SaaS Valuations: How to Value a SaaS Business in 2022

FE International

MARCH 23, 2022

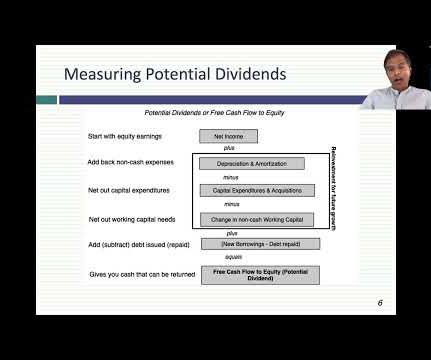

If you want to understand how to value a business, the first question is whether to look at a multiple of SDE , EBITDA or Revenue. SDE vs. EBITDA vs. Revenue. Crucially, any owner salary/dividends can be added back to the profit number, too. If you want an accurate valuation, you can receive a free one via our page here.

Let's personalize your content