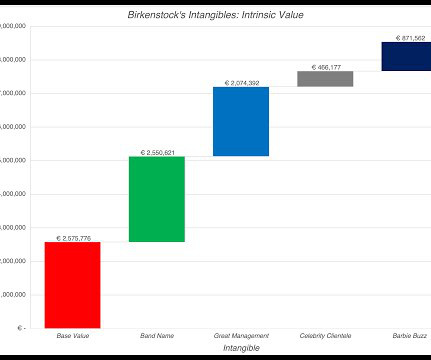

Invisible, yet Invaluable: Valuing Intangibles in the Birkenstock IPO!

Musings on Markets

OCTOBER 6, 2023

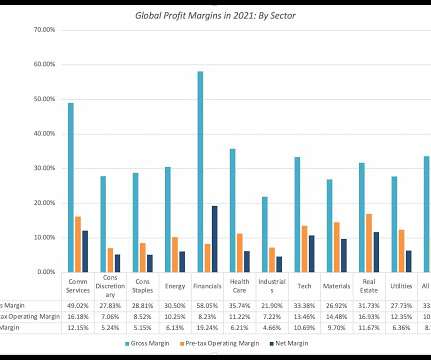

While I have seen claims that intangibles now account for sixty, seventy or even ninety percent of value, I take these contentions with a grain of salt, since the definition of "intangible" is elastic, and some stretch it to breaking point, and the measures of value used are questionable.

Let's personalize your content