The Seven Samurai: How Big Tech Rescued the Market in 2023!

Musings on Markets

FEBRUARY 8, 2024

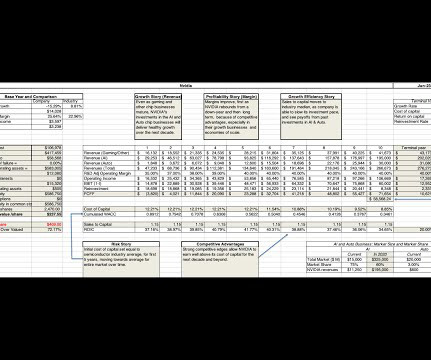

I was planning to finish my last two data updates for 2024, but decided to take a break and look at the seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) which carried the market in 2023. While these seven stocks had an exceptional year in 2023, their outperformance stretches back for a much longer period.

Let's personalize your content