Oneok shakes up the midstream industry

Valutico

MAY 24, 2023

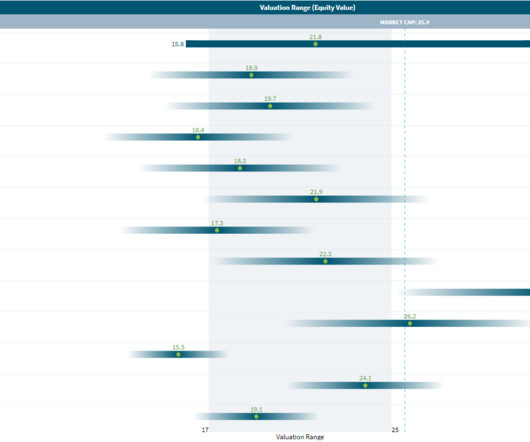

This merger is expected to be earnings accretive from 2024, with projected annual EPS accretion of 3%-7% (2025-2027) and average free cash flow per share growth exceeding 20% (2024-2027). 2022 saw a robust cash and capital structure with a staggering USD 967 million adjusted EBITDA in Q4, up by 14% from the previous year.

Let's personalize your content