5 Factors Impacting Activists’ Declining Success Rate

Harvard Corporate Governance

SEPTEMBER 30, 2022

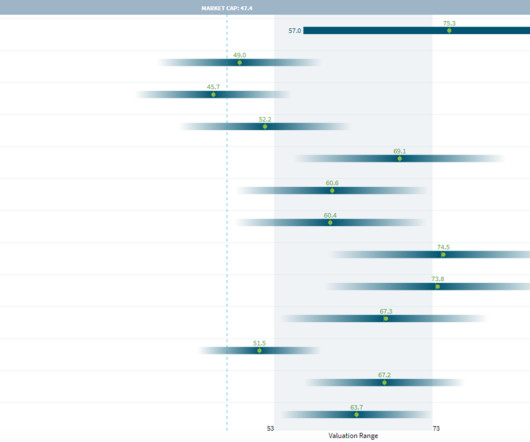

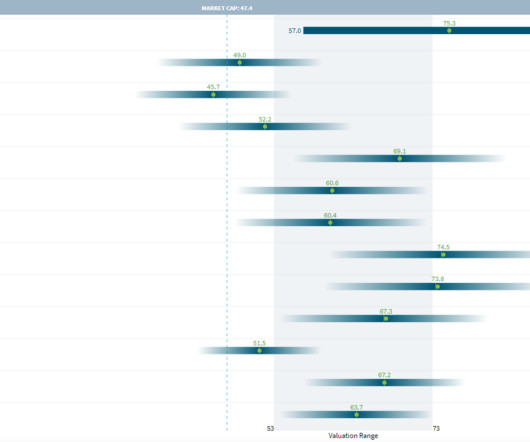

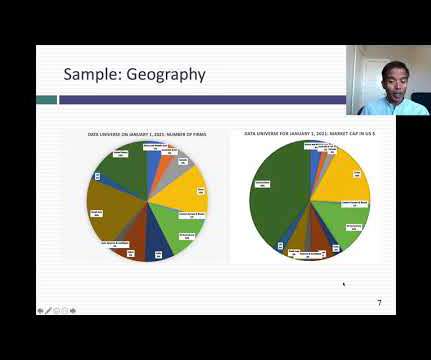

companies with market capitalizations of at least $100 million and where ISS and Glass Lewis published voting recommendations. From 2017 through 2020, activists won at least one board seat in 57% of these contests. FTI Consulting examined proxy contests in which the underlying campaign sought board seats at U.S.

Let's personalize your content