DBS Equity Capital Markets Head Art Karoonyavanich On A Decade Of Growth

Global Finance

JUNE 17, 2024

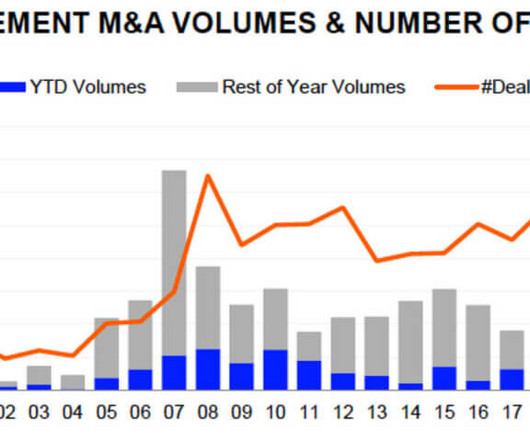

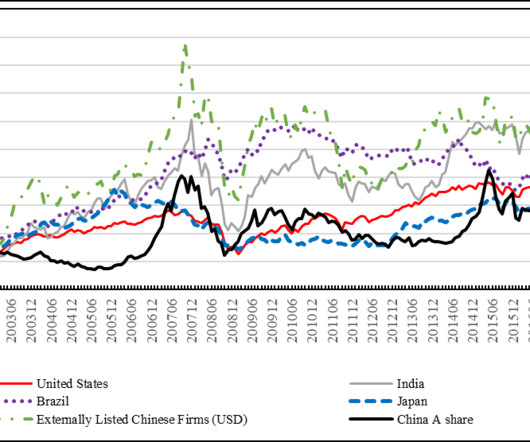

A 10-year veteran at DBS Bank, Karoonyavanich recently expanded his role to cover all Equity Capital Markets business for the bank globally when the firm merged its equities, fixed income and brokerage businesses to form a new Investment Banking unit. In 2017 and 2018, we saw China continue to open up.

Let's personalize your content