Good (Bad) Banks and Good (Bad) Investments: At the right price.

Musings on Markets

MAY 7, 2023

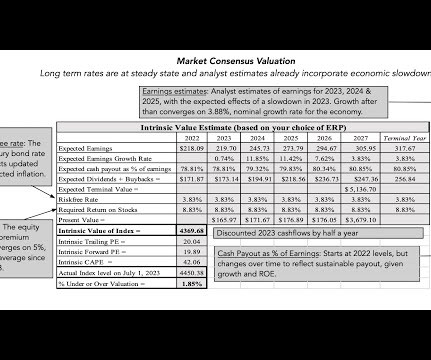

Consequently, you can only value the equity in a bank, and by extension, the only pricing multiples you can use to price banks are equity multiples (PE, Price to Book etc.).

Let's personalize your content