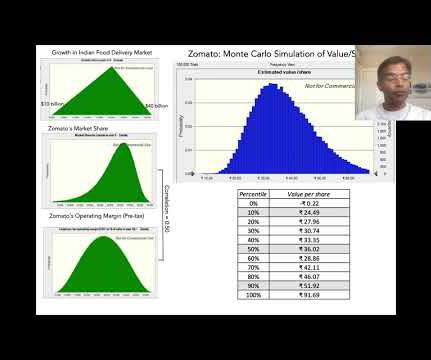

Musings on Markets

JULY 22, 2021

Zomato, an Indian online food-delivery company, was opened up to public market investors on July 14, 2021, and its market debut is being watched for clues by a number of other online ventures in India, waiting in the wings to go public.

Sun Acquisitions

OCTOBER 13, 2023

Valuation techniques in M&A involve a comprehensive assessment of financial, operational, and market factors. Market-Based Valuation One widely used valuation technique in M&A is market-based valuation. Asset-Based Valuation Asset-based valuation determines the worth of a company by considering its net asset value (NAV).

RNC

OCTOBER 1, 2024

It’s a crucial factor in determining the value of an investment. Investors and analysts assess a company’s worth using various methods that consider its earnings, assets, and market conditions. Price-to-Book Ratio (P/B) This ratio compares a company’s market value to its book value (assets minus liabilities).

Let's personalize your content