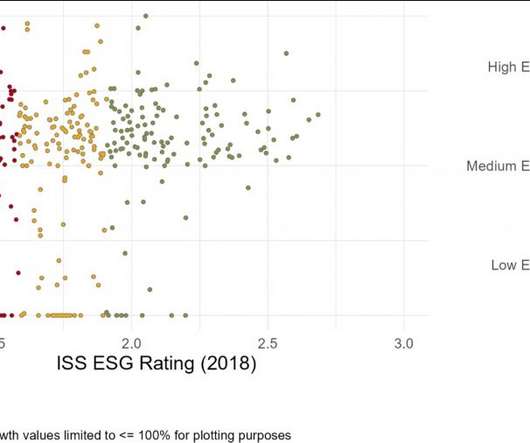

Can High ESG Ratings Help Sustain Dividend Growth?

Harvard Corporate Governance

AUGUST 18, 2022

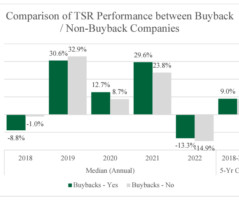

With US inflation running at a 40-year high and a rocky first half of the year for both equity and fixed income markets globally, uncertainty is high. One possible source of returns in this environment could be dividends, particularly from those companies able to grow their dividends despite the prevailing macroeconomic headwinds.

Let's personalize your content