UniCredit strikes first deal of Orcel era with Greek tie-up

Financial Times M&A

OCTOBER 23, 2023

Italian lender seeks to acquire 9% stake in Alpha Bank from Greek state and take control of Romanian unit

Financial Times M&A

OCTOBER 23, 2023

Italian lender seeks to acquire 9% stake in Alpha Bank from Greek state and take control of Romanian unit

Brian DeChesare

JULY 5, 2023

If you want to find investment banking league tables , it’s easy: Google the term and add a specific region, industry, or year you’re interested in: “Investment banking league tables us healthcare [20XX]” For faster results, use Image Search to scan the results and find relevant-looking tables. 50 transactions), or fees (e.g., $200

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

NOVEMBER 14, 2024

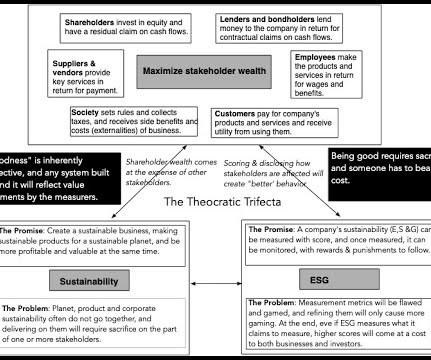

With ESG, for instance, the end game when it was initiated was making the world a better place (doing good ), which evolved to generating alpha (excess returns for investors), on to being a risk measure before converting on a disclosure requirement.

Brian DeChesare

MARCH 8, 2023

But a few related areas, such as commodity desks at banks, commodity trading advisors (CTAs), and physical commodity trading shops could put up a good fight for that “most cyclical” title. Commodity trading desks within sales & trading at the large banks.

Reynolds Holding

JANUARY 23, 2024

Wells Fargo Investors’ $1 billion settlement against Wells Fargo comes in the wake of years of scandal and resolves allegations that the bank concealed its inability to clean up its act. In the Relevant LIBOR-Based Financial Instruments action, the banks were alleged to have manipulated the London Interbank Offered Rate for U.S.

Valutico

APRIL 25, 2023

All finance professionals who value companies, such as accountants, auditors, tax advisors, M&A professionals, investment managers, corporate finance advisors, and banks who want to consider ESG factors as part of their decision-making process, especially as an input to the valuation. Who is ValutECO for?

Valutico

APRIL 25, 2023

All finance professionals who value companies, such as accountants, auditors, tax advisors, M&A professionals, investment managers, corporate finance advisors, and banks who want to consider ESG factors as part of their decision-making process, especially as an input to the valuation. Who is ValutECO for?

Let's personalize your content