A Deeper Look at the Scope, Impact, and Risks of Company Political Spending

Harvard Corporate Governance

SEPTEMBER 7, 2024

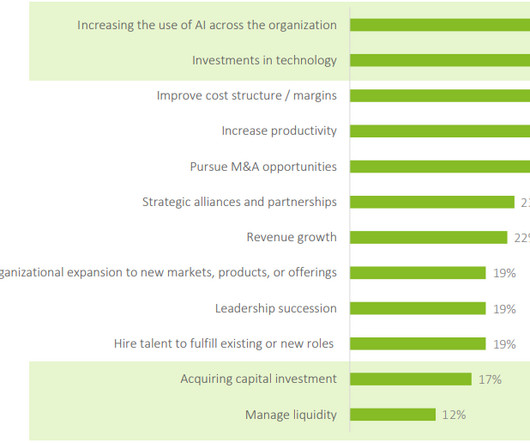

Posted by Bruce Freed and Jeanne Hanna, Center for Political Accountability, on Saturday, September 7, 2024 Editor's Note: Bruce F. Freed is President and Co-Founder and Jeanne Hanna is a Research Director at the Center for Political Accountability. This post is based on their CPA memorandum. What exactly is the scope and impact of corporate political spending?

Let's personalize your content