Recap of the 2024 Say on Pay Season

Harvard Corporate Governance

SEPTEMBER 10, 2024

Based on our analysis of these data, this article places into context the recent results of the 2024 SOP season compared to historical trends.

Harvard Corporate Governance

SEPTEMBER 10, 2024

Based on our analysis of these data, this article places into context the recent results of the 2024 SOP season compared to historical trends.

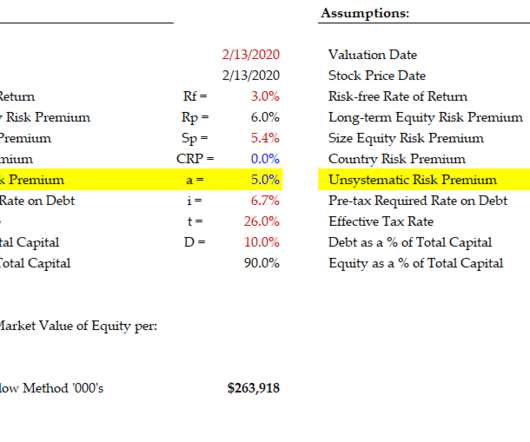

Value Scope

JULY 21, 2020

How do you justify making substantial investments and fundamental changes to corporate structures and culture without empirical evidence that it will make a direct impact on shareholder value, total shareholder return, net present value, and individual rates of return? What about stock price?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Reynolds Holding

DECEMBER 10, 2023

In this article we consider the board’s responsibly to balance various factors whilst we keep our primary focus on the implementation process of these different buyback rationales. The board needs to manage the conflicts between the agents, the principals and indeed between the longer and shorter-term shareholders within the principals.

Reynolds Holding

MARCH 6, 2024

It is based on his recent article, “Getting Serious About Stakeholders,” available here. And the utility function must include criteria to weight tradeoffs between different sets of stakeholders.

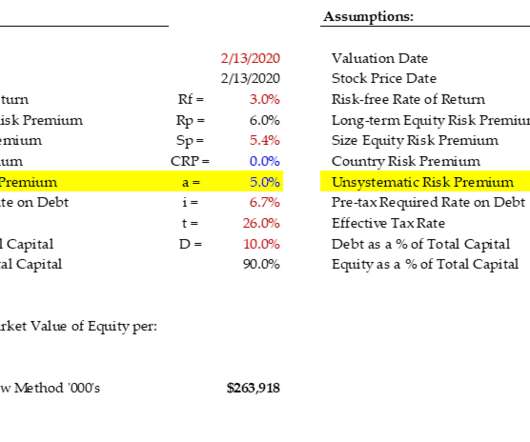

Value Scope

SEPTEMBER 24, 2020

How do you justify making substantial investments and fundamental changes to corporate structures and culture without empirical evidence that it will make a direct impact on shareholder value, total shareholder return, net present value, and individual rates of return? . These are fair questions.

Let's personalize your content