Catastrophic Risk: Investing and Business Implications

Musings on Markets

FEBRUARY 16, 2024

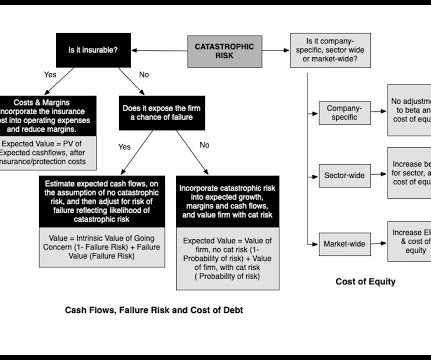

In some cases, a change in regulatory or tax law can put the business model for a company or many company at risk. I confess that the line between whether nature or man is to blame for some catastrophes is a gray one and to illustrate, consider the COVID crisis in 2020. Note that these higher discount rates apply in both scenarios.

Let's personalize your content