Good (Bad) Banks and Good (Bad) Investments: At the right price.

Musings on Markets

MAY 7, 2023

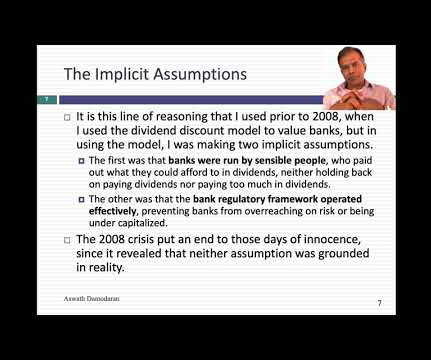

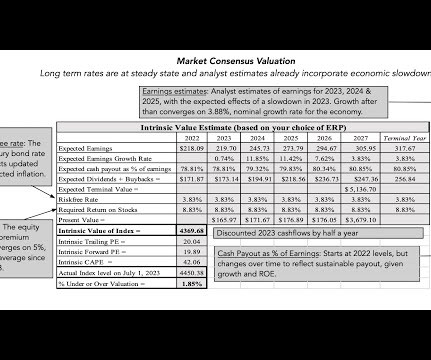

Consequently, you can only value the equity in a bank, and by extension, the only pricing multiples you can use to price banks are equity multiples (PE, Price to Book etc.). Note the differences between the bank FCFE and bank dividend discount models.

Let's personalize your content