And the Award for Most Creative Attempt to Evade a Book Value Buy-Sell Provision Goes To.

Farrel Fritz

MARCH 4, 2024

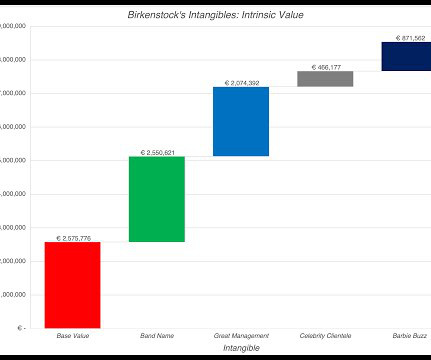

“Under any standard of value, the true economic value of a business enterprise will equal the company’s accounting book value only by coincidence.” So why do so many shareholder buy-sell agreements require that the shares be purchased for book value? Neville, Rodie and Shaw, Inc. 16, 2024) is the latest.

Let's personalize your content