Weekly Roundup: October 27-November 2, 2023

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

Benzinga

AUGUST 21, 2023

Greenlight has also issued a third seven-figure dividend to its shareholders, following the first-ever issuance of a dividend by an MSO in April of this year. In 2023, Greenlight has returned consecutive dividends that amount to over 13% of. of cultivation and manufacturing space in 6 states.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Benzinga

OCTOBER 6, 2023

Special dividend estimated to be $1.5118 per share Payment of special dividend conditioned upon closing of merger, which is subject to stockholder approval BOSTON, Oct. 06, 2023 (GLOBE NEWSWIRE) -- Talaris Therapeutics, Inc. The Special Dividend will not exceed an amount equal to $67.5

Benzinga

APRIL 26, 2023

and 0.91%, Respectively, Excluding Non-Recurring Expenses First Quarter 2023 Loan Growth of $22.1 Non-performing Assets were 0.14% of Total Assets at March 31, 2023 Common Equity Tier 1 and Tangible Common Equity Ratio of 12.16% and 7.63%, Respectively, at March 31, 2023 1 LAKEVILLE, Conn., million, or 1.8% million, or $0.52

Musings on Markets

JULY 17, 2023

I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis.

Brian DeChesare

JANUARY 4, 2023

Any discussion of the financial markets in 2022 needs to acknowledge one important fact upfront: it was the worst year for stocks and bonds since at least 1871. Meanwhile, disasters kept emerging in the riskiest parts of the market, such as crypto (see: FTX , Celsius, etc.), Total Gain Over Pre-Covid Market Levels: +54%.

Benzinga

JANUARY 12, 2024

billion a year ago, led by market beta on average AUM, positive organic base fee growth, and higher securities lending revenue. BlackRock Inc (NYSE: BLK ) reported Q4 FY23 revenue growth of 7% Y/Y to $4.631 billion, marginally above the consensus of $4.627 billion. billion from $3.40

Harvard Corporate Governance

JULY 16, 2023

Posted by Lane Ringlee, Marizu Madu, and Joadi Ogelsby, Pay Governance LLC, on Sunday, July 16, 2023 Editor's Note: Lane Ringlee is Managing Partner, Marizu Madu is a Principal, and Joadi Oglesby is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. trillion in 2022”. [1] more…)

Musings on Markets

JANUARY 21, 2023

It is the nature of stocks that you have good years and bad ones, and much as we like to forget about the latter during market booms, they recur at regular intervals, if for no other reason than to remind us that risk is not an abstraction, and that stocks don't always win, even in the long term. at the start of that year.

Benzinga

NOVEMBER 9, 2023

CPI's Electron Device Business manufactures electronic components and subsystems primarily serving the aerospace and defense market. CPI's Electron Device Business generated approximately $300 million in revenue for its fiscal year ended September 30, 2023.

Benzinga

JULY 25, 2024

per basic and diluted share, for the three months ended June 30, 2023. per basic and diluted share, for the six months ended June 30, 2023. million for the respective 2023 periods. and 16.7%, respectively, versus the same period in 2023. per basic and diluted share, for the three months ended June 30, 2023.

Harvard Corporate Governance

MARCH 28, 2023

Posted by Brian Tayan (Stanford University), on Tuesday, March 28, 2023 Editor's Note: Brian Tayan is a researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business. This post is based on a recent paper by Mr. Tayan, Andrew Baker, David Larcker , and Derek Zaba. more…)

Benzinga

APRIL 28, 2023

April 28, 2023 (GLOBE NEWSWIRE) -- Mid Penn Bancorp, Inc. NASDAQ: MPB ) ("Mid Penn"), the parent company of Mid Penn Bank (the "Bank") and MPB Financial Services, LLC, today reported net income available to common shareholders ("earnings") for the quarter ended March 31, 2023 of $11.2 HARRISBURG, Pa.,

Harvard Corporate Governance

MAY 14, 2023

Posted by Carey Oven, Ira Kalish and Daniel Bachman, Deloitte & Touche LLP, on Sunday, May 14, 2023 Editor's Note: Carey Oven is National Managing Partner at the Center for Board Effectiveness and Chief Talent Officer, Ira Kalish is Chief Global Economist, and Daniel Bachman is a Senior Manager at Deloitte & Touche LLP.

Musings on Markets

MARCH 8, 2023

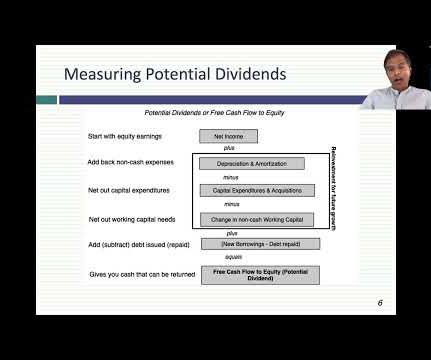

This is the last of my data update posts for 2023, and in this one, I will focus on dividends and buybacks, perhaps the most most misunderstood and misplayed element of corporate finance. Viewed in that context, dividends as just as integral to a business, as the investing and financing decisions.

Chris Mercer

FEBRUARY 14, 2024

This second musing addresses the use of restricted stock studies to support marketability discounts in gift and estate tax appraisals prepared for the Internal Revenue Service (or for anyone, for that matter). And more than a few appraisers use these stale and tired studies to guess at marketability discounts in 2024.

Benzinga

MAY 9, 2023

Nexstar Media Group, Inc (NASDAQ: NXST ) reported a Q1 2023 net revenue growth of 3.9% billion, beating the consensus of $1.24 Revenues from Television Advertising declined 6% Y/Y to $425 million, comprising Core Advertising revenue that fell 2.6% Y/Y to $417 million and a 66.7% Y/Y decline in Political Advertising revenue to $8 million.

Musings on Markets

SEPTEMBER 5, 2024

Last Wednesday (August 28), the market waited with bated breath for Nvidia’s earning call, scheduled for after the market closed. This dance between companies and investors, playing out in expected and actual earnings, is a feature of every earnings season, especially so in the United States, and it has always fascinated me.

Musings on Markets

DECEMBER 21, 2022

Starting in late January 2023, I will be back in the classroom, teaching valuation and corporate finance to the MBAs and valuation to the undergraduates, and these classes will continue through May 2023. firms in emerging markets or private businesses.

Musings on Markets

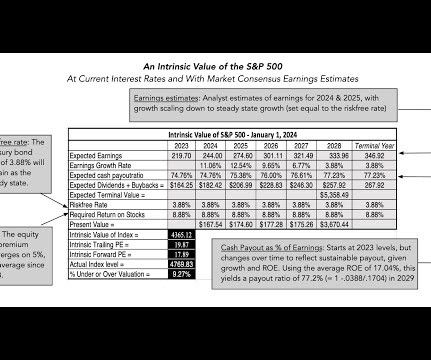

JANUARY 17, 2024

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. In that post, I noted that if inflation subsided quickly, and the economy stayed out of a recession, stocks had upside, and that is the scenario that played out in 2023.

Brian DeChesare

JANUARY 3, 2024

The markets in 2023 were almost a complete reversal of 2022, and hardly anyone – me included – saw it coming. This result is disappointing because it ends my 4-year streak of matching or beating the market, and it’s all because of my bad decisions. But my real estate investment funds were down ~10% , which hurt.

Harvard Corporate Governance

AUGUST 29, 2023

Posted by Martin Lipton, Wachtell Lipton Rosen & Katz, on Tuesday, August 29, 2023 Editor's Note: Martin Lipton is a founding partner of Wachtell, Lipton, Rosen & Katz, specializing in mergers and acquisitions and matters affecting corporate policy and strategy. Rosenblum , Karessa L.

Benzinga

FEBRUARY 29, 2024

Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million acquisition of Infinite ID Fourth Quarter 2023 Highlights 1 Revenues of $202.6 Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million Net Income of $37.3

Benzinga

MAY 4, 2023

May 04, 2023 (GLOBE NEWSWIRE) -- Kimball International, Inc. NASDAQ: KBAL ) today announced results for the third quarter ended March 31, 2023. Selected Financial Highlights: Third Quarter FY 2023 Net sales of $166.1 Selected Financial Highlights: Third Quarter FY 2023 Net sales of $166.1 Net income of $5.7

Benzinga

DECEMBER 6, 2023

The CSHG Real Estate platform is one of the most relevant players in the Brazilian REIT market, ranking top 5 in market share and investing across a diverse range of market strategies including Logistics, Retail, Office and Receivables. GRAND CAYMAN, Cayman Islands, Dec. Full story available on Benzinga.com

Global Finance

JULY 23, 2024

Significantly, Mizuho CEO Masahiro Kihara said the bank will either pass on the proceeds from its sales of equity holdings to investors as dividends or invest them in growth-directed activities, and Sumitomo Mitsui aims to reduce the market value of its equity holdings to less than 20% of the value of its consolidated net assets.

Benzinga

APRIL 4, 2024

If you are a registered stockholder, for inquires unrelated to the Proxy Materials, please call Equiniti Trust Company, LLC, the transfer agent, dividend paying agent and registrar for MFIC, AFT and AIF, at 1-800-937-5449. There can be no assurances with respect to the amount of each CEF Tax Dividend. per share and $0.17

Benzinga

JANUARY 22, 2024

Barrick denies this claim, stating that Barceló’s last visit to Panama was in early 2023 for a mining conference. This setback led to the suspension of dividends, voluntary retirements and contributed to. Full story available on Benzinga.com

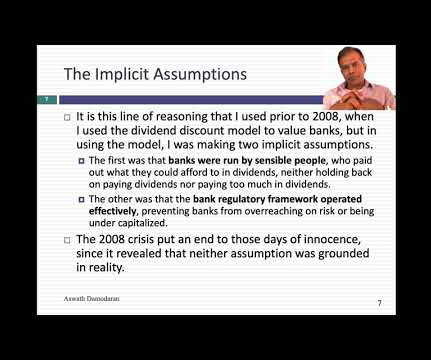

Musings on Markets

MAY 7, 2023

While differentiating between good and bad banks can be straightforward, it does not follow that buying good banks and selling bad banks is a good investment strategy, since its success depends entirely on what the market is incorporating into stock prices.

Benzinga

OCTOBER 22, 2024

per share cash dividend declared _ (1) A reconciliation of GAAP net income to FFO is provided at the end of this press release. per diluted share, for the three months ended September 30, 2023. per diluted share, for the nine months ended September 30, 2023. per diluted share for the third quarter of 2023. HIGHLIGHTS $32.1

Global Finance

OCTOBER 6, 2024

trillion worldwide in 2022, according to the 2023 Global Wellness Economy Monitor report, which predicted it will enjoy a compound annual growth rate of 8.6% Bhutan now allows foreign investors to repatriate dividends, and the limit on leases of state land was extended this year from 30 years to 99. of GDP in 2023.

Valutico

OCTOBER 1, 2022

Founded in 1995, Lockheed Martin Corporation is a Bethesda, Maryland-based aerospace company with a $106 billion market capitalization. . The company published its Q2 2023 financial results this week. dividend yield and an ongoing share buyback program. . A WACC of 5.7%

Valutico

MARCH 28, 2023

UBS Group AG Weekly Valuation – Valutico | 28 March 2023 Link to the valuation Context In recent days, the financial markets have experienced increased turmoil, causing growing concerns about financial stability. As a result, they have been pouring into money market funds at the highest rate since the COVID pandemic began.

Benzinga

NOVEMBER 22, 2023

SciSparc seeks to scale up revenues and will consider transferring its pharmaceutical activities to a separate legal entity and explor ing the possibility of dividend distributi on TEL AVIV, Israel, Nov. 22, 2023 (GLOBE NEWSWIRE) -- SciSparc Ltd. As a result of the Merger, all outstanding shares of the Target Company will be converted.

Cooley M&A

JANUARY 19, 2023

1] On December 27, 2022, the Department of the Treasury (“Treasury”) and the IRS issued Notice 2023-2 (the “Notice”), providing interim guidance on the Excise Tax. This post highlights key guidance from the Notice as it relates to common M&A and capital market transactions.

Benzinga

APRIL 23, 2024

per share cash dividend declared _ (1) A reconciliation of GAAP net income to FFO is provided at the end of this press release. million of property dispositions under contract and, through our off-market sources, we recently acquired an excellent shopping center, featuring two supermarkets, in the San Diego market for $70.1

Reynolds Holding

NOVEMBER 30, 2023

On November 21, 2023, the staff of the Securities and Exchange Commission’s (SEC’s) Division of Corporation Finance issued eight new Compliance & Disclosure Interpretations (C&DIs), and revised two previously issued C&DIs, relating to the final pay-versus-performance (PVP) disclosure rules adopted last year.

Musings on Markets

AUGUST 5, 2023

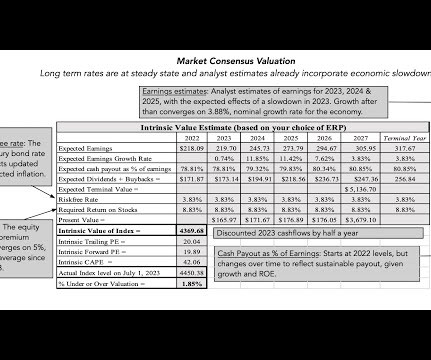

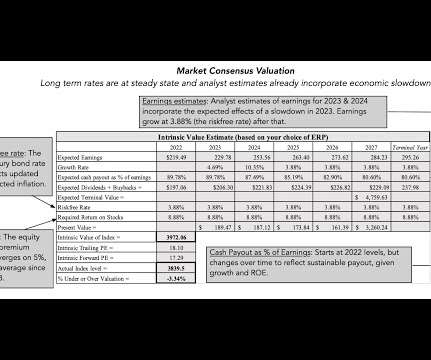

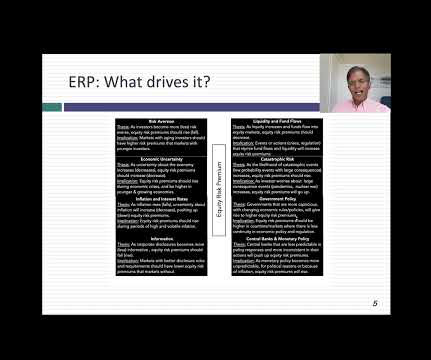

If you have been reading my posts, you know that I have an obsession with equity risk premiums, which I believe lie at the center of almost every substantive debate in markets and investing. The risk premium that you demand has different names in different markets.

Benzinga

NOVEMBER 7, 2023

Transaction Provides Financial and Strategic Benefits to All Shareholders Creates a Larger, More Scaled BDC Focused on Middle Market Direct Lending Combined Company Will Have Approximately $3.4 vi In addition, following the closing of the Merger(s), as applicable, MFIC will pay a cash dividend of $0.20

Reynolds Holding

DECEMBER 10, 2023

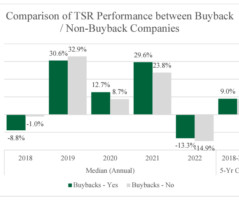

As a capital allocation decision, share buybacks intersect all three of the main corporate finance activities of investing, financing, and dividends [1]. For many mid and large cap companies in the UK and EU, share buybacks are implemented using Open Market Repurchases (OMRs) [9].

Benzinga

JULY 12, 2022

Capital Power will finance the transaction using cash on hand and its credit facilities and will not need to access the equity markets to finance the transaction. On the strength of the contracted cash flows from this acquisition, we are increasing our annual dividend growth guidance to 6% through 2025 from the previous 5%.

Valutico

JUNE 26, 2023

Devon Energy Corporation Weekly Valuation – Valutico | June 26, 2023 Link to the valuation About the company Devon Energy Corporation, based in Oklahoma City, is a prominent player in the energy industry known for its commitment to oil and natural gas exploration and production. Earthstone Energy, Inc. and Northern Oil and Gas, Inc.

Andrew Stolz

FEBRUARY 2, 2022

Highlights: Smartphone market matures, focus on emerging countries. EV market might turn into growth catalyst soon. Attractive dividend yield could rise above 5%. Smartphone market matures, focus on emerging countries. The smartphone market has constituted the main growth driver for the company. Conclusions.

Global Finance

SEPTEMBER 9, 2024

While that represents a 15% decrease from 2023, it suggests that a fear of business interruption persists. Corporates are hoarding cash, and that has meant a return to dividends and distributions but also more conservative cash management. How they access the market has also changed.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content