Issues faced when valuing a declining company

Andrew Stolz

MAY 8, 2020

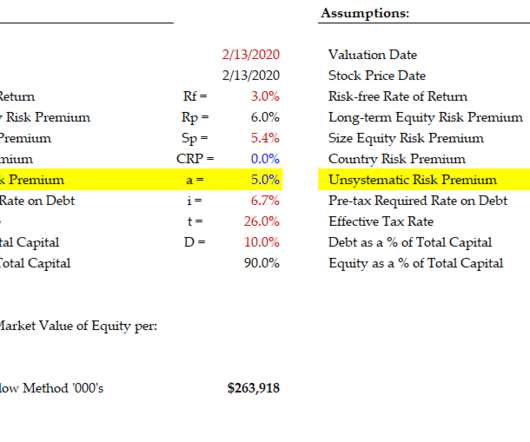

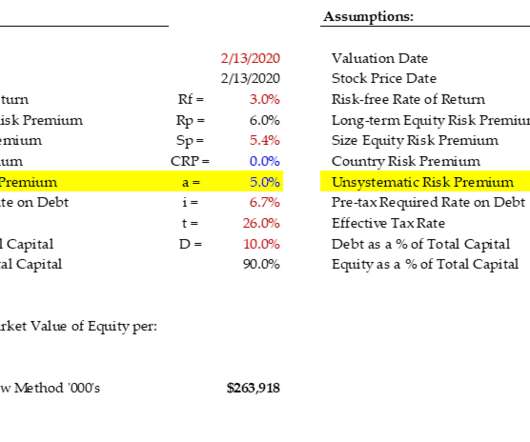

This is a Valuation Master Class student essay by Lim Lee Bin from June 16, 2018. When used to value a declining company, analysts will face special challenges as the characteristics of a declining company will cause some of the valuation model’s assumptions to break down. Conclusion.

Let's personalize your content