Data Update 2 for 2023: A Rocky Year for Equities!

Musings on Markets

JANUARY 21, 2023

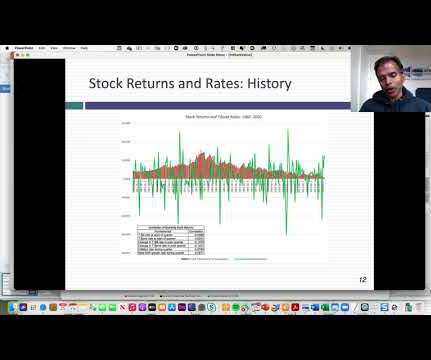

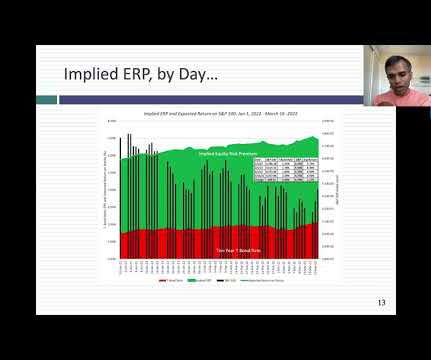

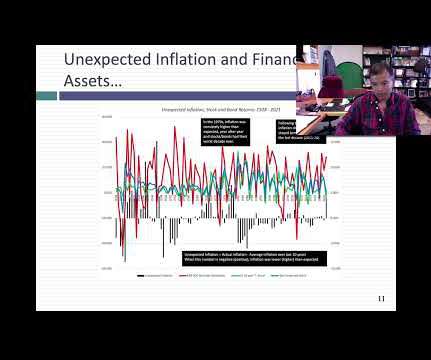

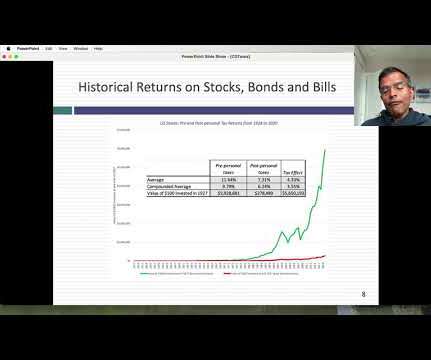

In 2022, we needed that reminder more than ever before, especially after markets came roaring back from the COVID drop in 2020 and 2021. We invest in equities expecting to earn more than we can make on risk free or guaranteed investments, but the risk in equities is that actual returns can deviate from expectations.

Let's personalize your content