Weekly Roundup: October 27-November 2, 2023

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

Musings on Markets

JANUARY 21, 2023

In this post, I will begin by chronicling the damage done to equities during 2022, before putting the year in historical context, and then examine how developments during the year have affected expectations for the future. Actual Returns Your returns on equities come in one of two forms. Stocks: The What? at the start of that year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

DECEMBER 21, 2023

Posted by Vincenzo Pezone (Tilburg University), on Thursday, December 21, 2023 Editor's Note: Vincenzo Pezone is an Associate Professor of Finance at Tilburg University. Once capital is infused, bank managers may have an ex post incentive to avoid making dividend payments on the preferred stock purchased by the government.

Benzinga

APRIL 26, 2023

and 0.91%, Respectively, Excluding Non-Recurring Expenses First Quarter 2023 Loan Growth of $22.1 Non-performing Assets were 0.14% of Total Assets at March 31, 2023 Common Equity Tier 1 and Tangible Common Equity Ratio of 12.16% and 7.63%, Respectively, at March 31, 2023 1 LAKEVILLE, Conn., million, or 1.8%

Harvard Corporate Governance

JULY 16, 2023

Posted by Lane Ringlee, Marizu Madu, and Joadi Ogelsby, Pay Governance LLC, on Sunday, July 16, 2023 Editor's Note: Lane Ringlee is Managing Partner, Marizu Madu is a Principal, and Joadi Oglesby is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. Fried, and Charles C.Y. trillion in 2022”. [1]

Benzinga

DECEMBER 29, 2023

29, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- ILUS International Inc. An update is provided on several matters of importance for Shareholders including the acquisition, an associated dividend for ILUS Shareholders, merger agreement negotiations, subsidiaries, and financing. NEW YORK, NY, Dec.

Musings on Markets

AUGUST 5, 2023

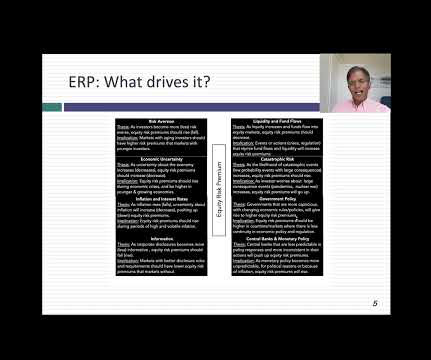

If you have been reading my posts, you know that I have an obsession with equity risk premiums, which I believe lie at the center of almost every substantive debate in markets and investing. How, you may ask, can equity risk premiums be that divergent, and does that imply that anything goes?

Harvard Corporate Governance

OCTOBER 27, 2023

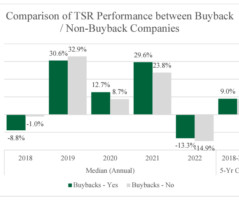

Osterrieder (University of Twente), on Friday, October 27, 2023 Editor's Note: Michael Seigne is the Founder of Candor Partners Limited, and Joerg R. Wang; and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here ) by Jesse Fried.

Harvard Corporate Governance

MAY 5, 2023

Securities and Exchange Commission, on Friday, May 5, 2023 Editor's Note: Hester M. May 3, 2023 Thank you, Chair Gensler. To the contrary, they enable companies to return excess cash to shareholders with greater tax-efficiency than dividends. [2] Peirce is a Commissioner at the U.S. Securities and Exchange Commission.

Benzinga

JANUARY 12, 2024

BlackRock Inc (NYSE: BLK ) reported Q4 FY23 revenue growth of 7% Y/Y to $4.631 billion, marginally above the consensus of $4.627 billion. Investment advisory, administration fees, and securities lending revenues increased to $3.61 billion from $3.40

Musings on Markets

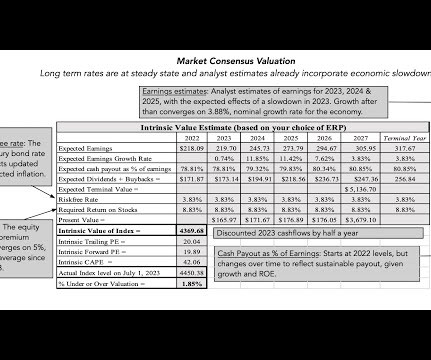

JULY 17, 2023

I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis. Markets, as is their wont, live to surprise, and the first six months of 2023 has wrong-footed the experts (again).

Brian DeChesare

JANUARY 4, 2023

Just look at the handy chart the Financial Times put together to see the horrifically bad numbers: In January 2022, everything seemed quite frothy, with mega-deals happening left and right and crypto and equity prices still at high levels. Real Estate (Equity Funds + Owned Properties): 15% [Up 5%]. Short-Term U.S.

Benzinga

JULY 25, 2024

per basic and diluted share, for the three months ended June 30, 2023. per basic and diluted share, for the six months ended June 30, 2023. million for the respective 2023 periods. and 16.7%, respectively, versus the same period in 2023. per basic and diluted share, for the three months ended June 30, 2023.

Benzinga

APRIL 28, 2023

April 28, 2023 (GLOBE NEWSWIRE) -- Mid Penn Bancorp, Inc. NASDAQ: MPB ) ("Mid Penn"), the parent company of Mid Penn Bank (the "Bank") and MPB Financial Services, LLC, today reported net income available to common shareholders ("earnings") for the quarter ended March 31, 2023 of $11.2 HARRISBURG, Pa.,

Musings on Markets

MARCH 8, 2023

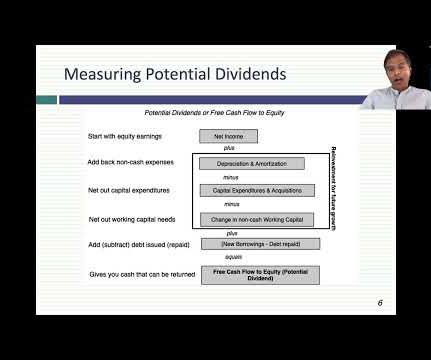

This is the last of my data update posts for 2023, and in this one, I will focus on dividends and buybacks, perhaps the most most misunderstood and misplayed element of corporate finance. Viewed in that context, dividends as just as integral to a business, as the investing and financing decisions.

Musings on Markets

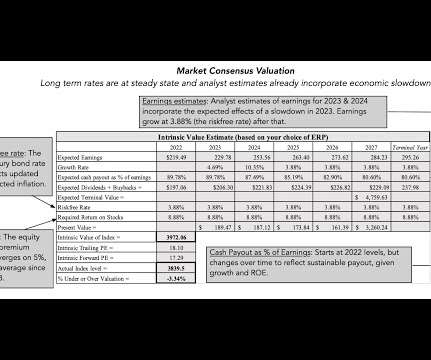

JANUARY 17, 2024

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. In that post, I noted that if inflation subsided quickly, and the economy stayed out of a recession, stocks had upside, and that is the scenario that played out in 2023.

Benzinga

NOVEMBER 9, 2023

CPI's Electron Device Business generated approximately $300 million in revenue for its fiscal year ended September 30, 2023. CPI's Electron Device Business manufactures electronic components and subsystems primarily serving the aerospace and defense market. "This business fits. Full story available on Benzinga.com

Benzinga

MAY 9, 2023

Nexstar Media Group, Inc (NASDAQ: NXST ) reported a Q1 2023 net revenue growth of 3.9% billion, beating the consensus of $1.24 Revenues from Television Advertising declined 6% Y/Y to $425 million, comprising Core Advertising revenue that fell 2.6% Y/Y to $417 million and a 66.7% Y/Y decline in Political Advertising revenue to $8 million.

Musings on Markets

MAY 7, 2023

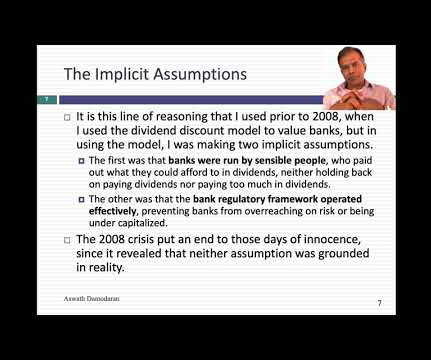

The Intrinsic Value of Bank Equity I am a dabbler in all things valuation-related, and I find the process fascinating, as stories about businesses get translated into valuation inputs, and finally into value. All Equity, All the time! With most non-financial service businesses, you face a choice in how you approach valuation.

Benzinga

MARCH 5, 2024

pence per share in cash along with a special dividend per share of 2.5 pence in place of a final dividend for the year ended December 31, 2023. As per the terms, Spirent shareholders will receive 172.5 Full story available on Benzinga.com

Reynolds Holding

SEPTEMBER 10, 2023

Here, we discuss several ways in which the proposed guidelines could have particular significance for private-equity sponsored acquisitions. Any of the proposed guidelines could be relevant to a transaction involving private equity, depending on the facts of the particular deal. Serial Acquisitions.

Musings on Markets

DECEMBER 21, 2022

Starting in late January 2023, I will be back in the classroom, teaching valuation and corporate finance to the MBAs and valuation to the undergraduates, and these classes will continue through May 2023. The class starts with a question of what the end game should be for a business (profitability, value, social good?),

Global Finance

JULY 23, 2024

Significantly, Mizuho CEO Masahiro Kihara said the bank will either pass on the proceeds from its sales of equity holdings to investors as dividends or invest them in growth-directed activities, and Sumitomo Mitsui aims to reduce the market value of its equity holdings to less than 20% of the value of its consolidated net assets.

Benzinga

FEBRUARY 29, 2024

Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million acquisition of Infinite ID Fourth Quarter 2023 Highlights 1 Revenues of $202.6 Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million Net Income of $37.3

Brian DeChesare

JANUARY 3, 2024

The markets in 2023 were almost a complete reversal of 2022, and hardly anyone – me included – saw it coming. and far too little in equities. When the markets rallied after the initial COVID sell-off in March 2020, I put more cash into equities and real estate. But my real estate investment funds were down ~10% , which hurt.

Benzinga

APRIL 19, 2023

Kuwaiti Dinar (approximately $6.53) per share, subject to a reduction by the amount of any dividends received by the KIPCO Sellers after January 1, 2023 (the " Transaction "). Following the closing of the Transaction, Fairfax's equity interest in GIG will increase from 43.69% to 90.01%.

Benzinga

OCTOBER 22, 2024

per share cash dividend declared _ (1) A reconciliation of GAAP net income to FFO is provided at the end of this press release. per diluted share, for the three months ended September 30, 2023. per diluted share, for the nine months ended September 30, 2023. per diluted share for the third quarter of 2023. HIGHLIGHTS $32.1

Valutico

MARCH 28, 2023

UBS Group AG Weekly Valuation – Valutico | 28 March 2023 Link to the valuation Context In recent days, the financial markets have experienced increased turmoil, causing growing concerns about financial stability. As of now, UBS is offering a dividend of USD 0.55 per common stock, with a dividend yield of 2.70%.

Benzinga

MAY 4, 2023

May 04, 2023 (GLOBE NEWSWIRE) -- Kimball International, Inc. NASDAQ: KBAL ) today announced results for the third quarter ended March 31, 2023. Selected Financial Highlights: Third Quarter FY 2023 Net sales of $166.1 Overview Third Quarter Fiscal 2023 Results Third quarter 2023 consolidated net sales were $166.1

Reynolds Holding

NOVEMBER 30, 2023

On November 21, 2023, the staff of the Securities and Exchange Commission’s (SEC’s) Division of Corporation Finance issued eight new Compliance & Disclosure Interpretations (C&DIs), and revised two previously issued C&DIs, relating to the final pay-versus-performance (PVP) disclosure rules adopted last year.

Valutico

OCTOBER 1, 2022

The company published its Q2 2023 financial results this week. dividend yield and an ongoing share buyback program. . Given the stable dividend payout ratio of ~65%, we also performed utilized a Dividend Discount Model with a Cost of Equity of 6.3% A WACC of 5.7%

Benzinga

AUGUST 22, 2024

from the 2023 reported figure. from the 2023 figure. Solid Return on Equity The return on equity for MKTX is 20.4%, which is higher than the industry average of 13.2%. Image Source: Zacks Investment Research Robust Growth Prospects The Zacks Consensus Estimate for MarketAxess' 2024 earnings is pegged at $7.06

Benzinga

FEBRUARY 1, 2023

Revised transaction structure results in ADES acquiring 100% of the equity interests of Arq Limited subsidiaries in exchange for issuance of preferred shares Final ownership terms results in legacy ADES shareholders retaining 59% of the outstanding equity GREENWOOD VILLAGE, Colo., per share. million term debt facility.

Farrel Fritz

JANUARY 22, 2024

Equity dilution is another common method by which those in control of a corporation or LLC attempt to squeeze out a minority owner. Dilution and Excessive Compensation Challenges to dilutive equity awards commonly focus on equity that the company elects to award its employees or officers as compensation.

Reynolds Holding

DECEMBER 10, 2023

As a capital allocation decision, share buybacks intersect all three of the main corporate finance activities of investing, financing, and dividends [1]. Buybacks for Financing A company can alter the debt-to-equity ratio of its capital structure by issuing debt and/or buying back shares. No, that risks massive regret. Of course not.

Benzinga

MARCH 28, 2024

("IFH") (OTCQX: IFHI ) today announced that they have entered into a definitive merger agreement under which CBNK will acquire IFH in a cash and stock transaction valued at $66 million, exclusive of the value of a dividend to be received by IFH shareholders at or immediately prior to closing. and Capital Bank. and Capital Bank.

Benzinga

APRIL 23, 2024

per share cash dividend declared _ (1) A reconciliation of GAAP net income to FFO is provided at the end of this press release. per diluted share, for the three months ended March 31, 2023. per diluted share for the first quarter of 2023. million for the first quarter of 2023. per share cash dividend.

Valutico

MARCH 1, 2023

Weekly Valuation – Valutico | 1 March 2023 Link to valuation About BP BP, a multinational oil and gas company, headquartered in London, is one of the largest oil and gas producers in the world. Furthermore, the company increased dividends by 10% and announced that it will buy back GBP 2.3 (USD billion worth of shares.

Musings on Markets

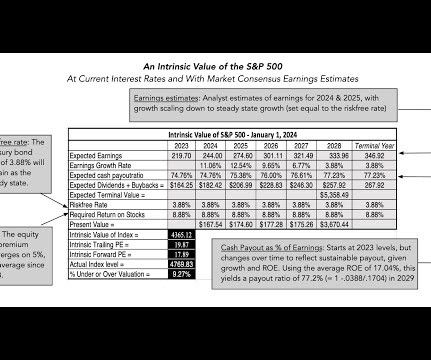

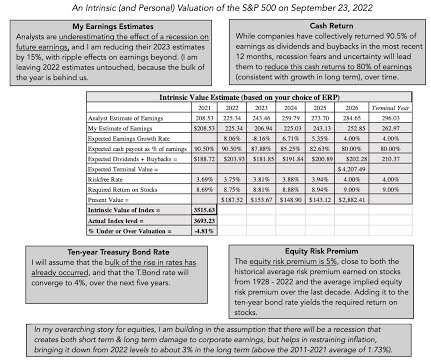

SEPTEMBER 27, 2022

In a third post on July 1, 2022 , I pointed to inflation as a key culprit in the retreat of risk capital, i.e., capital invested in the riskiest segments of every market, and presented evidence of the impact on risk premiums (bond default spreads and equity risk premiums) in markets. from what it was on January 1.

Benzinga

NOVEMBER 7, 2023

07, 2023 (GLOBE NEWSWIRE) -- MidCap Financial Investment Corporation (NASDAQ: MFIC ), Apollo Senior Floating Rate Fund Inc. vi In addition, following the closing of the Merger(s), as applicable, MFIC will pay a cash dividend of $0.20 Billion of Total Investments and $1.4 Billion of Net Assets i NEW YORK, Nov.

Benzinga

JULY 12, 2022

Capital Power will finance the transaction using cash on hand and its credit facilities and will not need to access the equity markets to finance the transaction. On the strength of the contracted cash flows from this acquisition, we are increasing our annual dividend growth guidance to 6% through 2025 from the previous 5%.

Chris Mercer

FEBRUARY 14, 2024

What would you (or a court) say if I created a guideline public company group for a valuation as of December 31, 2023, consisting of companies that existed twenty years ago, and based my analysis on multiples calculated as of December 31, 2003 ? The pricing and multiples from 2003 have no bearing on the value of my private company in 2023.

Benzinga

DECEMBER 11, 2023

11, 2023 (GLOBE NEWSWIRE) -- Occidental (NYSE: OXY ) today announced it entered into a purchase agreement to acquire Midland-based oil and gas producer CrownRock L.P., billion of common equity and the assumption of CrownRock's $1.2 Acquisition, valued at approximately $12.0 billion of new debt, the issuance of approximately $1.7

Benzinga

FEBRUARY 15, 2023

15, 2023 (GLOBE NEWSWIRE) -- Retail Opportunity Investments Corp. per share cash dividend paid _ (1) A reconciliation of GAAP net income to Funds From Operations (FFO) is provided at the end of this press release. DIVIDEND SUMMARY On December 29, 2022, ROIC distributed a $0.15 per share cash dividend. SAN DIEGO, Feb.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content