Can Salesforce return to its former lofty heights, after slumping 50% from its all time high?

Valutico

DECEMBER 6, 2022

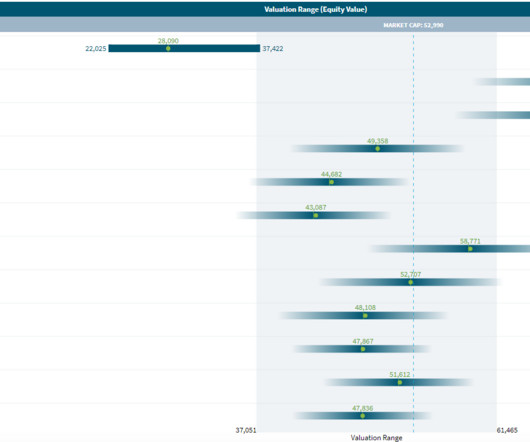

billion acquisition of Slack in 2020. At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. He played a major role in the $27.1 Salesforce announced total revenue of $7.8

Let's personalize your content