Weekly Roundup: October 27-November 2, 2023

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Harvard Corporate Governance

NOVEMBER 3, 2023

Circuit , ESG , intraportfolio , SEC SEC charges executives with fraudulent revenue recognition practices Posted by Cydney S.

Harvard Corporate Governance

MAY 5, 2023

Securities and Exchange Commission, on Friday, May 5, 2023 Editor's Note: Hester M. May 3, 2023 Thank you, Chair Gensler. To the contrary, they enable companies to return excess cash to shareholders with greater tax-efficiency than dividends. [2] Peirce is a Commissioner at the U.S. Securities and Exchange Commission.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

JULY 16, 2023

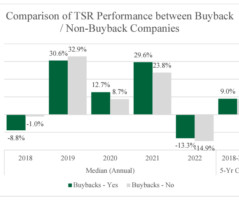

Posted by Lane Ringlee, Marizu Madu, and Joadi Ogelsby, Pay Governance LLC, on Sunday, July 16, 2023 Editor's Note: Lane Ringlee is Managing Partner, Marizu Madu is a Principal, and Joadi Oglesby is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. Fried, and Charles C.Y. trillion in 2022”. [1]

Harvard Corporate Governance

DECEMBER 21, 2023

Posted by Vincenzo Pezone (Tilburg University), on Thursday, December 21, 2023 Editor's Note: Vincenzo Pezone is an Associate Professor of Finance at Tilburg University. Once capital is infused, bank managers may have an ex post incentive to avoid making dividend payments on the preferred stock purchased by the government.

Musings on Markets

JANUARY 21, 2023

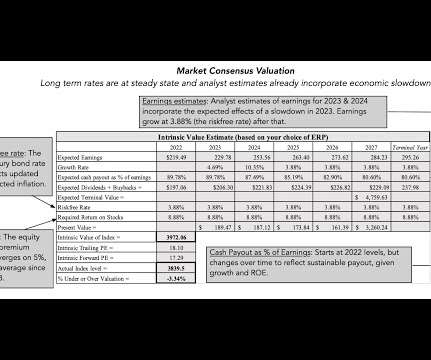

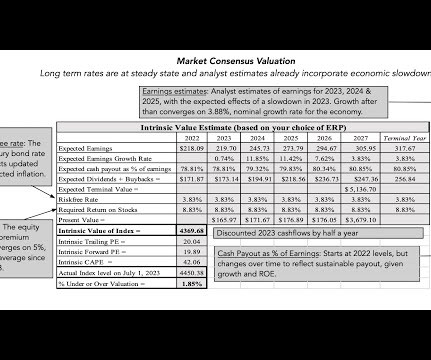

In this post, I will begin by chronicling the damage done to equities during 2022, before putting the year in historical context, and then examine how developments during the year have affected expectations for the future. Actual Returns Your returns on equities come in one of two forms. Stocks: The What? at the start of that year.

Harvard Corporate Governance

OCTOBER 27, 2023

Osterrieder (University of Twente), on Friday, October 27, 2023 Editor's Note: Michael Seigne is the Founder of Candor Partners Limited, and Joerg R. Wang; and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here ) by Jesse Fried.

Musings on Markets

AUGUST 5, 2023

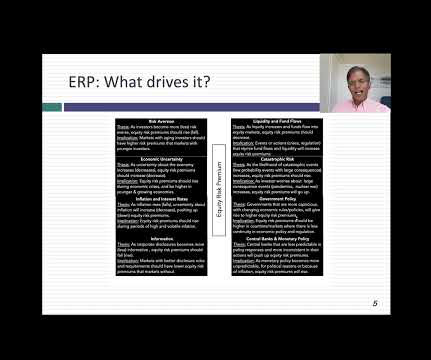

If you have been reading my posts, you know that I have an obsession with equity risk premiums, which I believe lie at the center of almost every substantive debate in markets and investing. How, you may ask, can equity risk premiums be that divergent, and does that imply that anything goes?

Musings on Markets

JULY 17, 2023

I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis. Markets, as is their wont, live to surprise, and the first six months of 2023 has wrong-footed the experts (again).

Brian DeChesare

JANUARY 4, 2023

Just look at the handy chart the Financial Times put together to see the horrifically bad numbers: In January 2022, everything seemed quite frothy, with mega-deals happening left and right and crypto and equity prices still at high levels. Real Estate (Equity Funds + Owned Properties): 15% [Up 5%]. Short-Term U.S.

Benzinga

APRIL 26, 2023

and 0.91%, Respectively, Excluding Non-Recurring Expenses First Quarter 2023 Loan Growth of $22.1 Non-performing Assets were 0.14% of Total Assets at March 31, 2023 Common Equity Tier 1 and Tangible Common Equity Ratio of 12.16% and 7.63%, Respectively, at March 31, 2023 1 LAKEVILLE, Conn., million, or 1.8%

Musings on Markets

DECEMBER 21, 2022

Starting in late January 2023, I will be back in the classroom, teaching valuation and corporate finance to the MBAs and valuation to the undergraduates, and these classes will continue through May 2023. The class starts with a question of what the end game should be for a business (profitability, value, social good?),

Musings on Markets

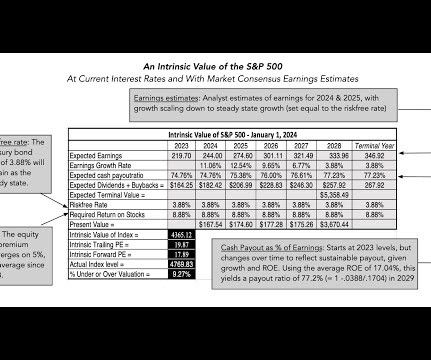

JANUARY 17, 2024

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. In that post, I noted that if inflation subsided quickly, and the economy stayed out of a recession, stocks had upside, and that is the scenario that played out in 2023.

Benzinga

JANUARY 12, 2024

BlackRock Inc (NYSE: BLK ) reported Q4 FY23 revenue growth of 7% Y/Y to $4.631 billion, marginally above the consensus of $4.627 billion. Investment advisory, administration fees, and securities lending revenues increased to $3.61 billion from $3.40

Benzinga

DECEMBER 29, 2023

29, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- ILUS International Inc. An update is provided on several matters of importance for Shareholders including the acquisition, an associated dividend for ILUS Shareholders, merger agreement negotiations, subsidiaries, and financing. NEW YORK, NY, Dec.

Global Finance

JULY 23, 2024

Significantly, Mizuho CEO Masahiro Kihara said the bank will either pass on the proceeds from its sales of equity holdings to investors as dividends or invest them in growth-directed activities, and Sumitomo Mitsui aims to reduce the market value of its equity holdings to less than 20% of the value of its consolidated net assets.

Musings on Markets

JANUARY 5, 2024

I have also developed a practice in the last decade of spending much of January exploring what the data tells us, and does not tell us, about the investing, financing and dividend choices that companies made during the most recent year. Return on Equity 1. Dividends and Potential Dividends (FCFE) 1. Return on Equity 2.

Musings on Markets

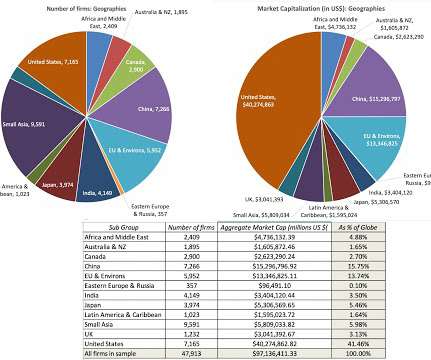

JANUARY 6, 2023

In January 2023, I ended up with 47,913 publicly traded firms in my sample , with the pie chart below providing a geographic breakdown. I do report on a few market-wide data items especially on risk premiums for both equity and debt. Cost of Equity 1. Standard deviations in equity and firm value 4. Return on Equity 1.

Benzinga

APRIL 28, 2023

April 28, 2023 (GLOBE NEWSWIRE) -- Mid Penn Bancorp, Inc. NASDAQ: MPB ) ("Mid Penn"), the parent company of Mid Penn Bank (the "Bank") and MPB Financial Services, LLC, today reported net income available to common shareholders ("earnings") for the quarter ended March 31, 2023 of $11.2 HARRISBURG, Pa.,

Musings on Markets

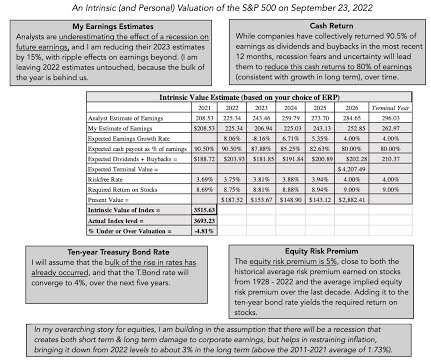

SEPTEMBER 27, 2022

In a third post on July 1, 2022 , I pointed to inflation as a key culprit in the retreat of risk capital, i.e., capital invested in the riskiest segments of every market, and presented evidence of the impact on risk premiums (bond default spreads and equity risk premiums) in markets. from what it was on January 1.

Benzinga

MAY 9, 2023

Nexstar Media Group, Inc (NASDAQ: NXST ) reported a Q1 2023 net revenue growth of 3.9% billion, beating the consensus of $1.24 Revenues from Television Advertising declined 6% Y/Y to $425 million, comprising Core Advertising revenue that fell 2.6% Y/Y to $417 million and a 66.7% Y/Y decline in Political Advertising revenue to $8 million.

Benzinga

JULY 25, 2024

per basic and diluted share, for the three months ended June 30, 2023. per basic and diluted share, for the six months ended June 30, 2023. million for the respective 2023 periods. and 16.7%, respectively, versus the same period in 2023. per basic and diluted share, for the three months ended June 30, 2023.

Benzinga

NOVEMBER 9, 2023

CPI's Electron Device Business generated approximately $300 million in revenue for its fiscal year ended September 30, 2023. CPI's Electron Device Business manufactures electronic components and subsystems primarily serving the aerospace and defense market. "This business fits. Full story available on Benzinga.com

Benzinga

MARCH 5, 2024

pence per share in cash along with a special dividend per share of 2.5 pence in place of a final dividend for the year ended December 31, 2023. As per the terms, Spirent shareholders will receive 172.5 Full story available on Benzinga.com

Valutico

MARCH 20, 2023

HSBC Holdings plc Weekly Valuation – Valutico | 20 March 2023 Link to the valuation Context The past weeks, the financial market was rattled by the collapse of Silicon Valley Bank, the go-to bank for tech startups, serving half of America’s venture capital-backed tech firms. HSBC is also planning a special dividend of $0.21

Brian DeChesare

JANUARY 3, 2024

The markets in 2023 were almost a complete reversal of 2022, and hardly anyone – me included – saw it coming. and far too little in equities. When the markets rallied after the initial COVID sell-off in March 2020, I put more cash into equities and real estate. But my real estate investment funds were down ~10% , which hurt.

Reynolds Holding

SEPTEMBER 10, 2023

Here, we discuss several ways in which the proposed guidelines could have particular significance for private-equity sponsored acquisitions. Any of the proposed guidelines could be relevant to a transaction involving private equity, depending on the facts of the particular deal. Serial Acquisitions.

Musings on Markets

JANUARY 31, 2024

In my last three posts, I looked at the macro (equity risk premiums, default spreads, risk free rates) and micro (company risk measures) that feed into the expected returns we demand on investments, and argued that these expected returns become hurdle rates for businesses, in the form of costs of equity and capital. trillion ($1.8

Valutico

MARCH 28, 2023

UBS Group AG Weekly Valuation – Valutico | 28 March 2023 Link to the valuation Context In recent days, the financial markets have experienced increased turmoil, causing growing concerns about financial stability. As of now, UBS is offering a dividend of USD 0.55 per common stock, with a dividend yield of 2.70%.

Valutico

OCTOBER 1, 2022

The company published its Q2 2023 financial results this week. dividend yield and an ongoing share buyback program. . Given the stable dividend payout ratio of ~65%, we also performed utilized a Dividend Discount Model with a Cost of Equity of 6.3% A WACC of 5.7%

Benzinga

APRIL 19, 2023

Kuwaiti Dinar (approximately $6.53) per share, subject to a reduction by the amount of any dividends received by the KIPCO Sellers after January 1, 2023 (the " Transaction "). Following the closing of the Transaction, Fairfax's equity interest in GIG will increase from 43.69% to 90.01%.

Benzinga

FEBRUARY 29, 2024

Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million acquisition of Infinite ID Fourth Quarter 2023 Highlights 1 Revenues of $202.6 Full Year 2023 Highlights 1 Revenues of $763.8 million one-time special dividend payment, $59.0 million Net Income of $37.3

Musings on Markets

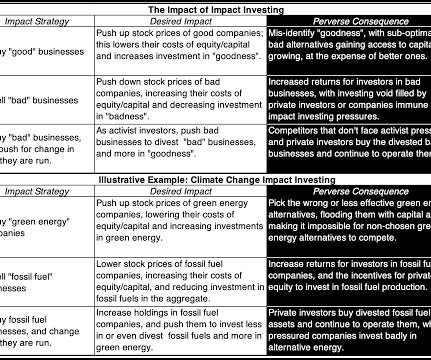

OCTOBER 12, 2023

The effect of impact investing in the inclusionary and exclusionary paths is through the stock price , with the buying (selling) in inclusionary (exclusionary) investing pushing stock prices up (down), which, in turn, decreases (increases) the costs of equity and capital at these firms. in the 2011-2023 time period.

Farrel Fritz

JANUARY 22, 2024

Equity dilution is another common method by which those in control of a corporation or LLC attempt to squeeze out a minority owner. Dilution and Excessive Compensation Challenges to dilutive equity awards commonly focus on equity that the company elects to award its employees or officers as compensation.

Valutico

MARCH 1, 2023

Weekly Valuation – Valutico | 1 March 2023 Link to valuation About BP BP, a multinational oil and gas company, headquartered in London, is one of the largest oil and gas producers in the world. Furthermore, the company increased dividends by 10% and announced that it will buy back GBP 2.3 (USD billion worth of shares.

Andrew Stolz

NOVEMBER 28, 2021

It raises $1bn new capital through the private equity fund TPG Rise Climate for a 11% stake. However, we expect that the company can turnaround its profitability in 2023. Retained earnings continue to decline in 2022 as Tata is likely to record a net loss again; we expect a turnaround in 2023. P&L – Tata Motors. Conclusions.

Benzinga

FEBRUARY 1, 2023

Revised transaction structure results in ADES acquiring 100% of the equity interests of Arq Limited subsidiaries in exchange for issuance of preferred shares Final ownership terms results in legacy ADES shareholders retaining 59% of the outstanding equity GREENWOOD VILLAGE, Colo., per share. million term debt facility.

Andrew Stolz

NOVEMBER 21, 2021

Management forecast the company should return to 10m vehicles by the end of 2023. The repurchase has helped to keep return on equity above its target of 10%. It is deducted from equity when the company buys back its own shares. The company pays out dividends on a consistent basis. The target might be a bit ambitious.

Benzinga

AUGUST 22, 2024

from the 2023 reported figure. from the 2023 figure. Solid Return on Equity The return on equity for MKTX is 20.4%, which is higher than the industry average of 13.2%. Image Source: Zacks Investment Research Robust Growth Prospects The Zacks Consensus Estimate for MarketAxess' 2024 earnings is pegged at $7.06

ThomsonReuters

JULY 13, 2021

The Tax Equity and Fiscal Responsibility Act of 1982 and Interest and Dividend Compliance Act of 1983 requires payers to backup withhold tax from certain reportable payments. Arizona legislation will increase the state’s unemployment taxable wage base from $7,000 to $8,000 in 2023. State and Local News.

Benzinga

JUNE 14, 2023

crude oil export terminal by capacity and accounted for approximately 12% of the United States' total crude oil exports in 2023 year-to-date 7. The Terminal achieved record volumes of over 670,000 bbl/d of oil in March 2023. billion in cash (the "Transaction"), subject to closing adjustments.

Reynolds Holding

DECEMBER 10, 2023

As a capital allocation decision, share buybacks intersect all three of the main corporate finance activities of investing, financing, and dividends [1]. Buybacks for Financing A company can alter the debt-to-equity ratio of its capital structure by issuing debt and/or buying back shares. No, that risks massive regret. Of course not.

Reynolds Holding

NOVEMBER 30, 2023

On November 21, 2023, the staff of the Securities and Exchange Commission’s (SEC’s) Division of Corporation Finance issued eight new Compliance & Disclosure Interpretations (C&DIs), and revised two previously issued C&DIs, relating to the final pay-versus-performance (PVP) disclosure rules adopted last year.

Benzinga

JULY 12, 2022

Capital Power will finance the transaction using cash on hand and its credit facilities and will not need to access the equity markets to finance the transaction. On the strength of the contracted cash flows from this acquisition, we are increasing our annual dividend growth guidance to 6% through 2025 from the previous 5%.

Global Finance

MAY 8, 2024

survey, most banks across APAC increased 2023 tech budgets to boost security, transform data and avoid downtime. billion) acquisition of Citigroup’s regional consumer banking business in 2022 bore fruit in 2023, more than doubling its customer base outside Singapore. Meanwhile, according to an International Data Corp. billion; a 2.3%

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content