SEC Risk Factors Disclosure Analysis

Harvard Corporate Governance

DECEMBER 3, 2023

Public companies continue to be challenged to create and protect enterprise value and stakeholder trust in the face of these and other significant risks.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Harvard Corporate Governance

DECEMBER 3, 2023

Public companies continue to be challenged to create and protect enterprise value and stakeholder trust in the face of these and other significant risks.

IVSC

APRIL 29, 2022

Former Chief Economist, Bank of America Merrill Lynch, Japan. ” Intangible assets are increasingly seen to be driving enterprise value creation across sectors and industries. Panellists. Megan Greene United States Global Chief Economist, Kroll. Financial Times columnist. Jesper Koll Japan Leading Japan economist.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Brian DeChesare

JUNE 1, 2022

The power & utilities investment banking team has a reputation for being “boring.”. We’ll get into these fun developments, but I want to start with the basic definitions: Power & Utilities Investment Banking Defined. ” Different banks classify their power & utilities groups differently.

Benzinga

APRIL 3, 2025

("BIP") (NYSE: BIP , TSX: BIP ) and its institutional partners (collectively, "Brookfield Infrastructure") reached a definitive agreement to acquire 100% of the world-class midstream asset portfolio Colonial Enterprises ("Colonial"), which includes the Colonial Pipeline, for an enterprise value of approximately $9 billion or 9x EBITDA.

Brian DeChesare

JULY 5, 2023

If you want to find investment banking league tables , it’s easy: Google the term and add a specific region, industry, or year you’re interested in: “Investment banking league tables us healthcare [20XX]” For faster results, use Image Search to scan the results and find relevant-looking tables. 50 transactions), or fees (e.g., $200

Brian DeChesare

APRIL 12, 2023

Over time, investment banking recruiting has become more impersonal with developments like HireVue interviews , online tests, and recruiters conducting the initial screens. At some banks and groups in the U.S., OK, But Why Do Investment Banking Assessment Centers Exist? An AC is broader than the typical Superday in the U.S.

Brian DeChesare

OCTOBER 18, 2023

Even though we’ve covered industry groups vs. product groups and teams such as M&A , ECM , DCM , and Leveraged Finance , we continue to get questions about capital markets vs. investment banking. The questions usually go like this: Are capital markets teams (ECM, DCM, and LevFin) “real” investment banking? Do you learn anything?

IVSC

AUGUST 28, 2024

This publication supports valuation professionals when they initiate conversations with their clients on ESG factors that might impact the valuation of a business.

Exit Strategy

APRIL 14, 2023

2021 […] The post Cornerstone International Alliance sets new record: $1.3 billion in business transactions appeared first on Exit Strategies Group, Inc.

Harvard Corporate Governance

OCTOBER 28, 2022

For example, it took the SEC over 30 years to review its disclosures regime for banks and savings and loan registrants. [7] 11] This was a quintessential investment decision involving the appropriate enterprise value of two different entities, not a vote on a routine matter or a non-binding shareholder proposal. 18, 2022). (go

Brian DeChesare

JANUARY 19, 2022

FSG Investment Banking: What the Financial Sponsors Group Does The Financial Sponsors Group vs. the Financial Institutions Group The Financial Sponsors Group vs. Leveraged Finance vs. Debt Capital Markets Recruiting: Who Gets Into the Financial Sponsors Group? Table Of Contents. normal, non-wealthy individuals).

Benzinga

AUGUST 11, 2023

per share in cash for a total enterprise value of approximately $8.5 billion in fully committed bridge financing from Bank of America N.A. On Thursday, Tapestry, Inc (NYSE: TPR ) disclosed plans to acquire Capri Holdings Limited (NYSE: CPRI ) for $57.00 Tapestry has secured $8.0 and Morgan Stanley Senior Funding, Inc.

Brian DeChesare

MAY 3, 2023

But people who aim for investment banking roles are very much into those bells and whistles, so questions about the DDM and other “exotic” methodologies began rolling in. To be fair, in some industries – like commercial banks and insurance within FIG – the DDM is a core valuation methodology.

Benzinga

AUGUST 31, 2022

NYSE: TFII ) ("TFI"), for a cash enterprise value of $525 million, subject to certain adjustments. The credit facility includes a consortium of lenders, including joint bookrunners JPMorgan Chase Bank, N.A. and Wells Fargo Bank, N.A. The term CFI does not include the CFI Dedicated or CFI Logistics U.S.

Benzinga

NOVEMBER 30, 2023

The transaction was completed for an implied enterprise value of $36.5 Nayax financed the initial payment with bank financing from Bank Hapoalim. million on a cash-free debt-free basis, to be paid partially in cash and the remainder in cash or equity, subject to certain earnout targets being met.

Benzinga

JUNE 2, 2023

Experienced and Proven Management: ABM's leadership team includes professionals with an aggregate of over 100 years of experience across natural resource extraction, geological engineering, global commodity logistics, and investment banking. June 02, 2023 (GLOBE NEWSWIRE) -- Seaport Global Acquisition II Corp.

Benzinga

OCTOBER 10, 2022

Transaction values the European business at an enterprise value of $220 million. The transaction values XBP Europe at an initial enterprise value of $220 million. Transaction is expected to close in the first half of 2023. Exela Technologies, Inc. IRVING, Texas and NEW YORK, Oct. Cantor Fitzgerald & Co.

Benzinga

MAY 22, 2023

NYSE: GHL ) today announced a definitive agreement for Mizuho to acquire Greenhill in an all-cash transaction at $15 per share, reflecting an enterprise value of approximately $550 million, including assumed debt. The Greenhill business will sit within Mizuho's banking division, led by Michal Katz, Head of Banking in the Americas.

Equilest

NOVEMBER 25, 2023

These interviews are not just a mere formality but a critical component of the hiring process in finance, investment banking, and consulting. Difference between Enterprise Value and Equity Value? EV to EBIT: Examines the company's operating profitability relative to its enterprise value. How to Value a Bank?

Benzinga

OCTOBER 30, 2024

offshore wind farms: Hornsea 1, Hornsea 2, Walney Extension, and Burbo Bank Extension, which have a combined total capacity of approximately 3.5 The enterprise value of the transaction is $2.3 Brookfield to acquire a 12.45% stake in 3.5 GW offshore wind portfolio under long-term contracts LONDON, Oct.

Benzinga

OCTOBER 12, 2022

" Ridgefield is focusing on serving sell-side and buy-side clients in a wide range of sectors in the $10 million to $150 million enterprise value size range. In addition to his background in private equity and investment banking, Boane also built up and sold Traemand, the largest kitchen installation services provider to IKEA.

Scott Mashuda

SEPTEMBER 5, 2023

Cleveland, OH – REAG , a leading lower-middle market investment bank specializing in mergers and acquisitions, is proud to announce their support in the majority recapitalization of TechNH, Inc. TechNH) connecting them with MCM Capital Partners (MCM).

Brian DeChesare

MAY 29, 2024

The term “Project Finance” at large banks refers to a group that operates like Debt Capital Markets or Leveraged Finance but for infrastructure rather than normal companies. in FP&A roles ) to advising clients on M&A deals in investment banking. the value of the target company’s core business operations in the deal).

Benzinga

APRIL 1, 2022

Morgan and Barclays Bank PLC. "We At the time of the announcement, the equity value of the transaction was approximately $5.1 billion and the enterprise value of the transaction was approximately $6.5 The extension of the agreement is supported by a financing commitment from J.P. Lee, President and CEO of MKS.

Brian DeChesare

JULY 31, 2024

We covered these three main segments in the industrials investment banking article , and they also apply here. Assume a Purchase Enterprise Value of $2.6 CD&R might get some multiple expansion if the cycle is more favorable by then, so let’s say the exit multiple is 6x, which makes the Exit Enterprise Value $3.6

Benzinga

DECEMBER 20, 2022

As previously announced, and as further described in the Registration Statement, the combined company will have an implied $915 million pro forma enterprise value, assuming no redemptions by Jack Creek's shareholders. UBS Investment Bank is serving as capital markets advisor to Jack Creek. King & Co.,

Benzinga

JANUARY 4, 2024

04, 2024 (GLOBE NEWSWIRE) -- APA Corporation ("APA" or the "Company") (NASDAQ: APA ) and Callon Petroleum Company ("Callon") (NYSE: CPE ) have entered into a definitive agreement under which APA will acquire Callon in an all-stock transaction valued at approximately $4.5 JPMorgan Chase Bank, N.A., * HOUSTON, Jan.

Benzinga

NOVEMBER 12, 2024

(NYSE: AE ) ("Adams" or the "Company") announced today that it has entered into a definitive agreement to be acquired by an affiliate of Tres Energy LLC ("Buyer") in an all-cash transaction that values the Company at a total enterprise value (including bank debt and financial leases) of approximately $138.9

Benzinga

AUGUST 1, 2024

In addition, Deutsche Bank and Royal Bank of Canada have committed to provide financing for the transaction, and Deutsche Bank Securities, Inc. Kirkland & Ellis LLP is acting as legal counsel to the Company. Centerview Partners LLC is serving as lead financial advisor to TowerBrook and CD&R.

Sun Acquisitions

JANUARY 26, 2024

By acquiring a paving business with complementary strengths and capabilities, companies can significantly increase their enterprise value. This article delves into the intricacies of strategic M&A within the paving sector, underscoring the synergies that bolster market positioning and business value.

Benzinga

AUGUST 18, 2023

The combined company has a total equity market capitalization of more than $11 billion and an enterprise value of more than $16 billion. Eastdil Secured and Deutsche Bank acted as financial advisors and Hogan Lovells US LLP has served as legal advisor to Urstadt Biddle. JACKSONVILLE, Fla.,

Benzinga

NOVEMBER 22, 2022

Estimated Post-Transaction Enterprise Value of $573 Million with up to $274 Million in Net Cash to Fund Growth Assuming No Redemptions by CIIG II stockholders; No Minimum Cash Condition. Strategic Manufacturing Partnership with Summit Group Already in Place and at Start of Production. NEW YORK and LONDON, Nov. Transaction Overview.

Benzinga

APRIL 21, 2024

billion 1 in enterprise value. The Acquisition is not subject to any financing contingency, with Quanex having attained fully committed financing from Wells Fargo Bank, N.A., Bank of America Securities and TD Bank. Tyman shareholders will also be entitled to receive the final dividend of 9.5

Valutico

MAY 6, 2024

Analysts use financial metrics and multiples such as Price to Earnings (P/E), Price to Book (P/B), Enterprise Value to Sales (EV/Sales), Enterprise Value to EBITDA (EV/EBITDA), and Price to Book (P/B) ratios derived from trading data of similar public companies or deal pricing data of similar M&A transactions.

Benzinga

MAY 18, 2023

("Urstadt Biddle" or "UBP") (NYSE: UBA ) today announced that the two companies have entered into a definitive merger agreement (the "Agreement") by which Regency will acquire Urstadt Biddle in an all-stock transaction, valued at approximately $1.4 billion, including the assumption of debt and preferred stock.

Brian DeChesare

OCTOBER 12, 2022

through merchant banking or angel investing ) and now want to do it full-time (also far less common). EXAMPLE: Let’s say you’re planning to have 10 portfolio companies in your first fund, and the average Purchase Enterprise Value will be $50 million. MD-level bankers who might have some investing experience (e.g.,

Equilest

MARCH 17, 2022

An example, however, makes it more transparent: Example: let's take a company without financial debts or cash, that is to say, without a loan or bank overdraft or a surplus bank account: it does not pay financial expenses. Typically, financial debts are therefore loans, credits, and overdrafts from banking establishments.

Benzinga

JUNE 12, 2023

Balance Sheet and Liquidity Strengthening: The Acquisitions are expected to deleverage and strengthen Northview's balance sheet, with debt to gross book value expected to decrease by approximately 500 basis points. The weighted average maturity of the REIT's mortgages is expected to increase from 2.6 years to 3.0 years to 3.0

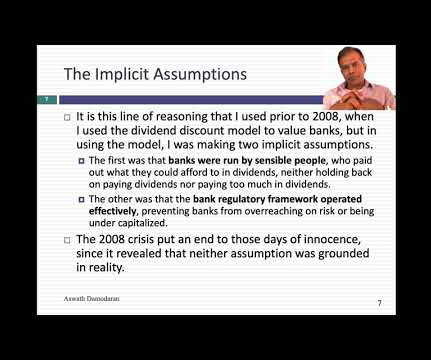

Musings on Markets

MAY 7, 2023

I also used the banking framework to argue that good banks have stickier deposits, with a higher precent of these deposits being non-interest bearing, that they invest in loans and investment securities on which they earn interest rates that cover and exceed the default risk in these investments. All Equity, All the time!

Valutico

OCTOBER 7, 2024

Market Multiple Method The Market Multiple Method involves valuing a startup by comparing it to similar companies (peers) and applying valuation multiples, such as the Enterprise Value/Revenue Multiples, or EV/EBITDA or EV/EBIT Multiples.

Brian DeChesare

SEPTEMBER 20, 2023

If you have an IB background, you should outline your deals by following the examples in the investment banking deal sheet article , and you should pick deals that are relevant to venture capital – a tech or healthcare IPO, a joint venture between two software companies, or something that required significant market analysis.

Brian DeChesare

AUGUST 3, 2022

As investment banking internships wind down each year, interns everywhere wake up and mysteriously come up with a similar idea: “I want to switch banks for my full-time role! Unfortunately, switching banks, groups, or locations after your internship is much easier said than done. Why Switch Banks?

Musings on Markets

JANUARY 9, 2021

The second is that there are great (and free) sources for macro economic data, ranging from the Federal Reserve (FRED) to the World Bank and I don’t see the point of replicating something that they already do well.

Brian DeChesare

OCTOBER 2, 2024

If you’re not familiar with it, the show follows several young graduates who start working in sales & trading and investment banking at JP Morgan Pierpoint & Co. half a yard” and “axes”), and in later seasons, they freely use terms like EBITDA and enterprise value vs. equity value. Many details are accurate (e.g.,

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content