Dark Accounting Matter

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Musings on Markets

MAY 7, 2023

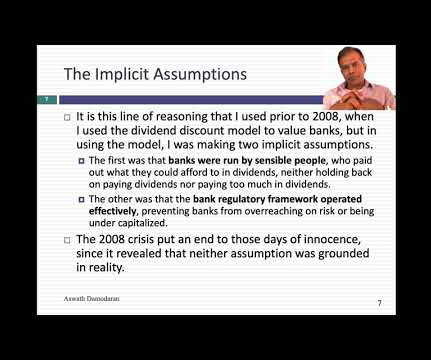

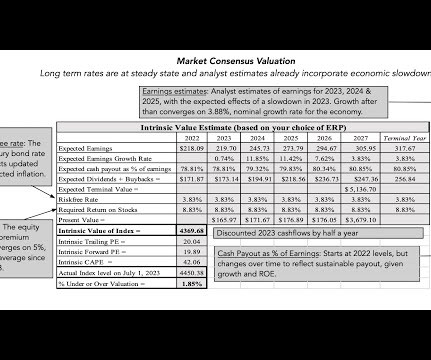

In this post, I will begin by looking at how to value banks and follow up with an examination of investor views of banking have changed, by looking at pricing, before examining divergences in how banks are priced in the market today. All Equity, All the time!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

IVSC

FEBRUARY 7, 2022

Comment: The importance of (and challenges with) valuing intangibles. Jeremy Stuber is a global equity analyst at Newton Investment Management , leading on valuation and accounting issues across all sectors. Searching for stocks with low price-to-book ratios was a good indication of a potential bargain.

Musings on Markets

JULY 17, 2023

In my second data update post from the start of this year , I looked at US equities in 2022, with the S&P 500 down almost 20% during the year and the NASDAQ, overweighted in technology, feeling even more pain, down about a third, during the year. trillion below their values from the start of 2022. that was lost last year.

Valutico

MAY 6, 2024

Market-based methods like Comparable Companies Analysis and Precedent Transactions Analysis offer relative measures of value based on market data. Income-based methods such as Discounted Cash Flow analysis focus on future cash flows to determine value. For more insights, do have a look at our article on market multiple based valuation.

RNC

OCTOBER 1, 2024

Different Methods of Benchmark Valuation There are several ways to conduct a benchmark valuation, each with its unique focus and methodology: Price-to-Earnings Ratio (P/E) The P/E ratio compares a company’s current share price to its earnings per share (EPS). Investors compare stock prices to similar companies or industry standards.

Equilest

NOVEMBER 25, 2023

Understanding the Concept: In essence, FCFF encapsulates the cash that can be distributed to both debt and equity holders after meeting operational needs and capital expenditures. The resulting value represents the cash available to all contributors of capital—both debt and equity. What is Free Cash Flow to Equity?

Let's personalize your content