Data Update 5 for 2022: The Bottom Line!

Musings on Markets

FEBRUARY 27, 2022

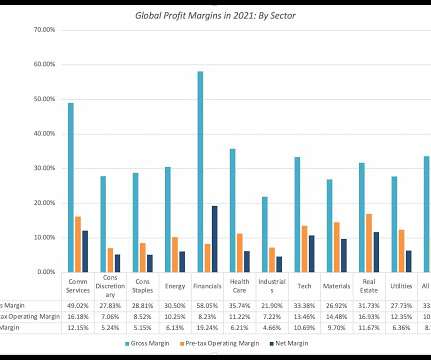

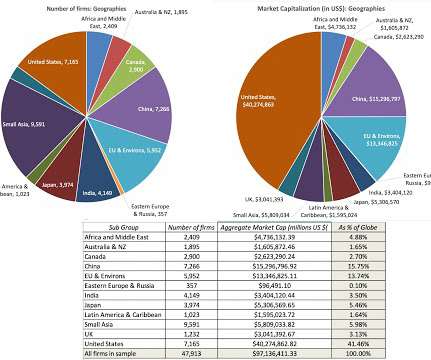

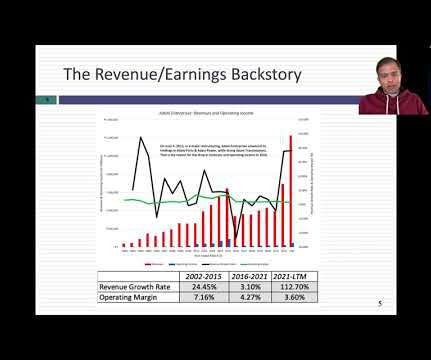

In this post, I will look at corporate profitability, in all its different dimensions, and how companies across the globe, and across industries, measured up in the most recent years. To make comparisons, profits are scaled to common metrics, with revenues and book value of investment being the most common scalar.

Let's personalize your content