Private equity targets UK accounting firms

Financial Times M&A

JANUARY 6, 2024

Buyout groups hope to roll smaller companies into bigger businesses to attract larger clients

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Times M&A

JANUARY 6, 2024

Buyout groups hope to roll smaller companies into bigger businesses to attract larger clients

Financial Times M&A

JUNE 10, 2024

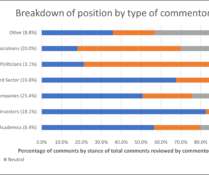

A wave of talks with financial bidders comes as regulators voice concern about audit quality and ‘tone’

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

FEBRUARY 5, 2024

Hellman & Friedman-led deal is largest in a sector reconsidering its partnership model

ThomsonReuters

MARCH 15, 2023

This is especially true for firms eyeing a capital infusion from private equity investor s. Today, a growing number of private equity investors are entering the accounting market as they’ve discovered that investing in accounting firms can yield great returns. They expect the same of their accounting firm.

Global Finance

JULY 30, 2024

Mid-tier accounting firms have found new paths to finance their growing needs. Last November, US accounting firm Forvis purchased the US unit of French Mazars to create a robust audit and advisory network. Tower Brook Capital invested in advisory and accounting expert EisnerAmper.

Financial Times M&A

MARCH 17, 2024

Accounting firms, consultancies and other professional services take outside cash to fund growth

ThomsonReuters

FEBRUARY 24, 2023

This is due, in part, to a growing number of private equity firms entering the accounting market. As Allan D. Koltin, CEO of Koltin Consulting Group, explained, private equity firms perceive accounting firms as being low risk, high reward. The post What attracts investors to accounting firms?

Financial Times M&A

MARCH 29, 2024

Accounting firm recently agreed to sell a majority stake to New Mountain Capital

Benchmark Report

JUNE 10, 2024

According to a recent webinar hosted by accounting firm PWC, the amount of cash presently held by and committed to private equity funds is at an all-time high.

Financial Times M&A

JUNE 11, 2024

Plus, private equity circles even more accounting firms and Citi’s new top hires spur succession speculation

ThomsonReuters

MARCH 13, 2023

These investments marked a notable transformation in the profession, with the realization among private equity firms that investing in large accounting firms can yield great returns. For firms looking to attract private equity investors, there are several factors to consider and ways to help draw appeal.

Financial Times M&A

NOVEMBER 20, 2024

Accounting firm agrees to sell stake to buyout group Cinven

ThomsonReuters

FEBRUARY 14, 2022

Every tax and accounting firm is unique, so there’s really no one-size-fits-all approach to hiring. Understanding your company culture is a useful step in finding a new accountant who is the right fit for your firm. Knowledge of finance and accounting is, of course, vital when hiring for a tax and accounting firm.

ThomsonReuters

JUNE 28, 2023

If you’re a tax firm leader looking to differentiate yourself from the competition, providing your clients with insight into their ESG data is a great way to set your firm apart. Let’s take a look at some best practices accounting firms can use to help clients overcome the challenges of ESG data collection and management.

Farrel Fritz

JUNE 6, 2022

Disputes over capital accounts and equity percentages are frequent fodder for business divorce litigation — especially in LLCs without operating agreements. Later in 2016, Moskowitz received the LLC’s 2015 K-1 showing an approximate $1 million increase in his capital account. Moskowitz v Fischer.

ThomsonReuters

JUNE 9, 2023

Perceived lack of support driving exodus of LGBTQ+ accountants Firms are seeing a higher attrition rate among LGBTQ+ accountants, with the research indicating that as high as 20 percent of departing professionals left the industry due to a lack of DEI.

ThomsonReuters

MARCH 20, 2023

For tax and accounting firms, therein lies an opportunity. Forward-looking firms are increasingly moving beyond compliance by telling a compelling ESG story that sets their firm apart from the competition. It is most effective when it tells a compelling story and fits into the firm’s vision.

Trout CPA

JUNE 20, 2022

LANCASTER, Pennsylvania (June 17, 2022) – Trout CPA a top-ranked regional accounting firm specializing in accounting, tax, and advisory services is pleased to announce that Andrew Rice, CPA, CVA has joined the firm as Managing Director of Transaction Advisory Services.

Reynolds Holding

DECEMBER 21, 2022

Moreover, the association between ESG disclosure and ESG disagreement is more pronounced when firms obtain third-party attestations on their ESG reports, especially from accounting firms. Journal of Accounting and Public Policy, 31 (6), 610–640. [14] The Accounting Review, 86 (1), 59–100. 14] Dhaliwal, D.

ThomsonReuters

FEBRUARY 18, 2022

Welcome candidates from a variety of backgrounds, experiences, and skillsets as a diverse accounting team can lead to more creative solutions and comprehensive problem-solving. Download our free special report, A roadmap for accounting firms to expand inclusion of diverse accountants , for more on diversity and inclusion.

Law 360 M&A

NOVEMBER 29, 2023

Big Four accounting firm Deloitte on Wednesday issued a report anticipating that women's elite sports will generate more than $1 billion in revenues for the first time next year — a prediction that comes as private equity firms are increasingly nabbing stakes in female professional sports clubs.

Law 360 M&A

SEPTEMBER 1, 2022

Securities and Exchange Commission's top accounting official has warned accounting firms that enforcement actions could result if they don't maintain auditing independence when selling parts of their businesses to private equity firms, showing that the agency is closely eyeing a wave of deals that could transform the industry.

Reynolds Holding

SEPTEMBER 8, 2022

4] Recently, we have observed instances of foreign issuers—especially foreign issuers located in the People’s Republic of China (“China”) or in Hong Kong—changing their lead auditor from a local registered public accounting firm to a registered public accounting firm located either in the U.S.

Benzinga

MAY 2, 2024

Mr. Hisey began his career at Ernst & Young, considered one of the Big Four accounting firms globally, as a. His experiences run the gamut from initial start-ups to Fortune 100 Companies. Full story available on Benzinga.com

Harvard Corporate Governance

NOVEMBER 23, 2022

This can be contrasted with the view that Scope 3 disclosures are being made by some entities already (see Private Equity Stakeholder Project ). The International Energy Credit Association also referred to the need “to acquire and disclose information from third parties and make public data and business plans that are proprietary.”

Shuster & Co.

FEBRUARY 27, 2021

The partnership agreement’s weighting could be amended to allow one party to assume a majority share in the decisions, finances, and liabilities of the business without having to buy out all of the other partner’s equity. Consequently, a buyout is necessary for the partnership to end.

Reynolds Holding

DECEMBER 10, 2024

The unpaid balances become a liability against the equity value of their homes. If the equity partnership that owns the solar system goes bankrupt, the financial burden of removing the system shifts back to the homeowner. Securitization and Tax Equity Partnerships. External Audit Firms and Valuation Appraisers.

Audit Board

MARCH 17, 2022

Social is the people aspect: human capital management, employee safety, human rights, diversity, equity, inclusion. . If assurance over data and metrics are required, then the regulators as well as the public accounting firms will all be focused on looking at controls.”.

Reynolds Holding

MAY 15, 2024

These are core tenets of the accounting profession. [4] 4] Why Does Tone at the Top Matter for Public Accounting Firms? 5] But a healthy tone at the top is of paramount importance at public accounting firms as well. Finally, how firm leadership plans to structure their future business reflects the tone at the top.

Shuster & Co.

APRIL 1, 2020

Sale of a marital home should be considered early in the divorce proceedings, as the equitable division of this property may become extremely complex, particularly if there is substantial equity in it.

Shuster & Co.

DECEMBER 15, 2021

In this instance, the formula accounts for the business’ total equity by calculating asset value minus total liabilities. A full-service Certified Public Accounting Firm located in Denver,Shuster &Company,P.C. The liquidation value method assumes that the business will cease operations and liquidate any assets.

ThomsonReuters

JULY 6, 2023

In this blog we’ll cover the key elements needed to understand M&A advisory services, including the differences between investment bankers and M&A advisors, why accountants should consider getting into mergers and acquisitions advisory, and more. What are M&A advisory services?

ThomsonReuters

JANUARY 12, 2023

Social risks include impacts to all stakeholders and global citizens, including the well-being, reputation, or privacy of customers, employees, or suppliers, as well as issues related to diversity, equity, and inclusion (DEI). . Investors and stakeholders are increasingly seeking transparency in ESG initiatives.

Appraiser Newsroom

JULY 9, 2023

Marina advises clients on valuation of complex securities for tax, financial reporting and risk management, including fixed income, commodity, and equity derivatives, contingent assets/liabilities, earnouts, and intellectual property. Josh Schaeffer, Ph.D , is Managing Director at Equity Methods.

Reynolds Holding

NOVEMBER 6, 2022

While the CDD Rule focuses exclusively on the “equity interests” of legal entities, the final rule — thanks to the addition of a catch-all provision to the already expansive definition included in the proposed rule — covers virtually all instruments, contracts, arrangements, or mechanisms used to establish ownership of a legal entity.

Brian DeChesare

APRIL 10, 2024

Amidst the miserable deal environment of the past few years, there has been one bright spot: sports private equity. Even as deal activity, fundraising, and exits have slowed everywhere, billionaires and PE firms backed by billionaires continue to acquire and invest in sports teams. only a handful a decade ago).

Reynolds Holding

NOVEMBER 29, 2023

7] The Commission’s case against SBF, filed in December 2022, alleged that SBF defrauded equity investors and the users of the now bankrupt FTX crypto asset trading platform. The press release highlighted actions against several audit and accounting firms, including Prager Metis and Crowe U.K. LLP (“Crowe”).

Reynolds Holding

NOVEMBER 14, 2023

Actions against investment professionals in fiscal year 2023 included: Charges against private equity firm Prime Group Holdings LLC for failing to adequately disclose millions of dollars of real estate brokerage fees that were paid to a firm that was owned by its CEO. Prime Group agreed to pay a $6.5

Farrel Fritz

APRIL 18, 2022

The post highlighted an apparent first-of-its-kind decision in a judicial dissolution case brought by certified public accountant Diane Straka, a minority shareholder of an accounting firm. Straka by a senior employee at the firm and other discriminatory conduct concerning her profit-sharing and management role.

Reynolds Holding

APRIL 21, 2022

These metrics would then be subject to audit by an independent registered public accounting firm and come within the scope of the institution’s internal control over financial reporting. Department of Labor Proposes ESG-Related Updates to the ERISA Investment Duties Regulation (Oct. 19, 2021), available at [link]. [17] 19] Id.

Farrel Fritz

JANUARY 6, 2025

The court rejected the accounting firm’s argument that it merely was hired to prepare tax returns and other financial statements that documented the allegedly fraudulent loans, and thus investigating and reporting the manager’s alleged fraud were beyond its duties. 1650 Broadway Associates, Inc.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content